Tether Dominance (USDT.D) Hits 2-Month High — Why This Is Concerning

Tether Dominance’s rise to a two-month peak is raising alarms for traders. Analysts caution that a push above 5% could confirm a bearish shift, though some see room for a rebound in Q4.

Tether Dominance (USDT.D) is one of the metrics closely correlated with Bitcoin’s price and overall market capitalization. Yet it is often overlooked in many market analyses. Now, this data has confirmed warning signals worth paying attention to.

USDT.D represents Tether’s share of the total crypto market capitalization. Changes in USDT.D can help measure how actively traders spend USDT, providing a basis for predicting possible scenarios.

Analysts Warn as Tether Dominance (USDT.D) Reaches 2-Month High

Tether (USDT) remains the leading stablecoin in terms of both market share and liquidity. A decline in USDT.D usually means traders spend more USDT to buy Bitcoin and altcoins, driving higher prices.

On the other hand, a rise in USDT.D indicates that traders are selling assets and moving back into USDT. This reflects cautious sentiment toward volatility and often signals potential downside risk.

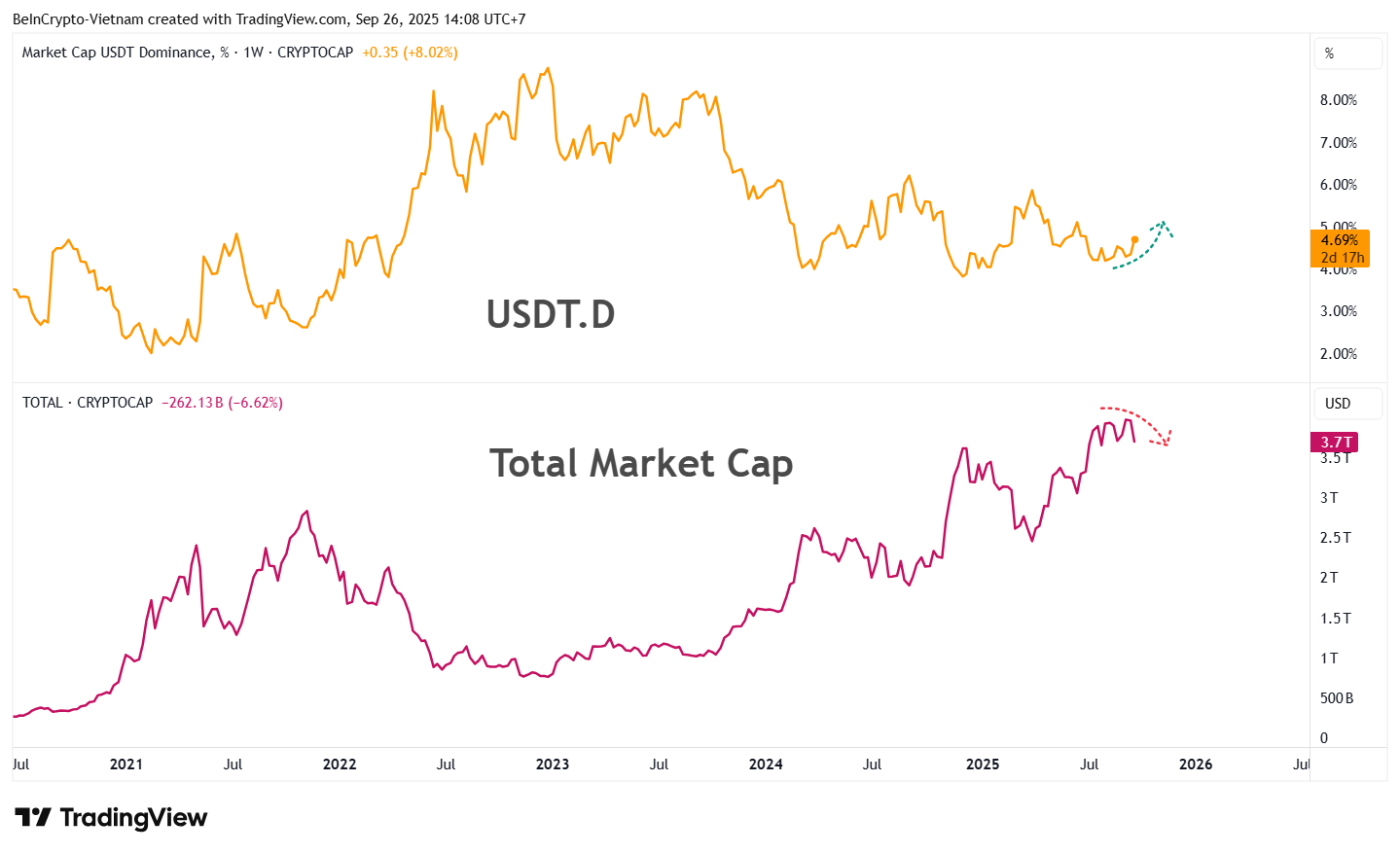

TradingView data shows that the inverse correlation between USDT.D and total crypto market capitalization has been observed repeatedly over the years.

Total Market Capitalization And USDT.D. Source:

TradingView

Total Market Capitalization And USDT.D. Source:

TradingView

During the final week of September, USDT.D climbed to 4.69%, its highest level in two months. Analysts see this breakout as a move that could push it even higher, raising concerns about a prolonged bearish outlook in the days ahead.

Market analyst Jason Pizzino remains hopeful that USDT.D will soon correct. However, he does not rule out a breakout above 5% as a troubling confirmation.

“Here’s the breakout no crypto bull wants to see. The good news is that USDT dominance is now testing the macro 50% level. However, above ~5% and the trend could be changing for the bulls. Hopefully, it’s a test and rejection. Otherwise, be prepared,” Pizzino commented.

Technical vs. Fundamental Considerations

At this stage, most negative analyses based on USDT.D rely heavily on technical signals, where trendlines and resistance levels play a central role. This limits reliability when broader fundamental factors are added to the picture.

Those fundamental factors include record-high USDT reserves on exchanges, new peaks in USDT netflows, and rising demand from traders reflected in Tether’s recent surge in USDT minting. This setup acts like gunpowder ready to be deployed.

“Now, given the perfect negative correlation between USDT.D and $TOTAL, this would imply ‘one more sweep of the lows’… But TA isn’t always perfect. It doesn’t make much sense to unload bags here just to maybe buy them back slightly lower. We are likely close to finalizing our high time-frame swing low for a bullish Q4,” Max, founder of BecauseBitcoin, said.

The late-September market decline has intensified doubts. Debate continues over whether this is a bear trap or the start of a broader downtrend. As a result, every new signal is being closely examined.

USDT.D is part of those signals. It should not be viewed in isolation but rather in combination with other indicators to minimize risk as much as possible.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Why Solana's Latest Plunge Highlights Underlying Weaknesses in the Crypto Market

- Solana's 57% price crash in Nov 2025 exposed systemic crypto vulnerabilities, including psychological biases, excessive leverage, and fragile infrastructure. - Token unlocks from Alameda/FTX estates and $30M selling pressure triggered the downturn, yet $101.7M in institutional inflows highlighted market paradoxes. - Fed rate cuts drove $417M into Solana ETFs, but uncertainty caused 14% price drops, revealing crypto's growing integration with traditional finance. - $19B in liquidations during the Oct 11 "

The Growing Impact of Security Systems Technology on the Future Development of Higher Education Infrastructure

- 21st-century higher education infrastructure increasingly relies on advanced security systems to address cyberattacks and campus safety threats. - AI and zero-trust architectures enable proactive threat detection, with 80% of institutions adopting zero-trust strategies by 2025. - Integrated security investments boost enrollment, research credibility, and institutional reputation, though skill gaps and outdated infrastructure hinder full implementation. - ROI extends beyond cost savings, with 60% of stude

Bitcoin Leveraged Position Liquidations and Market Fluctuations: Urging Proactive Risk Control Strategies

- 2025 crypto market saw $21B in leveraged liquidations as Bitcoin's volatility triggered systemic collapses in October and November. - Over-leveraged long positions, social media hype, and automated deleveraging mechanisms fueled cascading losses across exchanges. - Traders shifted to 1-3x leverage and AI-driven risk tools post-liquidations, with 65% reducing exposure in Q4 2025. - Experts emphasize dynamic position sizing, diversification, and 5-15% stablecoin allocations to mitigate volatility risks in

Urban Industrial Properties in Markets Following Corporate Divestitures: Approaches to Strategic Investment and Insights from the Xerox Webster Campus Example

- Xerox Webster campus in NY secures $14. 3M in public grants to transform 300-acre brownfield into advanced manufacturing hub. - Infrastructure upgrades reduced industrial vacancy to 2% by 2024, attracting $650M fairlife® dairy plant creating 250 jobs. - Public-private partnerships and policy alignment through Brownfield Opportunity Area designation ensure sustained investment and regulatory stability. - The model demonstrates how strategic infrastructure and policy frameworks can catalyze $1B+ developmen