News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec. 5) | 21Shares Launches 2x Leveraged SUI ETF on Nasdaq; U.S. Treasury Debt Surpasses $30 Trillion; JPMorgan: Strategy’s Resilience May Determine Bitcoin’s Short-Term Trend2Bitcoin looks increasingly like it did in 2022: Can BTC price avoid $68K?3The Chainlink ETF Disappoints Despite $41 Million Inflows — Why?

XRP Futures Rally with CME Reaching New Open Interest Peak

Cryptonewsland·2025/08/28 10:10

Hyperliquid DEX Sparks HYPE’s Price Surge to $51 All-Time High

Cryptonewsland·2025/08/28 10:10

Project Sakura Sparks DOGE Rebirth—Will Price Rally Soon?

Cryptonewsland·2025/08/28 10:10

XLM Stalls Below Resistance, Positive Flows Eye $0.45 Rally

DailyCoin·2025/08/28 10:06

XRP ETFs surprise with high institutional demand and billion-dollar volume

Portalcripto·2025/08/28 10:05

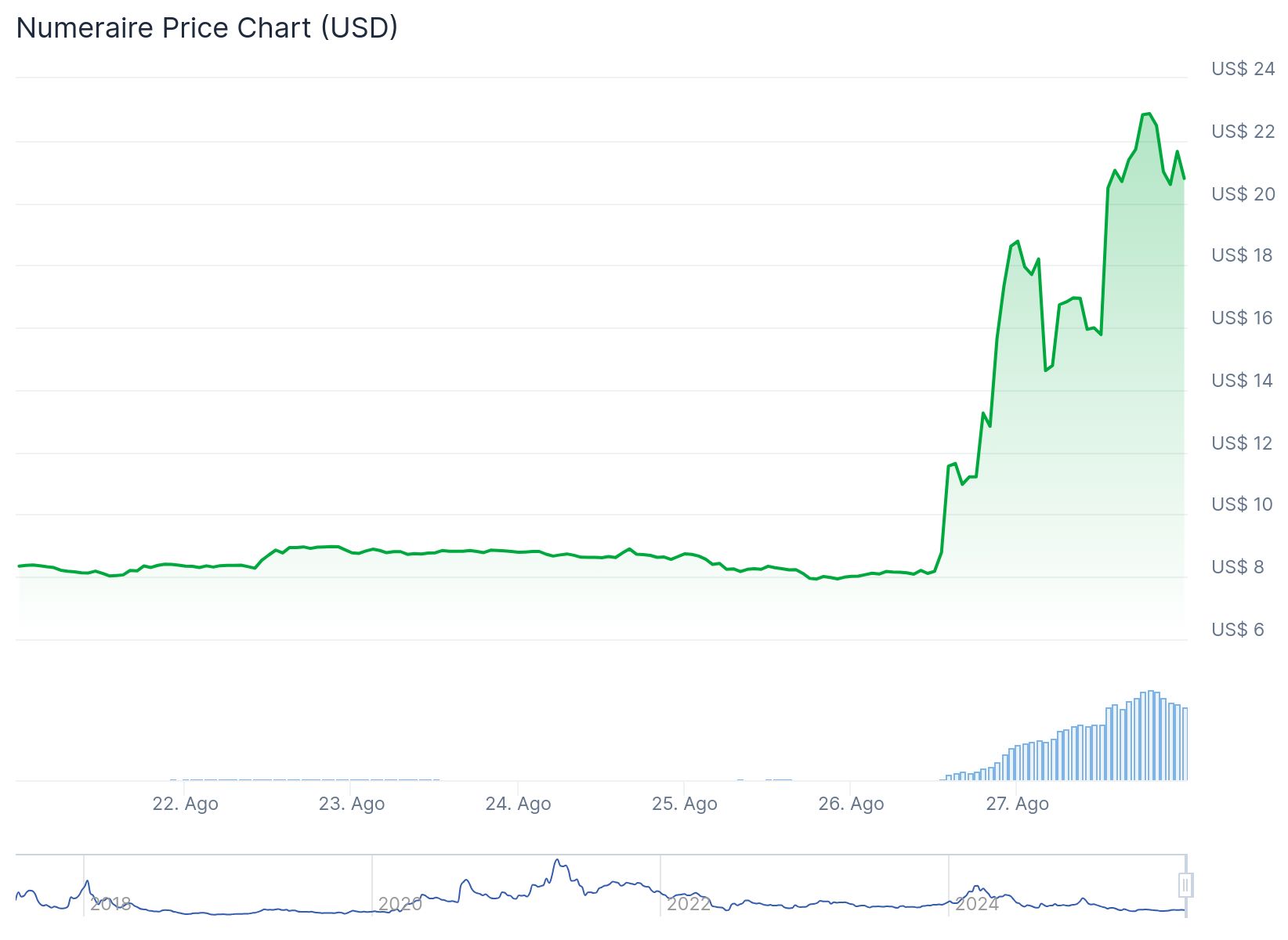

Numeraire (NMR) Cryptocurrency Soars After JPMorgan Invests $500 Million in AI Tokens

Portalcripto·2025/08/28 10:05

Xiao Feng's Bitcoin Asia 2025 Speech Full Text: DAT is More Suitable for Crypto Assets than ETF

DAT may be the best way to move crypto assets from Onchain to OffChain.

BlockBeats·2025/08/28 10:04

![[Long English Thread] A Brief Analysis of DATs: Financial Engineering or Business Operations? Which is Better, BTC or ETH?](/news-static/client/media/cover-placeholder.101bcc72032a7c4f0a397f15f3252c92.svg)

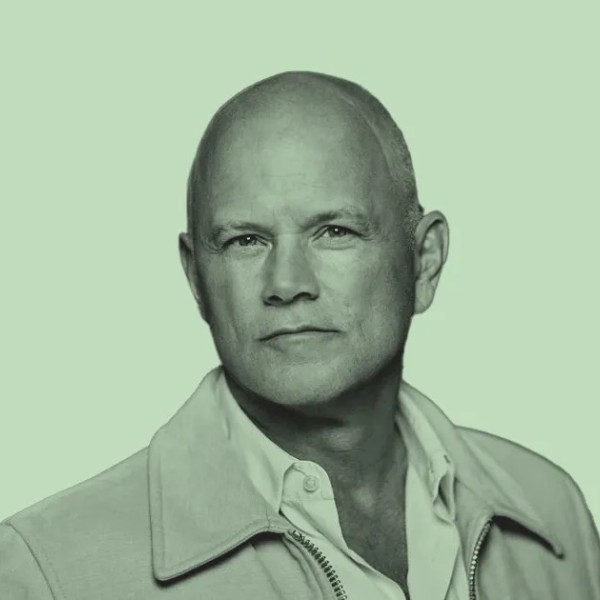

Michael Novogratz: Wall Street Refugee

Novogratz has never been a typical Wall Street person.

Block unicorn·2025/08/28 10:02

Aave Horizon Launches RWA Lending on Ethereum

Aave Labs introduces Horizon, a new RWA lending market on Ethereum allowing institutions to borrow stablecoins using real-world assets.How Aave Horizon WorksAave’s Vision for Institutional DeFi

Coinomedia·2025/08/28 10:00

Flash

- 05:1773% of most Bitcoin treasury companies are in debt, with 39% of them having liabilities exceeding the total value of their Bitcoin holdings.Jinse Finance reported that the latest dataset released by CoinTab shows that most publicly tracked bitcoin-holding companies are not just sitting on large amounts of (digital) gold; while holding bitcoin, they also carry considerable liabilities. In many cases, the total amount of these liabilities even exceeds the value of the bitcoin itself. Among the companies holding bitcoin on their balance sheets, 73% are in debt, and 39% have liabilities that exceed the current market value of their bitcoin holdings. About one-tenth of these companies appear to have accumulated bitcoin directly through borrowing, effectively turning their reserve strategy into leveraged trading.

- 03:31Data: In the past 7 days, CEXs have seen a cumulative net outflow of 8,915 BTCChainCatcher news, according to Coinglass data, in the past 7 days, CEXs have seen a cumulative net outflow of 8,915 BTC. The top three CEXs by outflow are as follows: · One exchange, with an outflow of 6,335.56 BTC; · One exchange, with an outflow of 1,193.43 BTC; · One exchange, with an outflow of 1,163.66 BTC. In addition, one exchange saw an inflow of 1,097.26 BTC, ranking first in terms of inflow.

- 03:21Analysis: Rising Bitcoin "vitality" indicator suggests the bull market may continueJinse Finance reported that crypto analyst "TXMC" posted on X, pointing out that although the recent bitcoin price has declined, the liveliness of this cycle continues to rise. This indicates that there is underlying demand for spot bitcoin, which is not reflected in the price trend and may suggest that the bull market cycle is not yet over. The analyst stated that this indicator reflects the long-term moving average of on-chain bitcoin activity, representing the sum of all lifecycle spending and on-chain holding activity. During bull markets, as supply changes hands at higher prices, market "liveliness" usually increases, indicating the inflow of new investment capital.

News