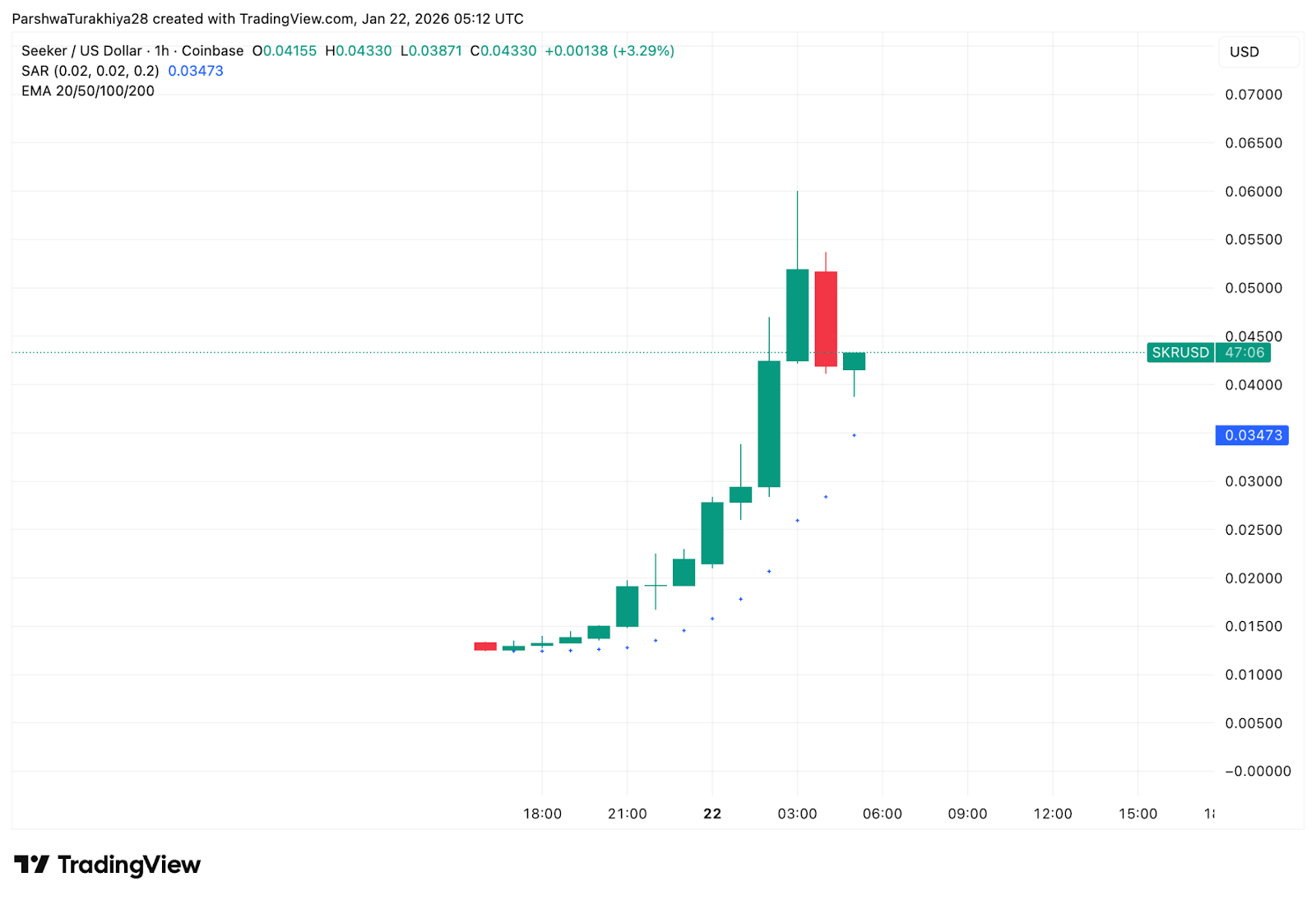

Seeker (SKR) launched January 21, 2026, distributing 1.82 billion tokens to over 100,000 verified Seeker smartphone owners. The token opened at $0.06 before crashing to $0.04 as airdrop recipients took profits, but the fundamentals tell a different story: 9 million transactions, $2.6 billion in volume, and 265 active dApps during Season 1.

This isn’t another crypto phone experiment. Solana Mobile proved the model works before launching the token—a rare reversal of the usual hype-first, deliver-later playbook.

- Current Price: $0.04000

- 24H Change: -4.58%

- Market Cap: ~$400M

- Circulating Supply: 3B tokens (30% of 10B total)

Traditional crypto tokens promise utility. SKR delivers it through physical devices already in users’ hands. The token powers three core functions: governance over app curation and ecosystem decisions, staking rewards starting at 28% APY, and access to the Seeker mobile dApp store.

The Guardian system separates SKR from typical governance tokens. Established Solana infrastructure firms like Anza, Helius Labs, and Jito act as Guardians, making ecosystem decisions while token holders delegate voting power. This creates accountability absent from most DAO structures.

Staking rewards decline linearly from 10% annual inflation, dropping 25% yearly until reaching 2%. Early participants capture outsized yields; late entrants face dilution through 2027.

Apple and Google control what apps ship, how developers get paid, and what rules apply. Seeker offers the alternative: an open mobile platform where SKR distributes control across builders, users, and hardware partners.

The stakes are massive. If Solana Mobile captures even 1% of the smartphone market, SKR becomes essential infrastructure for a billion-dollar mobile economy. If device sales stagnate below 250,000 units, the token becomes a speculative relic.

Season 1 proved the concept. Season 2—launching now—must prove scalability.

| Quarter | Price Target | Key Catalysts | Risk Level |

| Q1 2026 | $0.050 | Airdrop digestion, Season 2 launch, staking adoption | High |

| Q2 2026 | $0.075 | Breakpoint conference, Coinbase listing, device sales data | Medium |

| Q3 2026 | $0.095 | Utility validation, partnership expansion, dApp growth | Medium |

| Q4 2026 | $0.12 | Full-year hardware assessment, governance maturation | Low-Medium |

- Bull Case Year-End: $0.22 (+450%)

- Base Case Year-End: $0.12 (+200%)

- Bear Case Year-End: $0.055 (+38%)

What Happens: 100,908 airdrop recipients decide whether to hold or sell during the 90-day claim window. Expect violent swings as distribution pressure meets staking demand.

Bullish Triggers: Season 2 dApps demonstrate exclusive utility, early Guardian delegations succeed, staking participation exceeds 40% of circulating supply.

Bearish Triggers: Sustained selling below $0.035, weak Season 2 engagement, device sales miss expectations.

Watch: Daily staking deposits. Above 50M tokens weekly = accumulation. Below 20M = capitulation.

What Happens: Solana’s annual Breakpoint conference showcases Seeker progress. Coinbase listing goes live. Device verification improvements roll out.

Bullish Triggers: Season 2 volume exceeds $3B, 50+ exclusive mobile dApps launch, device sales hit 200,000+ units, Coinbase listing drives retail inflows.

Bearish Triggers: Developer exodus, Guardian governance proves ceremonial, hardware sales plateau below 175,000 units.

Watch: Daily active users. Above 150,000 = validation. Below 80,000 = failure.

What Happens: Market evaluates whether SKR is essential infrastructure or niche experiment. Token unlocks from growth allocation create supply pressure.

Bullish Triggers: 300,000+ cumulative devices, 400+ dApps, telecom partnerships announced, staking APY stabilizes above 18%.

Bearish Triggers: Staking yields collapse below 12%, major Guardians exit, competing crypto phones launch with better specs.

Watch: Transaction volume per device. Growing = healthy economy. Declining = user disengagement.

What Happens: Full-year device sales determine SKR’s long-term viability. Team token cliff approaches (January 2027). Year-end portfolio rebalancing.

Bullish Triggers: 500,000+ cumulative devices, $5B+ annual volume, meaningful treasury deployment, 200+ active developers.

Bearish Triggers: <250,000 devices sold, declining dApp counts, team tokens sell-off fears, macro crypto downturn.

Watch: Holiday device sales and developer retention through end-of-year.

- Entry Zone: $0.035-$0.045 after airdrop selling exhausts

- First Target: $0.075 (Season 2 momentum)

- Second Target: $0.12 (year-end base case)

- Stop Loss: Below $0.028 (thesis invalidation)

- Position Size: 1-2% of portfolio maximum. This is venture-stage infrastructure, not an established asset.

- Staking Decision: If holding 6+ months and conviction exists, stake for 28% APY. If trading shorter-term, avoid lockup risk.

- Hardware Dependency: Previous crypto phone (Saga) flopped. Seeker has better traction but sustained adoption unproven.

- Token Unlocks: 25% growth allocation releasing over 18 months. Team tokens (15%) cliff in 12 months. Predictable selling pressure.

- Competition: Apple/Google won’t surrender market share easily. Requires 10x better mobile experiences to gain traction.

- Staking Ponzinomics: 28% APY attracts mercenary capital. When yields compress toward 10-15%, expect mass exits.