Wall Street braces for year-end "liquidity crunch" as the Federal Reserve may hint at restarting "money printing" this week

BlockBeats News, December 9 — As the end of the year approaches, Wall Street banks are on high alert, preparing to deal with increasing money market pressures. Analysts say this may prompt the Federal Reserve to consider measures to rebuild liquidity buffers in this $12.6 trillion market.

The Federal Reserve policymakers will hold a meeting this week, which will be the first since the Fed stopped shrinking its balance sheet (the so-called quantitative tightening). There are now signs that reserves within the banking system are no longer abundant.

The Fed has yet to address policy issues following the reduction of its balance sheet, including the composition of its Treasury holdings. However, as financing costs remain high, more market participants believe that policymakers should take more concrete steps to ease tensions, such as resuming direct purchases of securities to supplement reserves.

They expect that Fed Chair Powell may provide some hints about the next steps at the conclusion of the monetary policy meeting on Thursday (Beijing time).

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

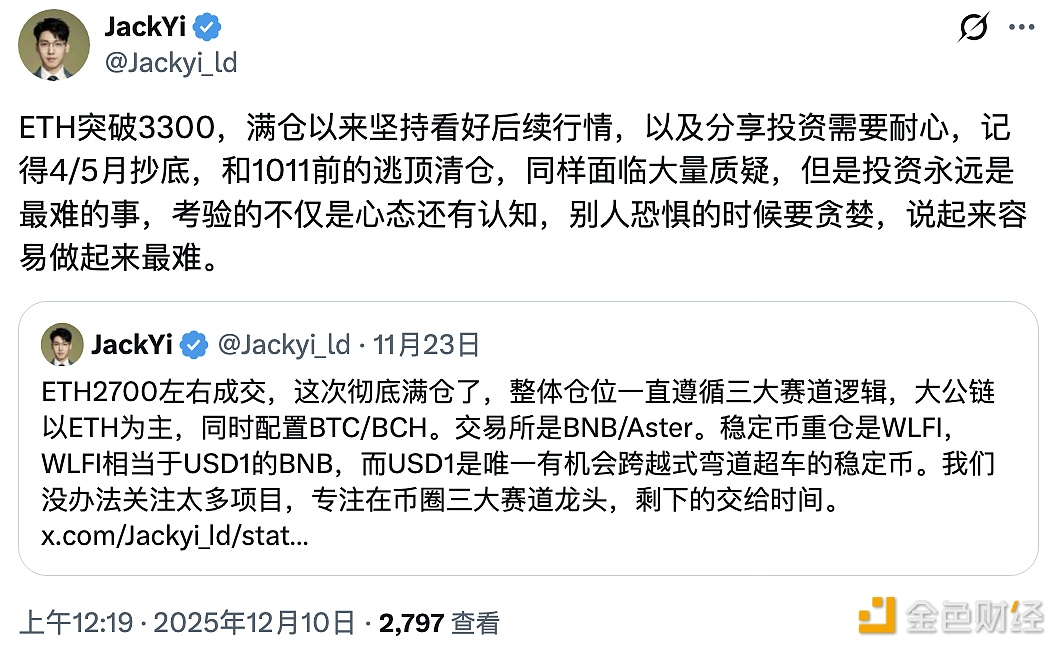

Yilihua: Remains bullish on ETH's future market since going all-in

Machi increases ETH long positions to 6,225 coins, with current unrealized profit of $1.13 million

A trader used 10x leverage to go long on ETH, earning an unrealized profit of over $578,000 in 20 minutes.