The New Bitcoin Cycle Has Arrived, And It’s Not What You Expect...Conclusion: The 4-Year Cycle Is Gone — The Liquidity Cycle Has Taken Over

Most crypto traders still believe $Bitcoin is following the traditional 4-year pattern:

Halving → Bull Run → Blow-Off Top → Multi-Year Bear Market.

But the evidence from the past decade clearly shows that Bitcoin’s biggest moves have never been caused by halvings.

They’ve been caused by liquidity expansions — and those expansions are forming again now.

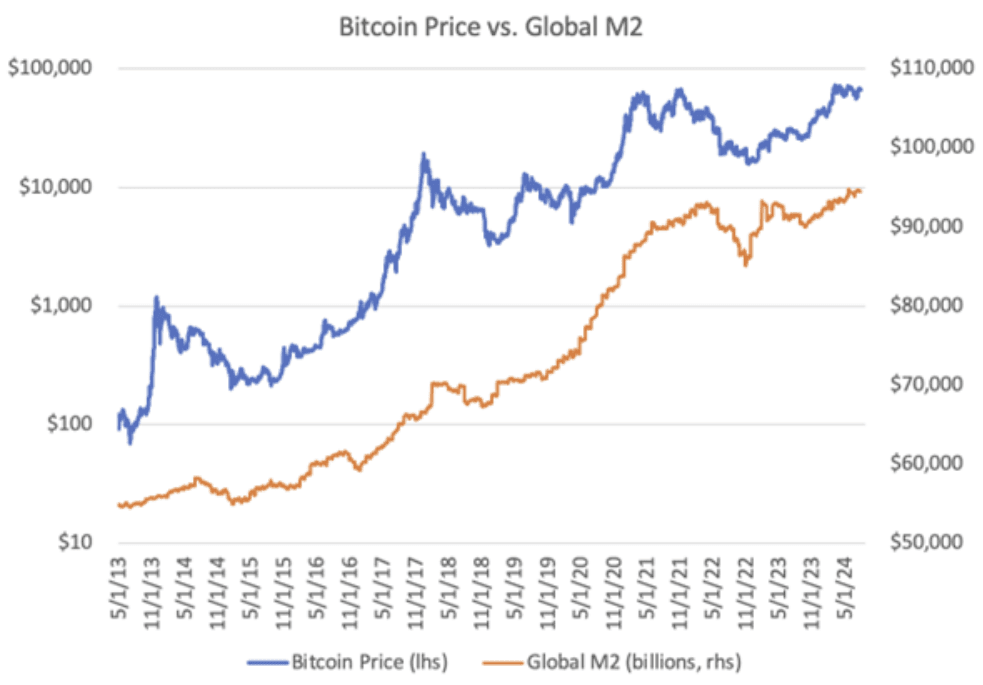

The chart comparing Bitcoin with the Global Liquidity Index makes the case unmistakable:

Every major peak aligned with liquidity surges, not halving dates.

And the same setup is beginning to build into 2025–2027.

As per X account Bull Theory, this is exactly the case.

1. Stablecoin Liquidity Shows the Real Story

Even with recent price drawdowns, total stablecoin supply continues to climb.

This matters because stablecoins are the closest thing crypto has to a money supply. Rising supply indicates:

- Institutions didn’t leave.

- Capital hasn’t exited the crypto ecosystem.

- Big players are sitting on massive dry powder, waiting for the macro catalyst.

Stablecoin liquidity rising during corrections is one of the strongest signals that the bull cycle is paused, not finished.

2. The U.S. Treasury Is Quietly Adding Liquidity Back Into Markets

One of the biggest catalysts is happening beneath the surface.

The TGA (Treasury General Account) is sitting near $940 billion — about $90B above its normal range.

When Treasury draws this balance down, that cash flows back into the financial system, boosting:

- market liquidity

- credit demand

- risk asset performance

This is the same mechanism that helped fuel previous expansions, and it’s happening again.

Treasury buybacks were only the first hint.

The real liquidity boost comes when the TGA begins to normalize — and historically, Bitcoin reacts early.

3. Global Economies Are Entering a New Liquidity Expansion Phase

What makes this cycle different from all previous ones is the synchronized global easing:

- China has been injecting liquidity for months.

- Japan launched a ~$135B stimulus package and eased crypto tax rules.

- Canada is shifting toward lower rates and easier conditions.

- The Fed has already ended QT, which is historically step one before liquidity expansion.

When multiple major economies inject liquidity at the same time, risk assets typically respond before equities and commodities.

This is why Bitcoin’s “delayed” cycle is more of a macro alignment phase than a completed top.

4. A Hidden Catalyst: Potential SLR Relief

In 2020, the SLR exemption allowed U.S. banks to expand their balance sheets and increase lending — resulting in massive liquidity acceleration across all markets.

If any form of SLR relief returns:

- bank lending increases

- credit expands

- liquidity rises across the entire system

- Bitcoin and crypto respond instantly

This policy alone could reshape the entire financial landscape for 2025–2027.

5. The Political Layer Makes 2026 a Major Turning Point

President Trump’s repeatedly stated policy direction reinforces the shift toward expansion:

- Potential tax restructuring, including exploring removal of income tax

- A proposed $2,000 tariff dividend

- Market-friendly regulatory posture

- A likely new Fed Chair more supportive of liquidity and constructive on crypto

This political cycle matters because policy shapes liquidity, and liquidity shapes Bitcoin cycles.

6. The Combined Signals Point to a New, Longer Bitcoin Cycle

When you stack every factor together, the picture becomes clear:

- Rising stablecoin liquidity

- Treasury preparing to inject cash back into markets

- Global QE returning (China, Japan, Canada…)

- QT ending in the U.S.

- Potential bank-lending expansion

- Pro-market policy shifts into 2026

- New institutional entrants

- Progress on the Clarity Act

- A more crypto-friendly Fed leadership on the horizon

This combination has never occurred before in Bitcoin’s history.

It breaks the old 4-year pattern entirely.

7. What the New Bitcoin Cycle Looks Like (2025–2027)

Instead of a classic cycle:

❌ Sharp run-up

❌ Blow-off top

❌ Multi-year bear market

We are entering:

**A liquidity-driven, extended expansion phase

that could last through 2026 and into 2027.**

A cycle defined by:

- structural liquidity growth

- global easing

- political incentives

- institutional inflows

- regulatory clarity

This is not the Bitcoin cycle of the past — it’s an entirely new macro cycle.

Conclusion: The 4-Year Cycle Is Gone — The Liquidity Cycle Has Taken Over

Bitcoin is no longer reacting to block rewards or halving dates.

It is reacting to global liquidity, just like every other major risk asset.

The data now shows:

- Liquidity bottomed.

- Liquidity is rising.

- Major economies are easing simultaneously.

- U.S. policy is turning expansionary.

- Stablecoins are expanding.

- Institutions are loading dry powder.

The next major Bitcoin phase will not follow the old script.

It will be longer, broader, and stronger — driven by macro liquidity, not mining schedules.