Bitkub Eyes Hong Kong IPO as Thai Market Downturn Stalls Local Listing Plans

Quick Breakdown

- Thailand’s largest crypto exchange is weighing a $200M IPO in Hong Kong.

- Volatile Thai markets and a five-year SET Index low stall the local debut.

- Hong Kong’s booming IPO scene and crypto-friendly stance attract Bitkub.

Bitkub considers overseas listing amid Thai market turmoil

Bitkub, Thailand’s largest cryptocurrency exchange, is exploring an initial public offering (IPO) abroad amid weak market conditions that continue to weigh on local investor sentiment. According to a Bloomberg report citing people familiar with the matter, the company is targeting about $200 million in a potential Hong Kong listing.

The move comes after Bitkub’s earlier plan to go public in Thailand in 2025 was put on hold due to heightened volatility and uncertainty in the domestic equities market.

Thai stock market hits five-year low in 2025

Thailand’s stock market has struggled to find stability throughout 2025 amid escalating political tensions with Cambodia and concerns over trade disruptions.

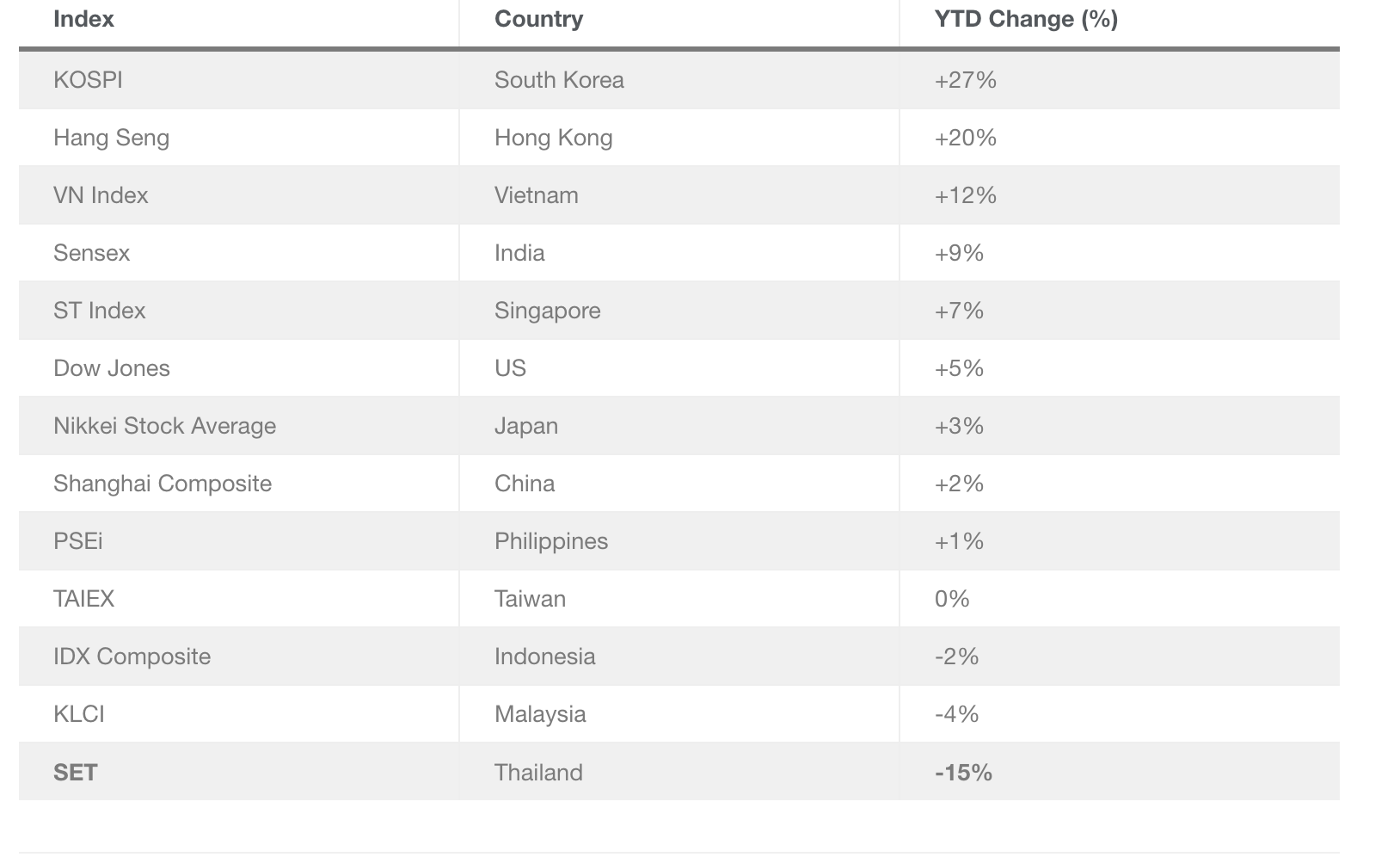

The Stock Exchange of Thailand (SET) has dropped roughly 10% this year, sliding to a five-year low in the first half of 2025, one of the weakest performances in Asia.

Source

:

Thailand Business News

Source

:

Thailand Business News

Even after two months of modest recovery, foreign investors remained net sellers, offloading more than 100 billion baht (about $3 billion) in equities during the first 10 months of the year.

This contrasts sharply with broader regional performance: major Asian markets, including South Korea and Hong Kong, saw gains of 27% and 20%, respectively, over the same period.

Hong Kong’s IPO boom draws global crypto firms

For Bitkub, Hong Kong’s surging IPO ecosystem presents a more attractive path. The Hong Kong Stock Exchange reported raising HK$216 billion (around $27.8 billion) from IPOs between January and October 2025, a massive 209% jump from the previous year.

The city has quickly become a hotbed for digital asset companies. Bitcoin Depot, the world’s largest Bitcoin ATM operator, is among the notable crypto firms expanding into the region.

In October, local crypto heavyweight HashKey Group also filed for a public listing, aiming to raise $500 million ahead of a planned 2026 debut, potentially one of the first local crypto IPOs.

Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP News Today: XRP's ETF-Fueled Surge Encounters Major Barrier at $2.23 While Bulls Strive for Further Gains

- XRP surged 25% above $2, driven by institutional ETF inflows and growing mainstream adoption via products like Franklin Templeton's XRPZ and Grayscale's GXRP . - Technical analysts highlight OBV divergence and 2017 breakout parallels, suggesting potential $3.30–$3.50 retests despite key resistance at $2.23 and moving averages. - Ripple's $500M funding at $40B valuation supports infrastructure expansion, but traders prioritize liquidity metrics over corporate milestones for near-term price momentum. - Reg

XRP News Today: XRP ETFs Ignite Hope, Yet 42% of Tokens in Loss Point to Underlying Risks

- XRP price fell below $2 as open interest hit a 12-month low, with 42% of supply in loss positions despite ETF-driven inflows. - ETFs like XRPC and Bitwise's XRP ETF generated $422M inflows, but Bitcoin's decline and macroeconomic risks overshadowed gains. - Technical analysis highlights $2.00–$2.06 support as critical, with institutional capital potentially stabilizing demand amid structural risks. - Leverage, liquidity constraints, and Fed policy uncertainty amplify downside risks despite SEC's 2025 reg

The Comeback of Momentum ETFs: Could Momentum (MMT) Be the Next Major Opportunity?

- Momentum ETF MMT underperformed in 2025 due to weak tech stocks, contrasting SPMO's 21% gains and $5.4B inflows. - Market shifts favor diversified, low-fee strategies as robo-advisors and tax-advantaged plans redirect capital from concentrated tech bets. - Retail investors prioritize systematic allocation over speculative tech, pushing MMT to adapt via diversification or robo-advisor partnerships. - Institutional interest in MMT rose 84.7% in Q4 2024, suggesting potential if it aligns with modern investo

Stellar News Today: While privacy coins face setbacks, Stellar's compliance-oriented technology drives expansion in international transactions

- Stellar (XLM) emerges as top growth candidate with $169M TVL, 5,000 TPS scalability, and partnerships with Archax/Franklin Templeton. - Zcash (ZEC) gains institutional traction via Cypherpunk's $150M investment but faces regulatory scrutiny over privacy features. - Chainlink (LINK) strengthens DeFi infrastructure but struggles with 30% futures open interest drop and whale selling pressure. - XLM's regulatory alignment (AM Best "A" rating) and cross-border payment focus position it to outperform privacy c