Recently, the Chainlink price prediction 2025 has taken center stage as many hope for a strong rally this time. This optimism continues as the network expands from its early DeFi roots into a broader infrastructure. With the Chainlink price today at $16.09, both fundamental and technical indicators suggest that LINK may be approaching a pivotal phase with its accelerated adoption.

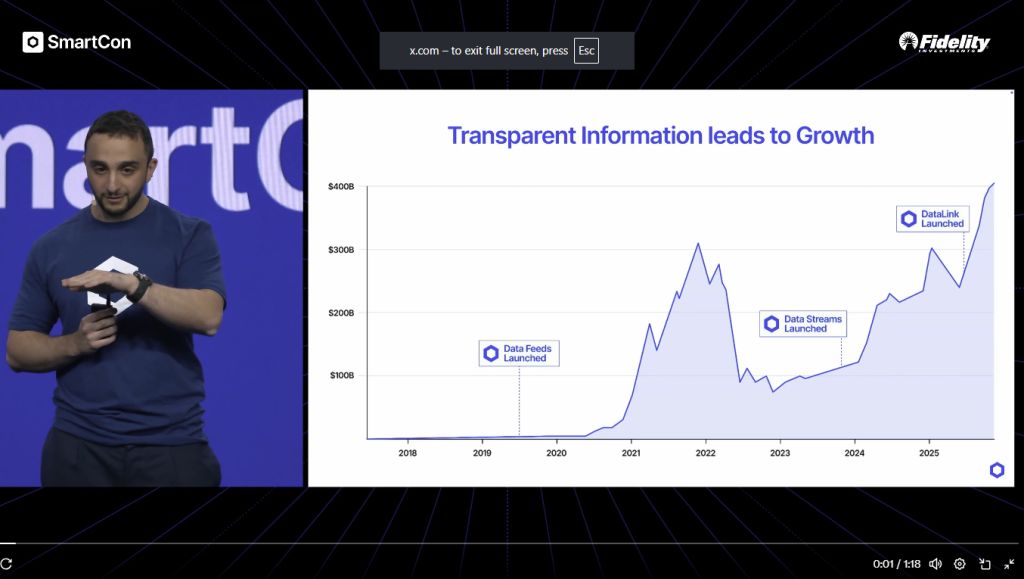

In a recent update shared on Chainlink’s official X account, the company’s CBO highlighted how Chainlink’s innovation cycle has fueled growth across multiple market cycles. He described the early days of 2019 as a “desert” with very little happening onchain. That changed when data feeds launched, rapidly expanding DeFi activity during 2021.

Later, in late 2023, Chainlink introduced data streams, which again boosted usage across trading and liquidity protocols. Now, in 2025, the rollout of Data Link represents the next major step, creating transparent and consistent information flow for tokenized stocks, ETFs, and real-world assets moving onchain.

These developments reinforce the long-term Chainlink price prediction narrative, as transparency-driven infrastructure becomes central to the next wave of tokenization. With global financial systems migrating toward digital settlement, Chainlink crypto remains positioned as a key interoperability and data layer that benefits directly from this structural shift.

The Chainlink price chart continues to show constructive behavior, as well. LINK /USD has repeatedly found stability above the $14.5 zone, forming a base that aligns with the 0.618 Fibonacci retracement, a historically reliable reversal area. This zone has acted as an anchor through recent volatility, per analyst Ali Martinez’s post.

Analyst post suggests price targets of $26 and $47 , if LINK maintains strength. Meanwhile, short-term dynamics show that a confirmed break above $16 is required to signal the beginning of a new upward phase. With Chainlink price USD hovering at $16.09, LINK sits right at this threshold.

Should Bitcoin maintain its broader momentum, liquidity could rotate into altcoins and strengthen the Chainlink price before 2025 concludes. However, market watchers are aware that Bitcoin’s direction remains a key influence on LINK’s near-term performance.

The CBO’s comments on transparent data powering trillions in future onchain value highlight how Chainlink anticipates significant ecosystem growth. By enabling tokenized financial products from equities to ETFs, Chainlink’s infrastructure could extend its role well beyond DeFi.

This narrative aligns with the current technical setup, where sustained demand around the $14–$16 region continues to build a foundation for medium-term appreciation. If LINK reclaims higher levels, the Chainlink price prediction 2025 narrativ e could strengthen sharply as tokenization adoption scales throughout the year.