BitMine buys $199M in Ether as smart money traders bet on ETH decline

BitMine Immersion Technologies, the world’s largest corporate Ether holder, continues buying the dip, despite the industry’s most successful traders betting on Ethereum's price fall.

BitMine acquired $199 million worth of Ether (ETH) during the past two days, through a $68 million ETH acquisition on Saturday and another $130.7 million buy on Friday, according to blockchain data platform Lookonchain.

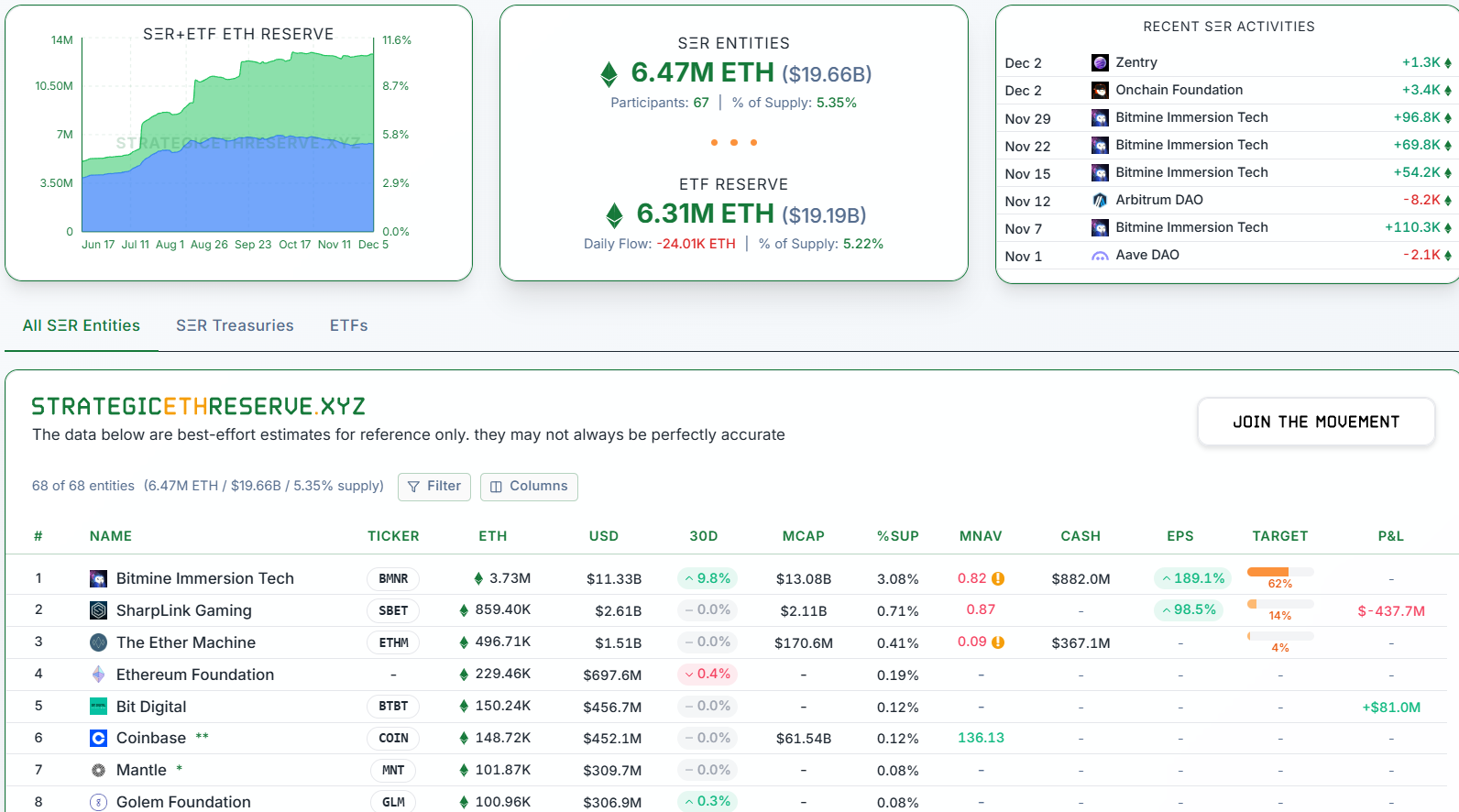

With the latest investments, BitMine now holds $11.3 billion, or 3.08%, of the total Ether supply, closing in on its 5% accumulation target, according to data from the StrategicEthReserve.

BitMine’s continued accumulations are a strong sign of conviction in Ether's long-term growth potential. The company holds an additional $882 million in cash reserves, which may be used for more Ether accumulation.

BitMine’s investment comes amid a significant slowdown in digital asset treasury (DAT) activity, which saw corporate Ether acquisitions fall 81% in three months, from 1.97 million Ether in August to 370,000 in net ETH acquired in November.

Despite the slowdown, BitMine accumulated the lion’s share, or 679,000 Ether worth $2.13 billion during the past month.

Smart money traders are betting on Ether’s price decline

The crypto industry’s best-performing traders by returns, who are tracked as “smart money” traders on Nansen’s blockchain intelligence platform, are betting on the short-term depreciation of Ether’s price.

Smart money traders added $2.8 million in short positions over the past 24 hours, as the cohort was net short on Ether, with a cumulative short position of $21 million, according to Nansen.

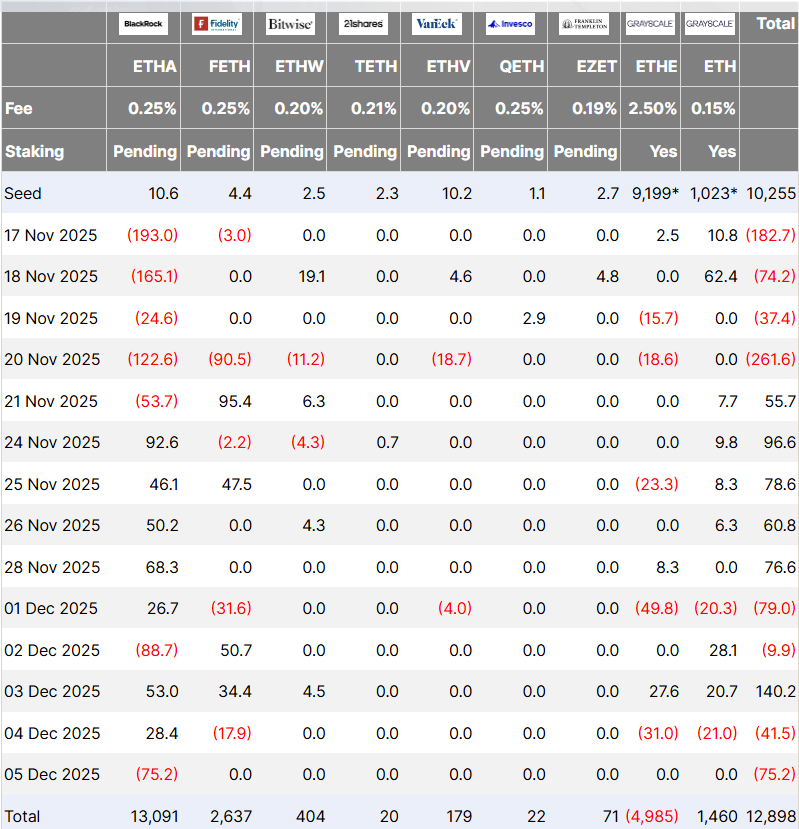

Ethereum exchange-traded funds (ETFs), a significant driver of liquidity for Ether, also continue to lack demand.

The spot Ether ETFs recorded $75.2 million in net positive outflows for the second consecutive day on Friday, following the $1.4 billion in monthly outflows in November, according to Farside Investors.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Zcash’s Unpredictable Rise: Immediate Drivers and Future Outlook for Privacy

- Zcash (ZEC) rebounded 20% after a 55% drop, testing $375 as liquidity events and technical indicators fueled short-term optimism. - RSI/MACD signals suggest potential $475 breakout if bulls reclaim $375, though ZEC remains 57% below its 2025 peak. - Institutional adoption grows with Grayscale Zcash Trust assets surging 228%, driven by optional privacy tech attracting both retail and institutional users. - Regulatory scrutiny under MiCA and FinCen rules, plus Zcash's hybrid privacy model vs. Monero/Dash,

Zcash Halving and Its Impact on the Cryptocurrency Market

- Zcash’s 2028 halving will reduce block rewards by 50%, mirroring Bitcoin’s scarcity-driven model. - Historical data shows pre-halving price surges, fueled by FOMO and social media-driven hype cycles. - Behavioral economics highlight crypto markets’ reliance on narratives over fundamentals, with sentiment driving 30% of short-term price swings. - Zcash faces adoption challenges despite robust privacy tech, as regulatory uncertainty and competition limit its market share growth. - The 2028 event tests whet

Algo Slips 0.22% as Market Volatility and Investor Lawsuits Intensify

- ALGO fell 0.22% on Dec 7, 2025, marking a 60.15% annual decline amid broader market turbulence. - Investor lawsuits against Alvotech (ALVO) and agilon health (AGL) triggered 34-51.5% stock drops over alleged misrepresentations. - Rising litigation in healthcare/biotech sectors highlights investor demands for corporate transparency and regulatory compliance. - ALGO's decline reflects sector-wide risk aversion rather than direct legal ties, with analysts predicting prolonged caution until regulatory clarit

The Importance of Teaching Financial Skills Early for Lasting Wealth Accumulation

- Early financial education reduces cognitive biases like anchoring and overconfidence, improving investment decisions and wealth accumulation. - College-level programs enhance critical thinking, leading to measurable outcomes like higher credit scores and reduced debt in states like Georgia and Texas. - Long-term benefits include compounding returns, with Utah and Chile showing increased savings rates and retirement planning due to mandatory financial literacy. - Addressing systemic gaps, educated investo