News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

From the frustration of not getting paid for fixing bikes as a teenager, to disrupting the financial system three times with E-Loan, Prosper, and Ripple, see how Chris Larsen is reshaping the payment world for ordinary people.

All efforts ultimately point toward one core goal: maximizing user experience value.

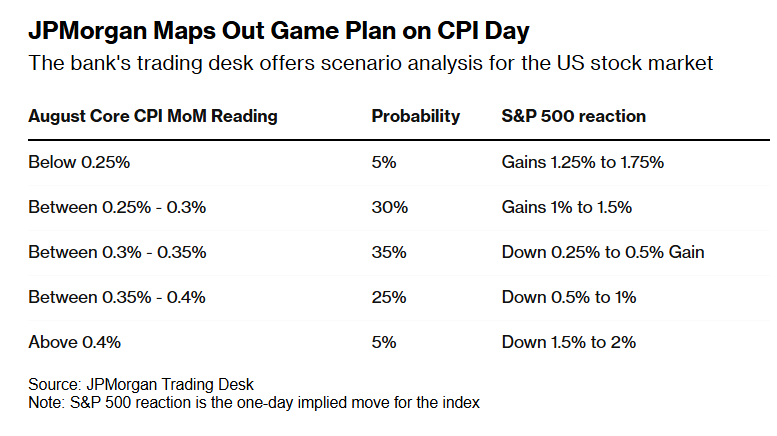

The PPI data may indicate that the CPI will also cool down, adding complexity to the debate over the extent of the Federal Reserve's rate cut in September...

The August CPI is about to be released, but Wall Street remains calm. This Thursday, the implied volatility in the stock market is lower than the average actual volatility on CPI release days over the past year and also lower than the expected volatility for the next non-farm payroll day.

- 08:06Analyst: The Federal Reserve appears slightly hawkish, gold may pull back to $3,600 in the short termJinse Finance reported that Marex analyst Edward Meir stated, "The Federal Reserve's overall stance on interest rates is slightly hawkish, and they are not truly enthusiastic about supporting rate cuts. Therefore, we have seen the US dollar strengthen after the Fed meeting, and US Treasury yields have also risen... I think in the short term, gold prices may be a bit overbought and could further retreat to the $3,600 mark."

- 07:47Hawkish Fed expectations drive USD/JPY surgeAccording to ChainCatcher, citing Golden Ten Data, after the Federal Reserve's rate cut, the US dollar weakened across the board. The Japanese yen once rose, but ultimately the USD/JPY exchange rate erased all losses and surged. The FOMC dot plot shows that two more rate cuts are expected in 2025, while the market expects three. Federal Reserve Chairman Powell described the rate cut as a "risk management" action, and future data will be key. Strong data may trigger a hawkish shift in rate expectations, supporting the dollar, while weak data may continue to put pressure on it. The rise in the yen was mainly driven by market expectations of a dovish Federal Reserve.

- 07:26Bloomberg Analyst: DOGE Spot ETF and XRP Spot ETF Issued by REX-Osprey to Be Listed on ThursdayChainCatcher news, Bloomberg ETF analyst Eric Balchunas posted on social media that the DOGE spot ETF and XRP spot ETF issued by REX-Osprey will be listed on Thursday. In addition, the TRUMP spot ETF and BONK spot ETF have also submitted registration, but the launch dates have not yet been announced. It is worth noting that, unlike the Bitcoin and Ethereum spot ETFs which previously required a lengthy approval process, these funds utilize the Investment Company Act of 1940 (commonly known as the "40 Act"). This framework provides a streamlined path for products, including enhanced investor protections for custody, governance, and transparency—features that regulators view positively.