Bitcoin Price Tanks Below $97K as Analyst Warns the Worst Is Yet to Come

Despite the positive developments on a macro front, such as the US government reopening, BTC’s quite unfavorable price actions continued in the past 12 hours or so as the asset plunged to a new multi-month low.

The cryptocurrency stood above $107,000 just three days ago after Trump promised to send tariff checks of at least $2,000 to some Americans and hinted that the government shutdown might end soon. However, bitcoin failed to capitalize on this momentum and quickly dipped back to $103,000.

Nevertheless, it rebounded to $105,000 on Wednesday before the bears took complete control of the market, especially on Thursday. The POTUS signed legislation to reopen the government, which was first followed by an immediate bounce, but the landscape changed for the worse shortly after.

In less than a day, bitcoin dumped by more than eight grand and currently struggles below $97,000, which is the lowest it has been since early May.

Doctor Profit, who has been bearish on the asset for weeks, believes the worst is yet to come by predicting another nosedive to somewhere around $90,000 and $94,000.

#Bitcoin: First promised target of 90-94k region is about to be hit. Important to note that I wont take any profits from the short at 90-94k region! https://t.co/p6qQqxsaor pic.twitter.com/Rhamwixvct

— Doctor Profit 🇨🇭 (@DrProfitCrypto) November 14, 2025

The altcoins have followed suit with multiple double-digit price declines. AAVE, ENA, RENDER, SUI, PEPE, and LINK are also down by more than 12%. Even the largest of the bunch has plunged by over 11% and now struggles well below $3,200.

You may also like:

- Bitcoin’s Price Jumps as Trump Signs Bill to End Record US Govt Shutdown

- Bitcoin Tumbles Below $100K Again, Liquidations Approach $700 Million

- BTC Steadies Over $100K: Sign of Maturity While ‘Moonvember’ Buzz Builds

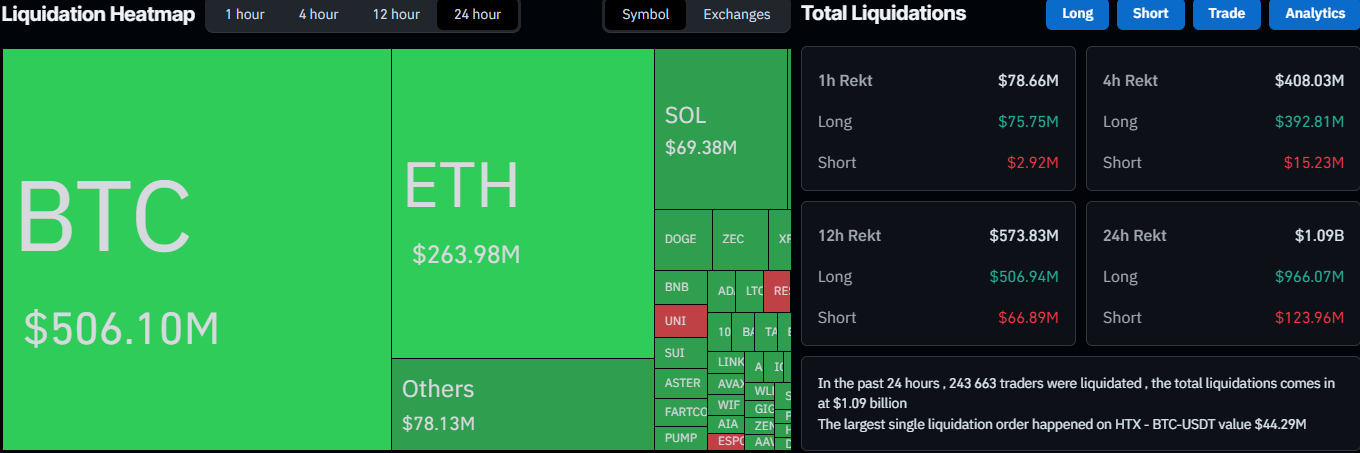

The total value of wrecked positions has skyrocketed to almost $1.1 billion on a daily basis. The single-largest liquidated position, according to CoinGlass, took place on HTX and was worth a whopping $44.29 million. The number of wrecked traders is above 240,000.

Naturally, longs represent the lion’s share, with $966 million. Short liquidations are worth $124 million as of press time.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Timeless Strategies for Investing in Today’s Market

- 2025 financial markets face AI-driven disruptions and volatility, yet timeless principles from R.W. McNeel and Warren Buffett remain relevant for navigating uncertainty. - Both emphasize intrinsic value (Buffett's "price vs. value" mantra) and emotional discipline, exemplified by Buffett's 2008 Goldman Sachs investment and 2025 AI-focused portfolio adjustments. - Their strategies prioritize compounding through retained earnings (e.g., Coca-Cola , Apple) and confidence in U.S. economic resilience, alignin

Investing in STEM and Digital Skills: Shaping the Future of Higher Education and Workforce Integration

- Global EdTech market grows at 20.5% CAGR to $790B by 2034, driven by STEM/digital literacy demand. - AI/cybersecurity programs surge as universities launch accelerated degrees to address talent shortages. - Investors target EdTech's growth potential despite challenges like unstable pricing models and uneven infrastructure. - Platforms like Coursera and Udacity leverage AI for personalized learning, aligning education with workforce needs.

Zcash (ZEC) Value Soars: The Intersection of Privacy Advancements and Mainstream Institutional Embrace in 2025

- Zcash (ZEC) surged in late 2025 due to privacy innovations, institutional adoption, and robust on-chain activity. - Grayscale's Zcash ETF filing and Cypherpunk/Reliance's strategic holdings highlight growing institutional confidence in privacy-centric crypto. - Orchard protocol adoption (30% of ZEC transactions) and Zerdinals inscriptions drove 1,300%+ transaction growth, outpacing Ethereum/Solana in fee production. - Zcash's hybrid privacy model (shielded/transparent transactions) addresses regulatory c

SOL Value Plummets by 150%: Uncovering the Causes of the Solana Turmoil

- Solana's 150% price drop in 2025 exposed structural risks in its centralized validator network and fragile DeFi infrastructure. - Validator concentration (Teraswitch/Latitude controlling 43% stake) and Jito's 88% node dominance created systemic vulnerabilities. - $3.1B in 2025 DeFi losses from smart contract exploits highlighted unresolved security flaws despite AI audits and Rust-based safeguards. - Governance failures and regulatory uncertainties prompted 72% of institutions to enhance crypto risk prot