What Is Turtle (TURTLE)? The First Distribution Protocol Monetizing Web3 Activity

Decentralized finance (DeFi) has grown into one of the most dynamic sectors in crypto, but it still faces a fundamental problem: liquidity is fragmented and inefficiently distributed. Every protocol competes for user deposits, offering incentives to attract liquidity — often through short-term yield farming campaigns that struggle to sustain engagement. As the Web3 ecosystem matures, there’s an increasing need for smarter coordination layers that can connect liquidity providers, protocols, and users in a more transparent and efficient way.

That’s where Turtle (TURTLE) steps in. Launched in 2024, Turtle introduces a new category in DeFi — a liquidity distribution protocol that monetizes on-chain activity itself. Instead of focusing solely on where liquidity is stored, Turtle rewards users for what they do across Web3 — such as deploying liquidity, staking, swapping, or referring to others — all while keeping their funds under self-custody. By turning wallet activity into a source of income, Turtle represents a shift toward sustainable, incentive-aligned growth in decentralized finance.

What Is Turtle (TURTLE)?

Turtle (TURTLE) is the first liquidity distribution protocol designed to monetize Web3 activity by tracking and rewarding what users already do on-chain. Instead of requiring users to lock their assets into new smart contracts or pools, Turtle uses APIs and integrations to monitor wallet activity such as liquidity deployment, staking, swaps, validator delegations, and referral participation. Every action that generates real economic value in Web3 can be rewarded through Turtle’s network — meaning users can earn more from their existing DeFi habits without taking on extra risk or performing additional steps.

At its core, Turtle’s mission is to align incentives across the entire decentralized finance ecosystem — including liquidity providers (LPs), developers, venture capitalists, auditors, and protocols. It offers a structure where everyone benefits from transparent liquidity flow and collective due diligence. For users, Turtle provides exclusive access to curated liquidity deals, helping them boost yields on trusted partner protocols. For projects, it provides a way to attract capital efficiently without overspending on token emissions. With its non-custodial design and data-driven reward model, Turtle aims to build a safer, fairer, and more sustainable foundation for liquidity in Web3.

How Turtle (TURTLE) Works

Turtle’s ecosystem operates as a non-custodial coordination layer that rewards users for meaningful Web3 activity. Instead of creating new pools or locking assets into smart contracts, Turtle tracks users’ on-chain actions across integrated DeFi protocols and distributes extra rewards based on those activities. This makes earning additional yield as simple as continuing to use the Web3 tools you already trust.

● For Liquidity Providers (LPs): LPs register their wallet with Turtle by signing a simple message — no deposits or new contracts required. After that, they can keep providing liquidity, staking, or farming as usual, while earning extra incentives through Boosted Deals or Vaults, all without giving up self-custody of their assets.

● For Protocols and Projects: DeFi projects can tap into Turtle’s growing network of over 275,000 active LPs to attract liquidity efficiently. Through Turtle’s Client Portal, they can design, launch, and track campaigns that draw capital without relying on costly token emissions or unsustainable rewards.

● For Distribution Partners: Wallets, analytics platforms, and DeFi communities can integrate Turtle’s Earn feature using an API, widget, or SDK. This lets them offer their users curated earning opportunities while generating a new, consistent revenue stream from liquidity activity routed through their platform.

Turtle never acts as a counterparty or custodian. It does not hold user funds or introduce new smart contracts, minimizing both technical and regulatory risk. All user interactions happen directly with audited partner protocols, while Turtle simply tracks wallet activity and distributes rewards accordingly.

Turtle (TURTLE) Tokenomics

TURTLE is the native token of the Turtle ecosystem, serving as both a utility and governance asset that drives the platform’s incentive and reward mechanisms. It enables users to participate in governance, access exclusive liquidity deals, and earn additional rewards through staking or ecosystem activities. The token has a fixed total supply of 1 billion, ensuring long-term scarcity and preventing inflationary dilution. Its distribution model is designed to support sustainable growth, with allocations spanning the community, ecosystem incentives, team, investors, and strategic partners. Early airdrop campaigns and exchange promotions helped introduce the token to a wide user base, ensuring that initial distribution favored active Web3 participants rather than speculative holders.

A large portion of the supply is reserved for liquidity incentives and user rewards, reinforcing Turtle’s mission to monetize meaningful on-chain activity. Holders can stake TURTLE to gain governance rights and potentially earn boosted rewards in future iterations of the protocol, creating an additional layer of engagement and alignment. By combining transparent distribution, practical utility, and community-oriented governance, Turtle aims to make TURTLE more than just a reward token — it’s the foundation for a fair, data-driven liquidity network built around active participation and long-term value creation.

TURTLE Airdrop: Everything You Should Know

The Turtle Genesis Airdrop launched the TURTLE token and rewarded early contributors who helped shape the project’s ecosystem. Eligibility was based on genuine, value-added participation verified through on-chain data and partner contributions — not random snapshots or form submissions. Only wallets that created measurable impact, such as providing liquidity, joining campaigns, or contributing to the DAO treasury, were included. Sybil and bot activity were systematically filtered out to ensure fairness.

Qualified participants came from several groups:

● NFT Holders & OG Members: Holders of Turtle’s BeraChain or OG NFTs who made verified contributions of at least $1 to the DAO.

● Deal & Campaign Participants: Users involved in Boosted Deals, TAC Vaults, or other partner programs that generated real liquidity.

● Leaderboard Contributors: Top 1,000 users on the Liquidity Leaderboard before TGE shared 0.2% of the token supply.

● Partners & Referrers: Verified partners and distributors who expanded Turtle’s network through active user engagement.

The distribution prioritized active builders and LPs, allocating 11.9% of supply to user contributions, 9% to participants, and smaller portions to partners, referrals, and NFTs. To maintain long-term alignment, wallets receiving 1,700 TURTLE or less were fully unlocked at TGE, while larger allocations were 70% unlocked immediately with 30% vesting over 12 weeks.

Turtle (TURTLE) Price Prediction for 2025 – 2030

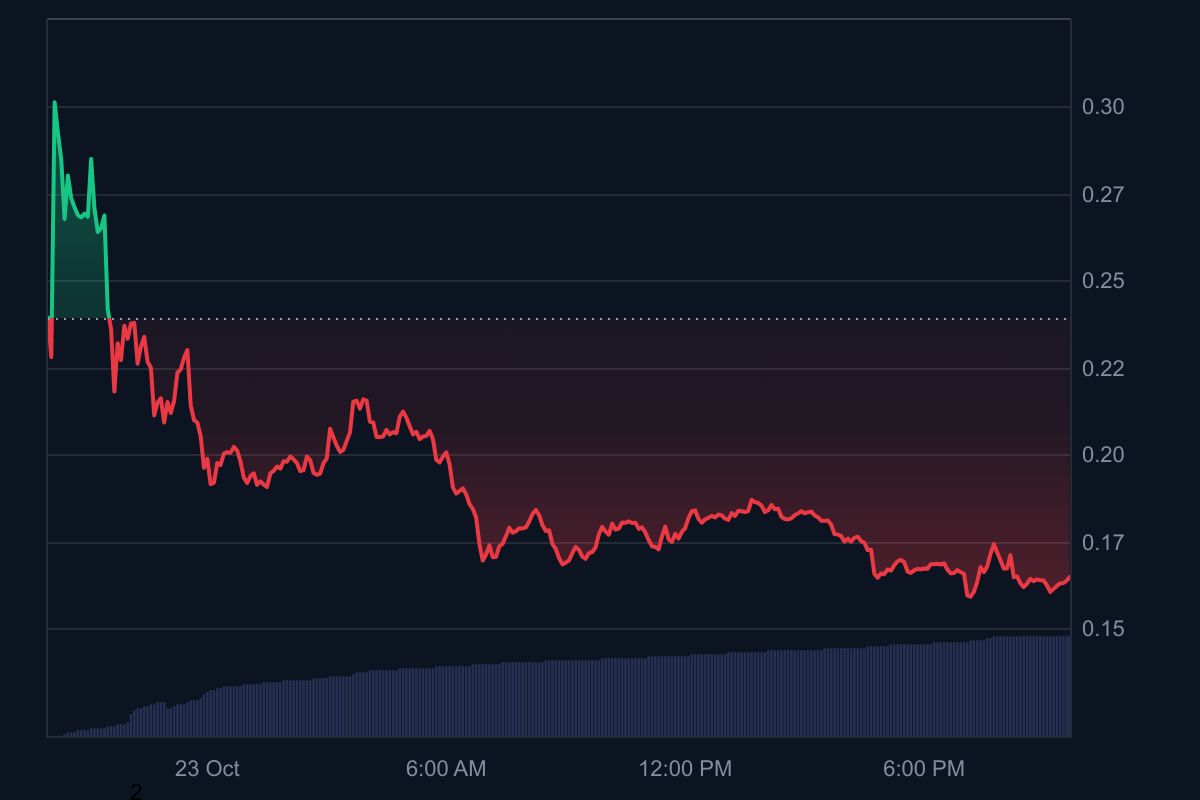

Turtle (TURTLE) Price

Source: CoinMarketCap

As of this writing, Turtle (TURTLE) is trading around $0.16, with a circulating supply of roughly 154.7 million tokens out of a maximum of 1 billion. Market activity has been steady since its token generation event, supported by growing adoption and liquidity integrations across DeFi. The following projections outline potential price scenarios based on network expansion, token utility, and broader market trends.

● 2025 Price Prediction: TURTLE may trade between $0.25–0.30, driven by post-launch stabilization and steady growth in active wallets, liquidity campaigns, and DeFi partnerships.

● 2026 Price Prediction: With continued expansion across chains and new integrations, the token could reach $0.40–0.60 as demand rises for governance and staking utility.

● 2027 Price Prediction: If the protocol strengthens its position as a key liquidity distribution layer, TURTLE might climb to $0.70–1.00, reflecting greater adoption and network effects.

● 2028 Price Prediction: In a mature market phase, TURTLE could surpass $1.00, potentially trading up to $1.50 if ecosystem activity and DeFi usage continue accelerating.

● 2029 Price Prediction: Assuming sustained growth and favorable macro trends, the token may move toward $1.50–2.00, reflecting the platform’s maturity and broader integration.

● 2030 Price Prediction: In an optimistic long-term scenario where Turtle becomes a leading liquidity infrastructure for Web3, TURTLE could reach $2.00–3.00+, backed by network utility and governance value.

While Turtle’s fundamentals and unique non-custodial design are promising, its future price depends on market conditions, user growth, and successful execution of its roadmap. Investors should monitor key metrics such as total value routed, protocol partnerships, and governance participation to assess long-term potential.

Conclusion

Turtle (TURTLE) introduces a new standard for decentralized finance by monetizing genuine on-chain activity and aligning incentives across the entire Web3 ecosystem. Through its non-custodial design, Turtle allows users to earn rewards for liquidity provision, staking, and other interactions without ever giving up control of their assets. Its data-driven approach and transparent distribution system offer a safer, more efficient framework for liquidity coordination, marking a clear shift from speculative yield farming to sustainable participation.

As DeFi continues to mature, Turtle’s model of turning wallet activity into measurable value could reshape how users and protocols collaborate. With a growing user base, thoughtful tokenomics, and an expanding network of partners, the project is well-positioned to influence the future of liquidity distribution. Can Turtle’s slow and steady approach truly redefine how value flows through Web3 — and set the blueprint for the next era of DeFi?

Disclaimer: The opinions expressed in this article are for informational purposes only. This article does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. Qualified professionals should be consulted prior to making financial decisions.