News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

- Hyperliquid’s HYPE token repurchased 8.7% of supply via $1.26B buybacks and burned 3,200 tokens in 24 hours, tightening float and creating bullish bias. - Whale wallets spent $35.9M to accumulate 641,551 HYPE tokens, driving 2.5–5.8% price surges and signaling institutional coordination. - Technical indicators show sustained upward momentum, with HYPE gaining 7.5% in August despite broader market declines, supported by $105M fee-funded buybacks. - Risks include Bitcoin correlation and whale manipulation

- Ethereum's institutional adoption accelerated in 2025 as corporate treasuries and ETFs controlled 9.2% of its supply, reshaping market dynamics. - 19 public companies and BlackRock's ETHA ETF dominated inflows, with $17.6B in corporate holdings and $27.66B in ETF assets by Q3 2025. - Regulatory clarity and yield-generating strategies reduced circulating supply, enhancing price resilience and positioning Ethereum as a regulated institutional asset. - Institutional accumulation created a flywheel effect, r

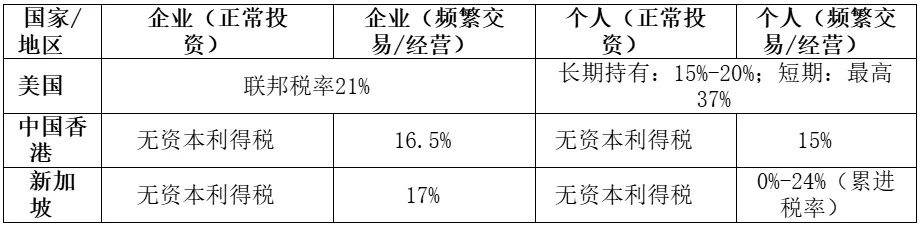

Tax arrangements are not a one-size-fits-all formula but need to be "tailor-made" according to the specific circumstances of each enterprise.

- Ethereum’s price resilience and institutional adoption drive Tom Lee’s $60,000 5-year forecast, supported by $27.6B ETF inflows and 55.5% market dominance. - Regulatory clarity (SEC approval, CLARITY Act) and 29% staked ETH bolster institutional confidence, while Layer 2 upgrades boost scalability and TVS to $16.28B. - Macroeconomic tailwinds (Fed rate cuts) and Ethereum’s role in stablecoins (55% market share) position it as a foundational asset, though competition and volatility pose risks.

- Bitcoin faces critical $110K–$112K resistance as on-chain metrics and institutional dynamics clash over bullish vs. bearish trajectories. - Taker-Buy-Sell ratio (-0.945) signals bearish pressure, while MVRV compression (1.0) suggests potential bull market rebalancing. - Institutional buyers accumulate during dips, offsetting whale-driven selling and ETF outflows amid $30.3B futures open interest. - Fed rate cut expectations and geopolitical risks create macro uncertainty, with 200-day SMA ($100K–$107K) a

- XRP faces a $3.08 breakout threshold, with technical indicators and institutional buying signaling potential for a $5.85 surge. - Post-SEC settlement, 60+ institutions now use XRP for cross-border payments, processing $1.3T via Ripple's ODL in Q2 2025. - $1.1B in institutional XRP purchases and seven ETF providers targeting $4.3B-$8.4B inflows by October 2025 reinforce bullish momentum. - A $3.65 price break would invalidate bearish patterns, while $50M+ weekly institutional inflows could validate the $5

- 22:32Suspected Wintermute wallet has accumulated SYRUP worth $5.2 million over the past two weeksForesight News reported that, according to Arkham monitoring data, a wallet suspected to belong to Wintermute has been "quietly" accumulating SYRUP tokens recently. Over the past two weeks, a total of $5.2 million worth of SYRUP tokens have been withdrawn from multiple exchanges and transferred to wallets associated with this market maker. As of now, this wallet holds SYRUP tokens worth $6.1 million, approximately 20.397 million tokens.

- 22:32Polymarket shows a 72% probability that Lighter's FDV will exceed $1 billion on the day after launchForesight News reported that according to Polymarket data, the market predicts a 72% probability that Lighter's FDV will exceed 1 billion USD on the day after its launch, and a 67% probability that it will exceed 2 billion USD. Currently, the trading volume of this prediction market has surpassed 15.45 million USD.

- 22:32A certain whale doubles down on ETH long positions again, with holdings valued at $60.93 million.Foresight News reported, according to on-chain analytics platform Lookonchain, the whale pension-usdt.eth once again opened a 2x leveraged long position of 20,000 ETH (approximately $60.93 million) today at a price of $3,040.92, with a liquidation price of $1,190.66.