Solana shows early signs of bounce: $131 support holds line

Solana price is flashing a daily bullish divergence while holding key support at $131, suggesting early signs of strength and the possibility of a short-term reversal toward higher resistance levels.

- Momentum shift emerges as Solana steadies at a long-tested support zone

- Market behavior reflects early accumulation after extended sell pressure

- Divergence hints that downside exhaustion may be forming beneath recent lows

Solana’s ( SOL ) latest price action is showing encouraging signals after an extended period of downside pressure. A clear bullish divergence has formed on the daily chart, hinting that momentum may be shifting back toward buyers.

With price holding a major support level and several indicators showing alignment, and with Wormhole’s new Sunrise DeFi platform launching on Solana and debuting Monad’s MON as its first listing, the current structure suggests that Solana may be preparing for a relief move.

Solana price key technical points

- Daily bullish divergence forming between price and RSI

- Major support at $131 continues to act as a reaction zone

- Key resistance lies at the value area low and later at $167

SOLUSDT (1D) Chart, Source: TradingView

SOLUSDT (1D) Chart, Source: TradingView

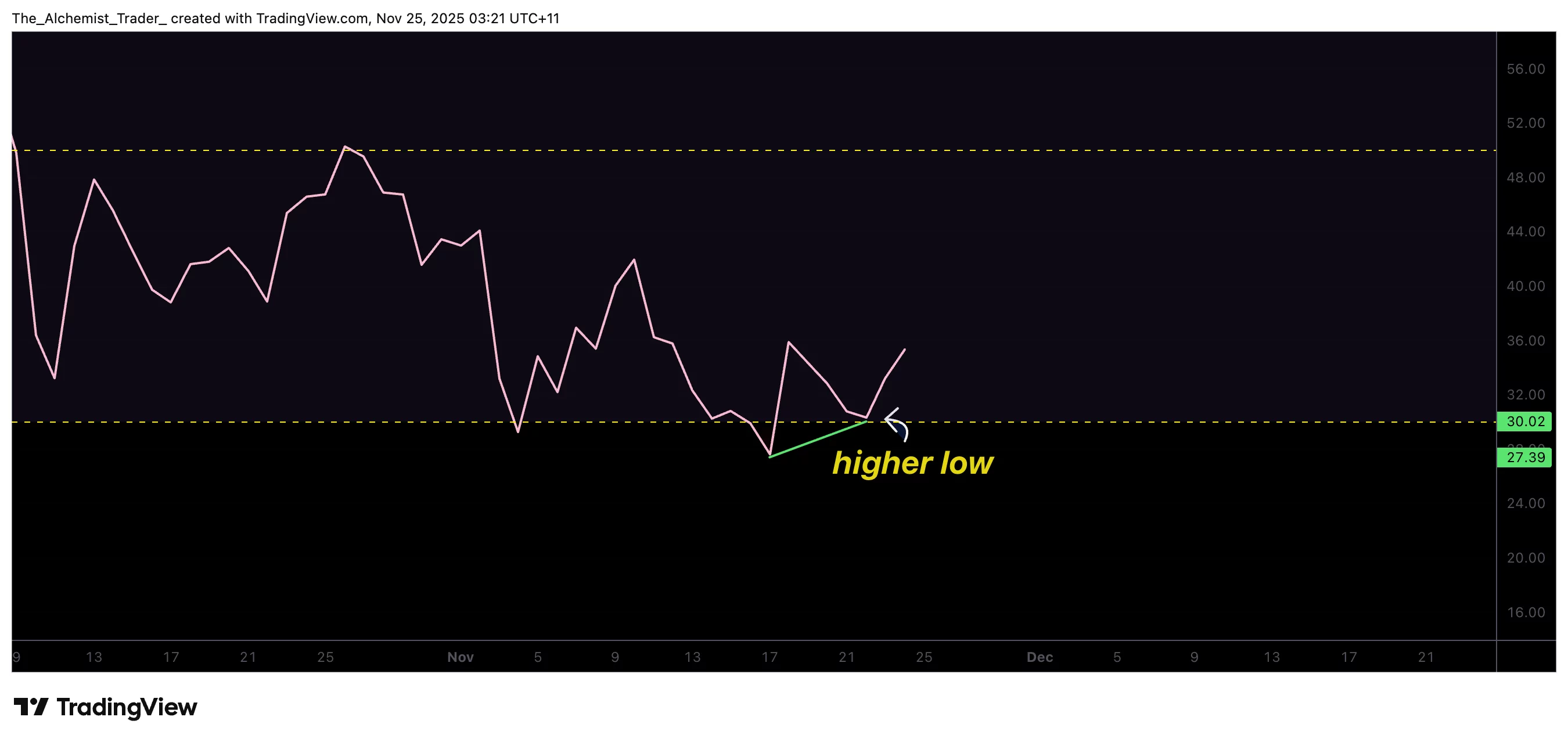

Solana is currently printing one of the most reliable early-reversal signals in technical analysis: a bullish divergence on the daily time frame. While price has recently formed a lower low, the RSI has created a higher low. This separation between momentum and price often suggests that sellers are losing strength even as price continues drifting downward.

Solana RSI, Source: TradingView

Solana RSI, Source: TradingView

The $131 region has become a focal point in recent sessions. This area has held as support multiple times, with price hovering above it for several days. Such behavior typically indicates the market is entering an accumulation phase where buyers absorb selling pressure before attempting a shift in direction.

If this support continues to hold, the next key level to watch is the value area low. Reclaiming this region would signal that buying pressure is returning, and that Solana may be preparing for a rotation toward the next significant resistance at $167. This level aligns with high-time-frame resistance and has historically acted as a significant decision point for trend continuation or rejection.

With new Solana ETFs from Grayscale and VanEck launching amid rising volatility, market flows may also help shape how the price reacts at this key level.

Price action and momentum indicators are now converging, suggesting a short-term reversal is becoming more likely. Bullish divergences often appear at the end of aggressive sell-offs, and Solana’s recent behavior fits this pattern. While confirmation is still pending, early signals suggest a potential shift in market sentiment.

Price action

If Solana maintains support at $131 and activates the bullish divergence, a move toward $167 may follow. A loss of support would delay the reversal and return the asset to a bearish continuation phase.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Updates: MetaPlanet Secures $130M Loan Using Bitcoin as Collateral to Increase Holdings Amid Market Downturn

- MetaPlanet secured a $130M loan backed by 30,823 BTC to expand Bitcoin holdings and repurchase shares, targeting 210,000 BTC by 2027. - The firm shifted to preferred stock financing to reduce shareholder dilution, mirroring MicroStrategy's strategy while leveraging a $500M credit facility. - Despite Bitcoin's 23% unrealized loss, MetaPlanet remains bullish, buying BTC at $108k amid Japan's $273B stimulus-driven market selloff. - Japan's regulatory developments and SoftBank's crypto investments highlight

XRP News Today: XRP ETFs Launch with Mixed Results: Institutional Excitement Meets Market Fluctuations

- Multiple XRP ETFs launched by Grayscale, Franklin Templeton, and Bitwise, marking the third wave of U.S. institutional crypto products. - XRP price dipped 7% amid whale selling and Bitcoin's decline, but ETFs attracted $15.8M in institutional inflows and $6.12B trading volume. - Ripple's 2023 SEC victory and spot crypto ETF approvals enabled regulatory clarity, with fee waivers boosting early adoption. - Analysts highlight XRP's efficient ledger and institutional interest in tokenized assets, though mean

Bitcoin Weekly Candle Closed Above the 4-Year Trend Key Level, Long-Term Outlook Stays Bullish

Pi Network Pursues MiCA Compliance, Pi Coin Traders Anticipate Possible Gains