Blast Royale: $500K raised within 15 minutes of the Open Pool opening

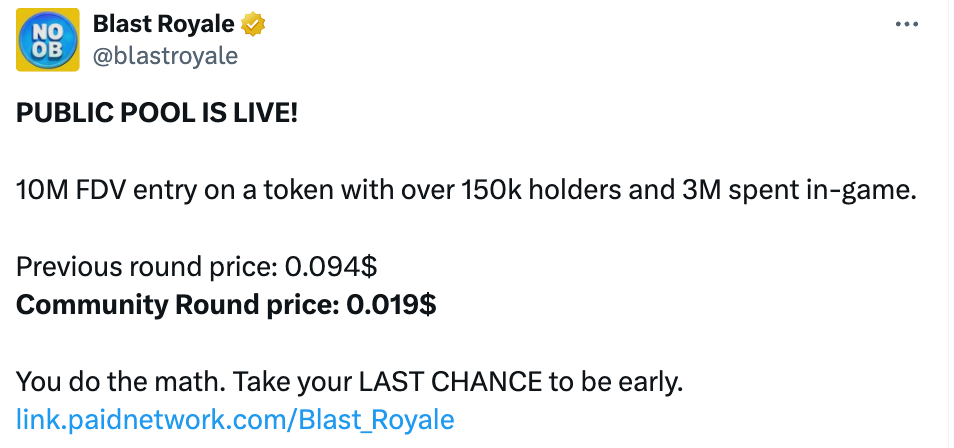

On November 13, Blast Royale published a post on the X platform, announcing that the Blast Royale token NOOB has opened a public fundraising (Public Pool). After the token was opened for fundraising, the funds raised reached $500,000 in 15 minutes.

The community round price of the Noob token was $0.019, and the price in the previous round was $0.094. The current FDV of Blast Royale token is $10 million, and the holders exceed 150,000.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Chinese National Gets 46 Months in Prison for $37 Million Crypto Scam Targeting Americans

Bitcoin Critical Support Holds as Market Sees Key Strength

BC-Nikkei 225 Futures

Parabolic Setup Forming: 5 Altcoins Trading Near Key Levels With 2×–4× Potential