MAV Down 518.02% in 24 Hours Amid Sharp Short-Term Volatility

- MAV token plummeted 518.02% in 24 hours amid sharp short-term selling pressure and sentiment reversal. - Despite 796.59% 7-day rebound, the asset remains in a long-term bearish trend with 6411.32% annual decline. - Analysts highlight extreme volatility and speculative trading dynamics, with technical indicators showing rapid overbought/oversold cycles. - Proposed backtesting strategy examines post-10% drop recovery patterns in high-volatility assets to assess risk-return profiles.

On AUG 30 2025, MAV dropped by 518.02% within 24 hours to reach $0.06251, MAV rose by 796.59% within 7 days, rose by 5266.55% within 1 month, and dropped by 6411.32% within 1 year.

The dramatic 24-hour decline signals intense short-term selling pressure following a sharp reversal in sentiment. While the token had surged over 5,000% in the preceding month, the recent drop indicates an accelerated profit-taking cycle or liquidity event. The 7-day rebound of nearly 800% highlights the token’s high volatility and its appeal to speculative traders, despite the overall long-term bearish trend observed over the past year. Analysts project that such extreme fluctuations reflect the inherent risk profile of the asset class and could continue in the near term amid uncertain market dynamics.

Technical indicators suggest the token has been operating in a highly compressed range, with RSI and MACD signals indicating overbought and oversold conditions alternating rapidly. The absence of clear trend continuation patterns suggests a market in transition, with no dominant force driving price direction. Traders are closely watching for a breakout or breakdown from the recent consolidation range, which could determine the next phase of the asset’s trajectory.

Backtest Hypothesis

To better understand the behavior of assets similar to MAV in response to sharp price drops, a backtesting strategy could be constructed. The hypothesis would involve identifying assets or tokens that experience a 10% or greater drop in a single day, defined as a close-to-close decline. This strategy could be applied to a selection of high-volatility instruments or indices to test how performance evolves over subsequent holding periods—ranging from one day to five days or until a defined opposite signal occurs.

This approach would allow analysts to assess whether a similar token or stock tends to recover, continue the decline, or enter a consolidation phase after a significant drop. If stop-loss or take-profit rules are applied beyond the initial trigger event, these could further refine the strategy’s risk-return profile. A backtest running from 2022-01-01 through 2025-08-30 would capture a wide range of market conditions, offering valuable insights into the behavior of such assets in both bearish and bullish environments.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitfarms stock jumps 16% as firm finalizes shift from bitcoin mining to AI infrastructure

As tech stocks tumble, traders flock to "anti-AI" concept stocks

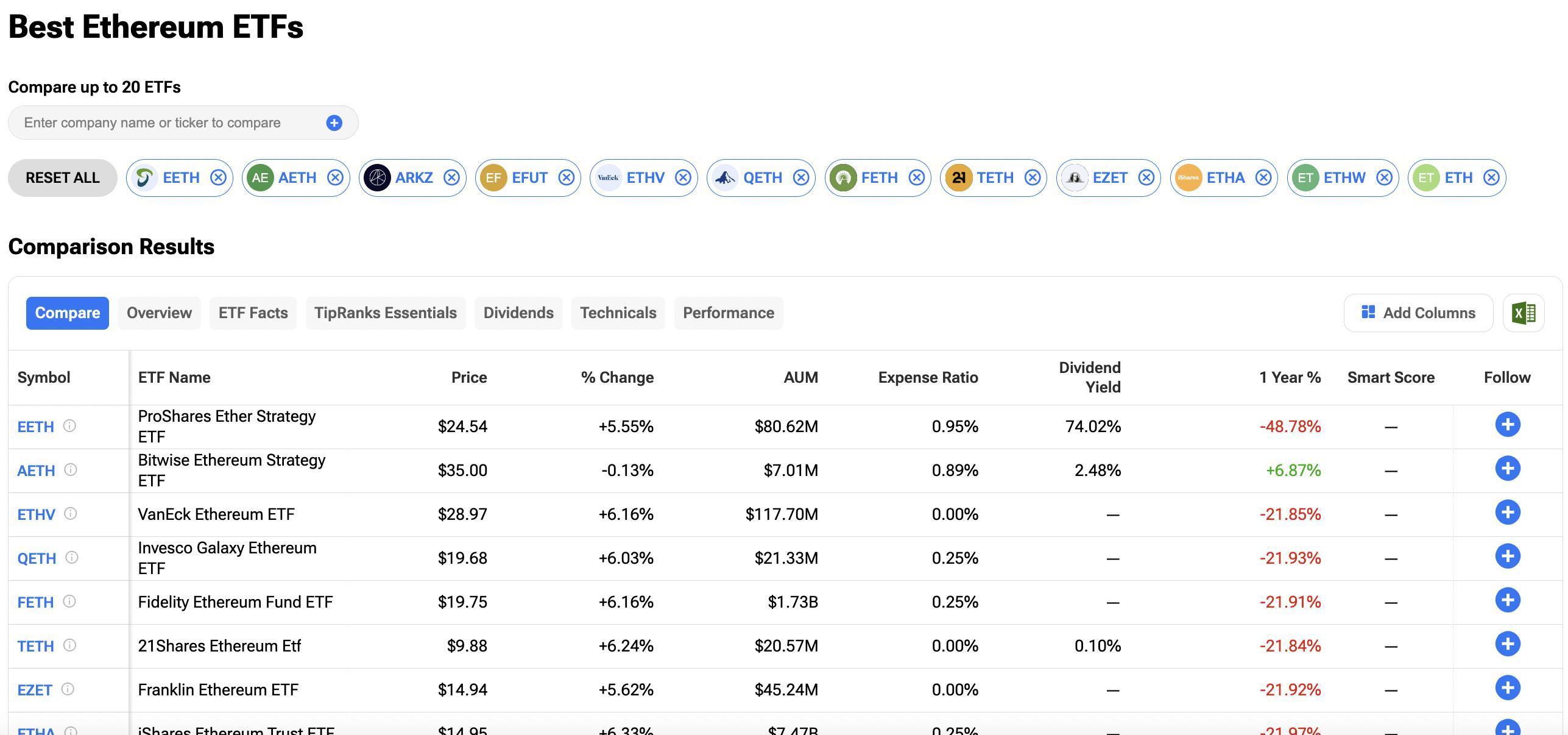

Ethereum ETFs Hemorrhage $81M as Investors Reach Breaking Point Near $1,900 Support

Hims & Hers drops 6.5% in early trading following legal threat from Novo Nordisk