Aster Price Dips 8% But This Secret Ingredient Is Keeping Its Uptrend Alive

Aster has slipped 8% in the past 24 hours, yet the altcoin continues to maintain a broader uptrend that has held firm for nearly three weeks. Despite bearish pressure from the wider crypto market, Aster is benefiting from unique structural advantages that are helping it resist deeper declines. Aster Has The Key To A Safe

Aster has slipped 8% in the past 24 hours, yet the altcoin continues to maintain a broader uptrend that has held firm for nearly three weeks.

Despite bearish pressure from the wider crypto market, Aster is benefiting from unique structural advantages that are helping it resist deeper declines.

Aster Has The Key To A Safe Rally

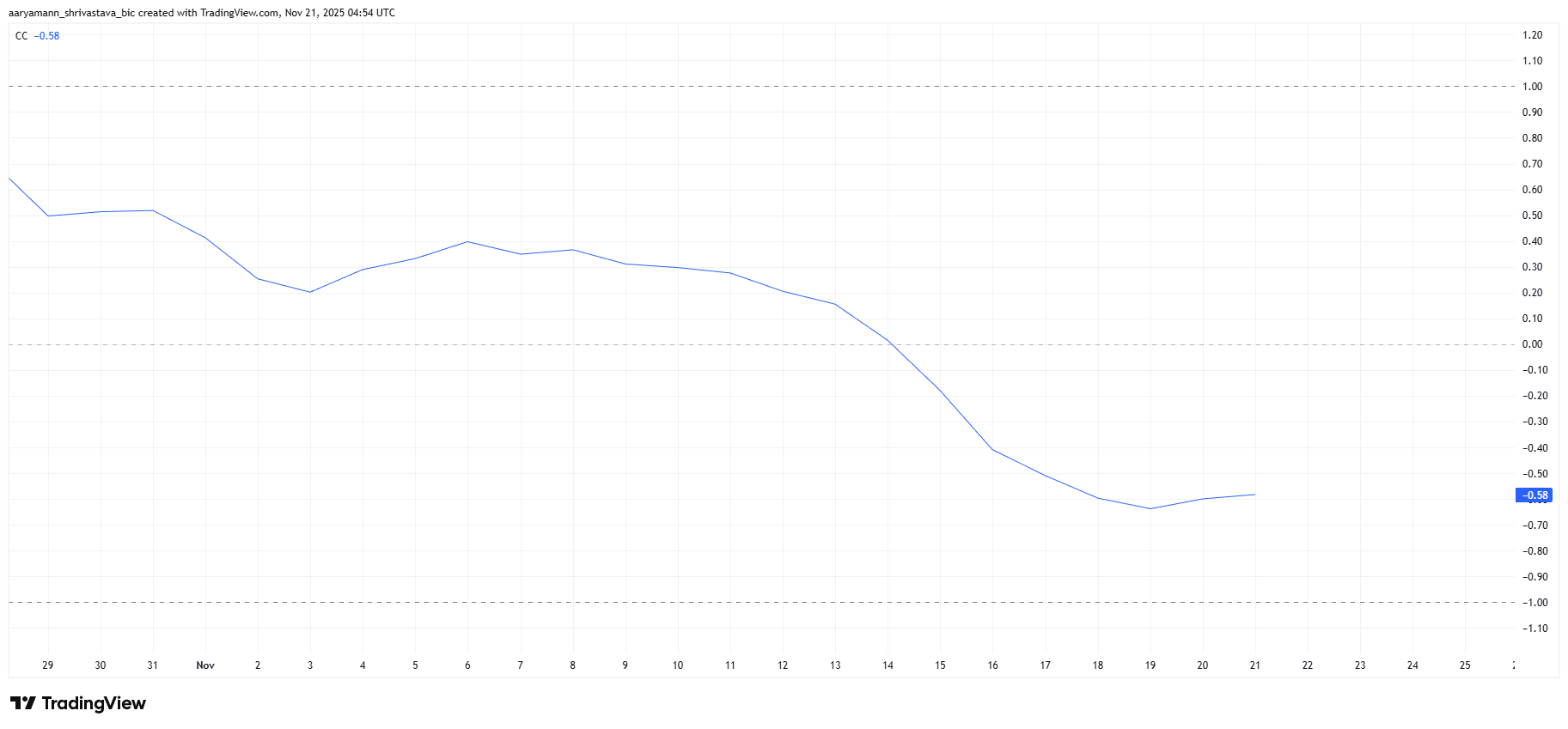

Aster’s negative correlation with Bitcoin is strengthening its position. At the time of writing, the correlation coefficient between Aster and BTC sits at -0.58, indicating that the two assets are moving in opposite directions. With Bitcoin continuing to decline on the daily chart, this negative relationship gives Aster room to rise even as the market weakens.

This dynamic has turned into one of Aster’s biggest advantages. As Bitcoin retreats, Aster’s price structure gains support from its divergence, allowing buyers to step in without the usual pressure tied to BTC’s volatility.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

ASTER Correlation To Bitcoin. Source:

ASTER Correlation To Bitcoin. Source:

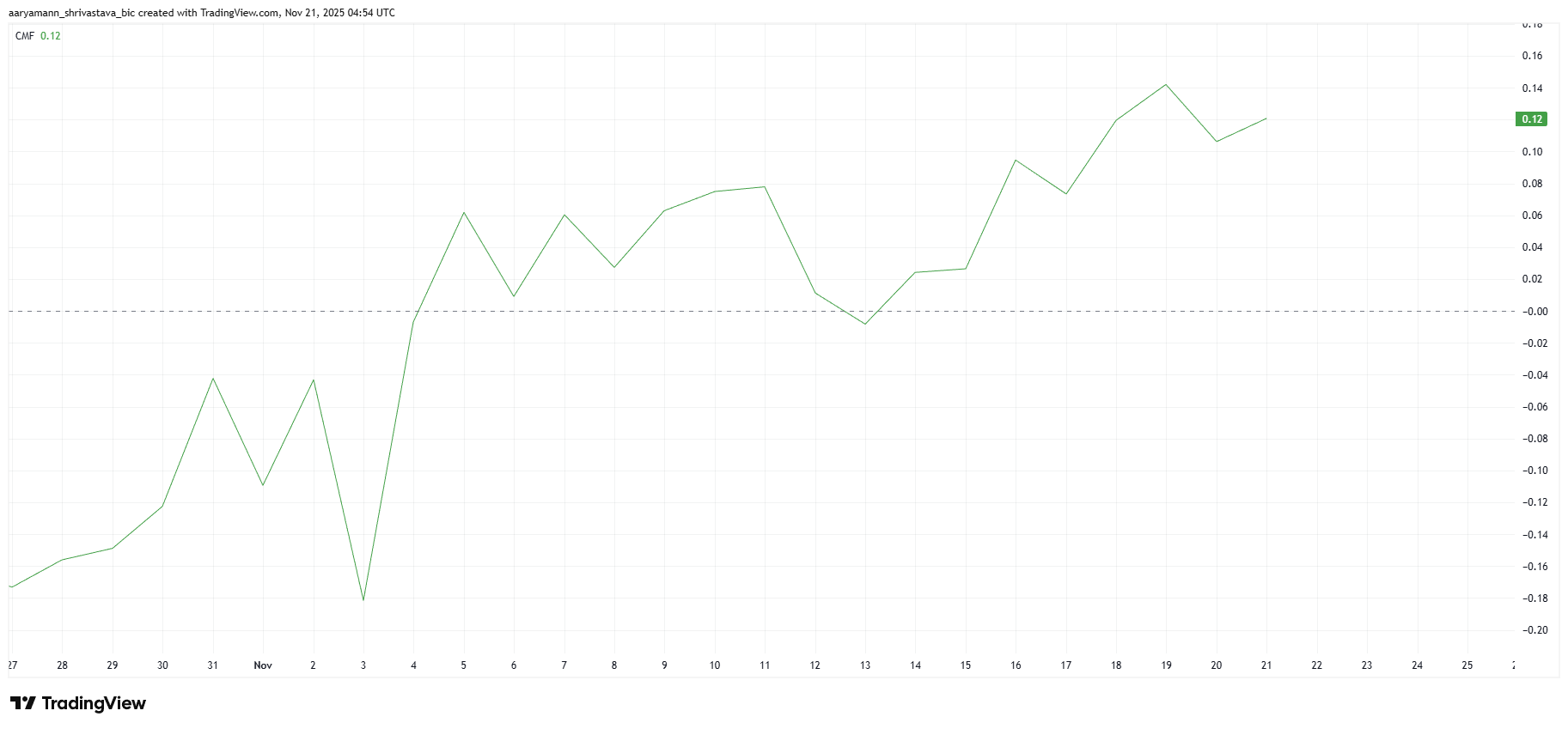

Macro momentum indicators are also pointing toward strengthening inflows. The Chaikin Money Flow is showing a sharp uptick, signaling rising capital entering the asset. Sustained positive CMF readings often indicate renewed investor confidence and provide essential backing for continued rallies.

Investor support plays a crucial role in maintaining price momentum, and Aster is benefiting from consistent accumulation. If these inflows continue, the altcoin could gain enough strength to push toward the $1.50 mark.

ASTER CMF. Source:

ASTER CMF. Source:

ASTER Price Will Continue Its Rise

Aster trades at $1.25 while holding above the key $1.20 support level, sitting just below the $1.28 resistance. Its current position suggests that the altcoin may continue rising as long as broader momentum and negative correlation with Bitcoin remain supportive.

Based on the current indicators, Aster’s nearly three-week-long uptrend appears likely to extend further. Even with the recent 8% drop, bullish conditions could drive the price toward $1.39. A breakout above that level would open the path to $1.50, reinforcing the strength of the ongoing rally.

ASTER Price Analysis. Source:

ASTER Price Analysis. Source:

However, if investors decide to lock in profits, Aster could lose its $1.20 support. A breakdown below that threshold may push the price to $1.07. This would invalidate the bullish thesis and signal a shift in sentiment.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Updates: Abu Dhabi Invests $518 Million in Bitcoin Despite Bearish Death Cross Warnings

- Bitcoin's 2025 "death cross" signals bearish concerns as price nears $90,000, contrasting Abu Dhabi's $518M IBIT investment boost. - Historical death cross patterns show mixed outcomes, with 2022's 64% drop contrasting recent local bottom recoveries amid rising selling pressure. - Institutional confidence grows (Harvard, KindlyMD) despite $3.1B ETF outflows, as technical indicators suggest short-term bounce but $100,000 resistance remains key.

Solana News Today: The Future of Crypto—Global Platforms, Immediate Connectivity, and Widespread Confidence

- Solana introduces Sunrise, a tool streamlining token imports via Orb and Jupiter integrations, tested by MON token migration from Monad. - CryptoAppsy, a no-registration crypto app, offers real-time insights and multilingual support to democratize 24/7 trading access. - Curaçao-licensed CryptoGames expands altcoin support to 50+ coins, showcasing blockchain's role in reshaping traditional industries like gaming. - These innovations, including Solana's infrastructure upgrades, aim to reduce barriers and p

Bitcoin News Update: Satoshi’s $41 Billion Decline Ignites Discussion: Ought Anonymous Crypto Wealth Be Included in Worldwide Rankings?

- Satoshi Nakamoto's Bitcoin holdings lost $41B in late 2025, dropping his estimated net worth to $95.8B and global ranking from 11th to 20th. - The 30% BTC price crash stemmed from institutional exits, liquidity strains, and macroeconomic pressures, tracked via the "Patoshi Pattern" mining signature. - Quantum computing risks and market instability reignite debates over whether pseudonymous crypto fortunes should be included in traditional wealth rankings. - Analysts warn Nakamoto's 1.1M BTC stash could d

Bitcoin News Update: Decentralization Scores Big with $265K Solo Miner Victory

- A solo Bitcoin miner earned $265,000 by solving block 924,569 using a 1.2 TH/s Bitaxe Gamma rig, defying 1-in-100,000 odds. - 2025 saw 13 solo-mined blocks, including a 6 TH/s win with 1-in-180 million daily odds, highlighting growing but risky accessibility. - Experts warn solo mining remains niche as Bitcoin's 855.7 EH/s network hash rate makes individual success statistically negligible. - The win underscores Bitcoin's decentralized appeal, though industrial dominance and halving events will likely sh