$16B in Longs Liquidated as Wall Street Sell-Off Extends BTC, ETH, Broader Crypto Market Meltdown

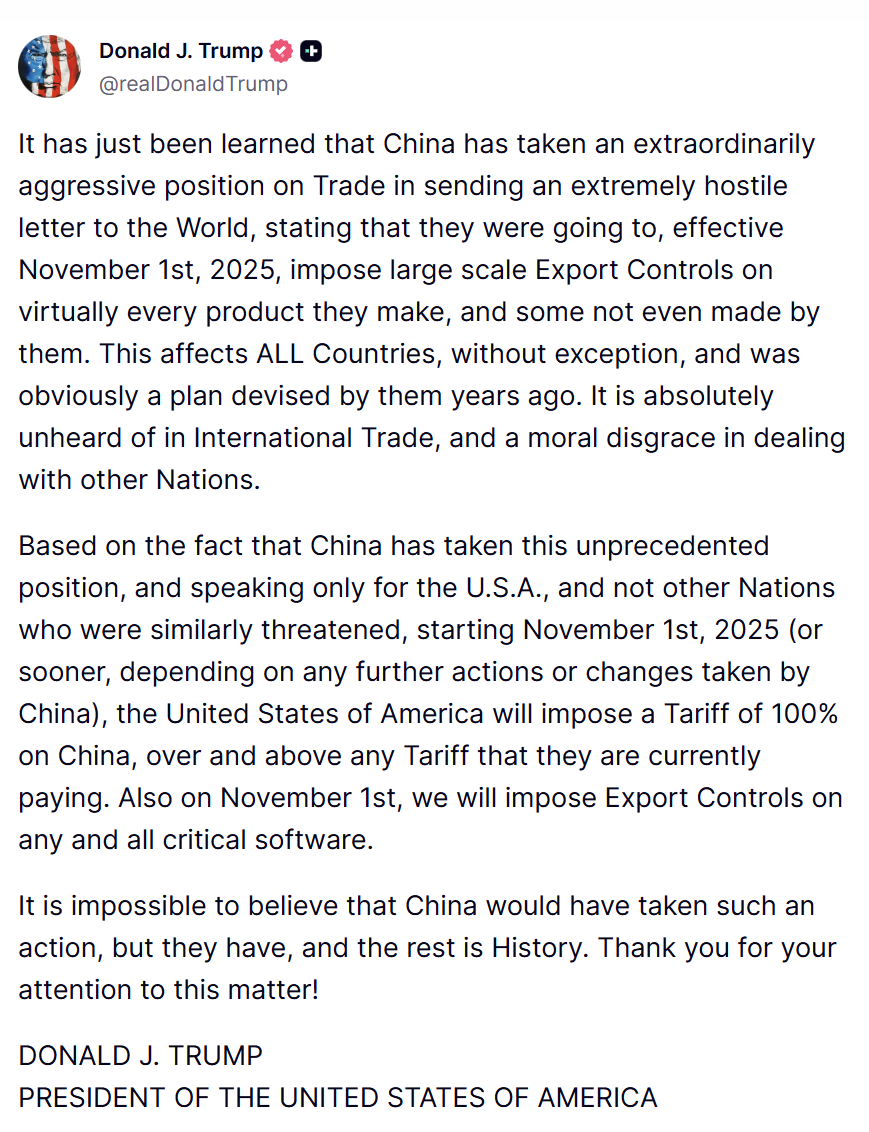

Crypto liquidations continued their rout early morning Asia hours after the broader crypto market continued its plunge hours after U.S. President Donald Trump threatened 100% tariffs on Chinese imports via a Truth Social post, which triggered a global risk-off wave and wiped out more than $16 billion in longs by midday Hong Kong time.

Trader anxiety that a cooling trade war was about to re-ignite sent a macro shock rippling through crypto, triggering one of the largest long declines in prices of BTC, ETH and other digital assets seen all year.

Bitcoin recovered to $113,294 and Ether to $3,844 as the CoinDesk 20 Index slid 12.1%. The world's largest cryptocurrency had fallen below $110,000 briefly, marking a 10% decline over the past 24 hours

Crypto's total market cap dropped to $3.87 trillion, and roughly $16.7 billion of the $19.1 billion in liquidations came from longs, while Ethena’s USDe briefly printed $0.9996, a mild deviation that highlights peg stress when derivatives markets whipsaw.

The Ethena team said USDe minting and redemptions remained fully operational despite the volatility and pointed out that the stablecoin is even more overcollateralized as unrealized gains from short positions are realized.

Adding to traders’ concerns, the U.S. government shutdown has delayed key economic data releases, leaving markets to navigate without official indicators just as trade war rhetoric returns to center stage.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin price dips below 88K as analysis blames FOMC nerves

Crypto: How Europe Wants to Enforce Its Version of the SEC

Stablecoin : Western Union plans to launch anti-inflation "stable cards"

Mars Morning News | SEC Expected to Issue "Innovation Exemptions" for the Crypto Industry in "About a Month"

The SEC is expected to issue an innovation exemption for the crypto industry. The UK "Digital Assets and Other Property Act" has come into effect. BlackRock's CEO revealed that sovereign wealth funds are buying bitcoin. Bank of America recommends clients allocate to crypto assets. Bitcoin selling pressure is nearing its end. Summary generated by Mars AI. The accuracy and completeness of this summary are still being improved as the Mars AI model continues to iterate.