Nvidia Stock vs. Tesla Stock: The Best Buy Right Now — And Why

Nvidia (NVDA) and Tesla (TSLA) have become poster children for two of the market’s hottest themes — artificial intelligence and electric vehicles. In mid-2025, Nvidia briefly reached an all-time high, pushing its market value over $4 trillion. Tesla, meanwhile, long celebrated as the world’s most valuable automaker, still commands a market capitalization of about $1 trillion after sliding from its late-2024 peak. These headline-grabbing valuations underscore just how central both companies have become in shaping investor sentiment across technology and growth sectors.

Yet, despite their status as industry leaders, Nvidia and Tesla stocks have moved along very different paths in 2025. Nvidia has regained momentum after early-year volatility, fueled by soaring demand for AI chips, while Tesla has struggled to sustain its lofty valuation amid slowing sales and intensifying competition. This divergence raises a key question for investors: with both companies positioned at the front lines of transformative industries, which stock stands out as the best buy right now — and why?

Nvidia Stock: The AI Chip King

Nvidia (NASDAQ: NVDA) was founded in 1993 by Jensen Huang, Chris Malachowsky, and Curtis Priem in Santa Clara, California. The company launched its first graphics card, the NV1, in 1995, and just a few years later, in 1999, it introduced the GeForce 256 — marketed as the world’s first GPU. That breakthrough transformed computer graphics and laid the foundation for Nvidia’s reputation as a pioneer in visual computing.

Since then, Nvidia has evolved far beyond gaming. Today, it is a global leader in semiconductors and artificial intelligence computing, providing hardware that powers data centers, cloud services, AI research, and autonomous vehicles. Its GPUs are now the backbone of modern AI, essential for training large language models and enabling advanced machine learning applications.

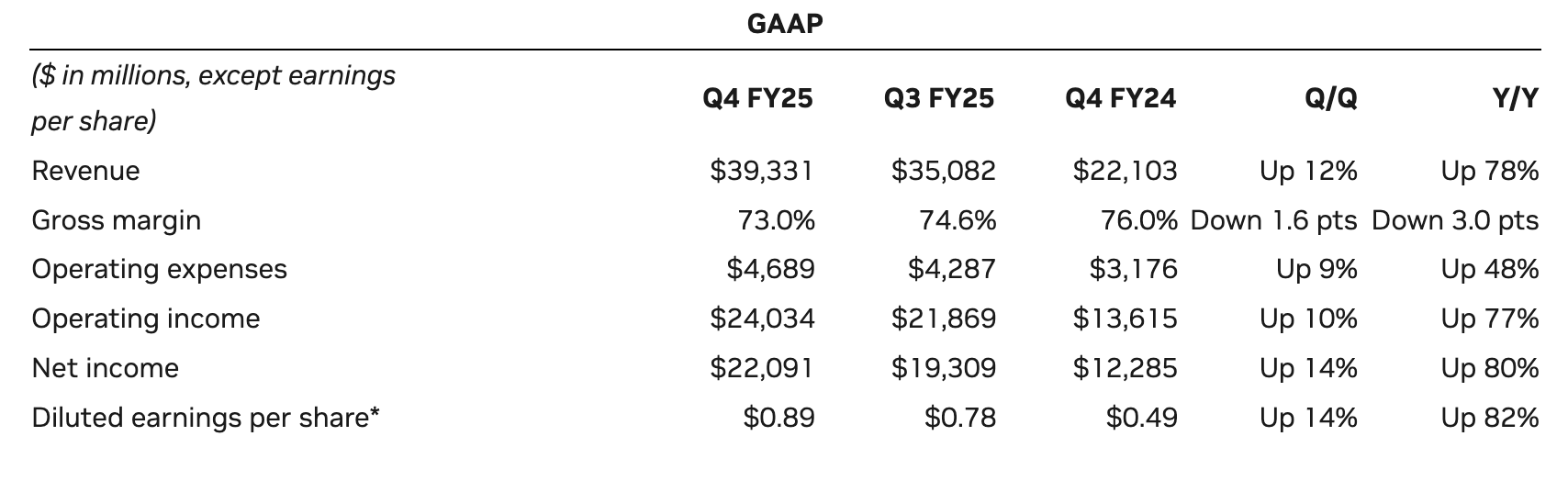

Nvidia Q4 Fiscal 2025 Summary

Source: nvidianews

Financially, Nvidia has delivered extraordinary results. In fiscal 2025 (ending January 2025), the company reported $39.3 billion in fourth-quarter revenue, up 78% year-over-year, and a record $130.5 billion for the full year, more than doubling from the previous year. These numbers were fueled by surging demand for its newest “Blackwell” AI GPUs, which CEO Jensen Huang has described as “amazing” for large-scale AI workloads. Thanks to this momentum, Nvidia is widely seen as the undisputed “AI chip king,” dominating one of the fastest-growing technology markets in history.

Tesla Stock: The EV Pioneer

Tesla (NASDAQ: TSLA) was founded in 2003 by engineers Martin Eberhard and Marc Tarpenning, and later joined by Elon Musk, who became its most prominent figure and long-time CEO. The company launched its first production car, the Tesla Roadster, in 2008, proving that electric vehicles (EVs) could be both fast and desirable. Since then, Tesla has grown into the world’s most recognized EV manufacturer, reshaping the auto industry and pushing the global shift toward sustainable transportation.

Source: Econovis

Today, Tesla is far more than just an automaker. Alongside popular vehicles like the Model 3 and Model Y — the latter being the best-selling EV worldwide — Tesla also develops energy storage systems, solar solutions, and cutting-edge autonomous driving software. Its market capitalization peaked at $1.54 trillion in late 2024 before sliding back to about $1 trillion in August 2025. Even at this reduced valuation, Tesla remains larger than many legacy automakers combined, reflecting both its market dominance and the high expectations investors continue to place on its future.

Nvidia Stock vs. Tesla Stock: Recent Performance and Market Trends

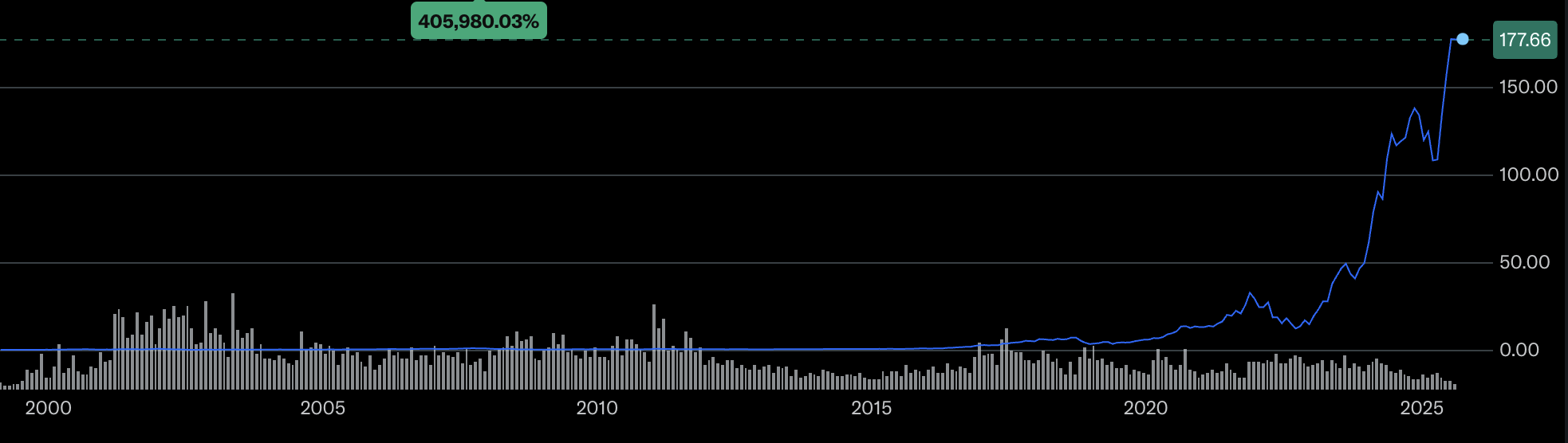

Nvidia (NVDA)

Nvidia (NVDA) Price

Source: Yahoo Finance

Nvidia’s stock has been one of the strongest performers in 2025. After stumbling early in the year on concerns about chip supply and rising competition, it quickly rebounded as demand for AI hardware surged. By mid-summer, the company had not only regained its losses but also reached historic highs, cementing its role as the market’s AI leader.

● Early 2025 dip: Pressured by supply concerns and competition from Chinese AI models.

● Recovery: By mid-summer, up roughly 30% year-to-date.

● Latest value: Around $4.27–4.28T (Aug 2025).

● Valuation: Trades at about 39× forward earnings, rich but lower than many of its hypergrowth peers.

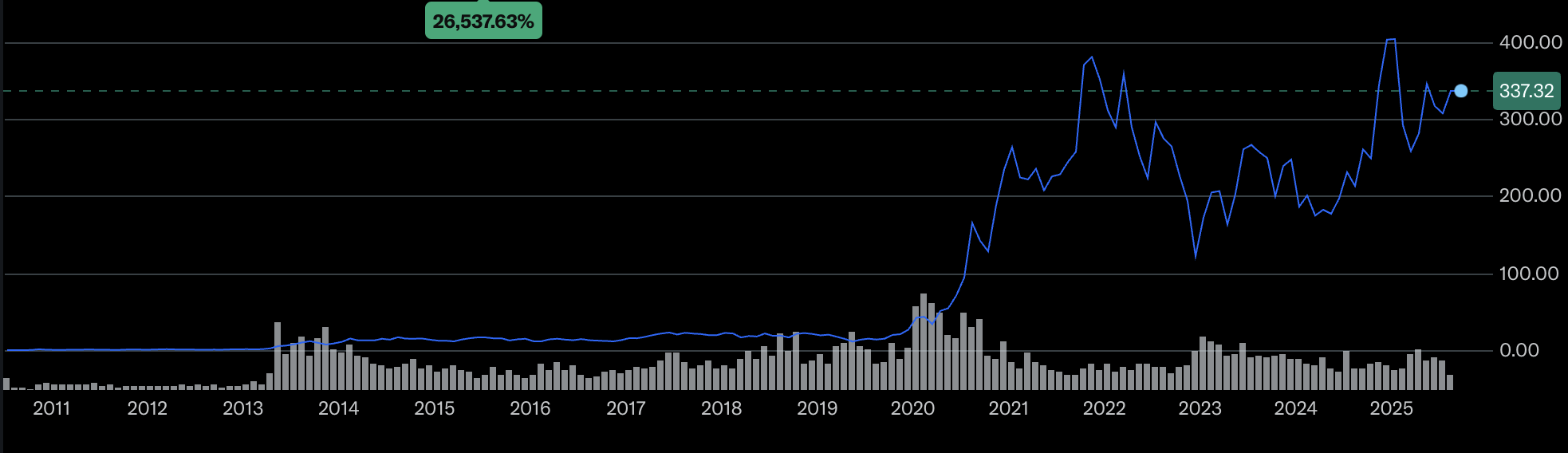

Tesla (TSLA)

Tesla (TSLA) Price

Source: Yahoo Finance

Tesla’s stock has taken the opposite path in 2025. After peaking at a record valuation in late 2024, it slumped as deliveries slowed and competition intensified. While occasional rallies showed investor enthusiasm, the overall trend has been downward, reflecting both operational headwinds and its demanding valuation.

● 2024 high: Reached $1.54 trillion market cap in December 2024.

● Sharp correction: Fell nearly 40% year-to-date by March 2025 before staging short rallies.

● Latest value: Around $1.01–1.08T (Aug 2025).

● Valuation: Trades at an extremely high 172–192× forward earnings, leaving little margin for error.

Broader Market Trends

● EV sector: By mid-2025, global EV sales had already reached 10.7 million, up 27% year-to-date, and full-year estimates point to 20–21 million units sold — meaning more than one in four new vehicles could be electric. China remains the largest driver, with over half of global EV sales.

● AI sector: Data-center spending on AI infrastructure could exceed $1 trillion, underpinning Nvidia’s continued growth.

In short, Nvidia has been lifted by AI momentum, while Tesla has faced headwinds in EV growth. Still, both companies remain at the center of industries that are expanding globally, which keeps investor attention firmly on them.

Nvidia Stock vs. Tesla Stock: Growth Outlook and Catalysts

Nvidia (NVDA)

Nvidia’s growth outlook remains tied to the global surge in artificial intelligence. The company is firmly established as the leading provider of GPUs for AI applications, with additional opportunities in gaming, professional graphics, and automotive technology.

● Strong demand for GPUs powering AI, data centers, and cloud services

● Expansion into automotive AI (DRIVE platform) and visualization markets

● Broader opportunities in gaming and professional graphics

● Continued optimism from analysts as AI investment accelerates

Tesla (TSLA)

Tesla’s future growth is shaped by both its role as a global EV leader and its bold bets on new technologies. The company is preparing to reach new customer segments with lower-cost vehicles, while also pursuing autonomy and energy solutions as long-term drivers.

● Development of a more affordable EV to expand mass-market reach

● Ambitious push into autonomy with robotaxi and full self-driving projects

● Growing energy segment with solar products and Powerwall storage

● Mixed analyst sentiment due to competition and execution risks

Conclusion

Nvidia and Tesla may seem like opposites — one builds the chips powering artificial intelligence, the other the cars leading the electric revolution — yet both are shaping how we live and invest in the future. Nvidia’s story is fueled by the relentless demand for AI computing, while Tesla’s rests on the promise of making EVs mainstream and unlocking autonomous driving. Each company dominates its arena, but their growth paths — and the risks tied to them — look very different.

So which is the “best buy right now”? That depends on where you place your bet: on the rise of AI that could transform every industry, or on a transportation shift that could redefine mobility worldwide. Both stocks offer huge potential and plenty of volatility — leaving investors to ask themselves not just which company they believe in more, but which vision of the future they want to own a piece of.

FAQs: Nvidia Stock vs. Tesla Stock

1. Is Nvidia stock a better investment than Tesla stock?

Not necessarily. Nvidia benefits from the booming demand for AI chips, while Tesla leads in EV adoption. The “better” choice depends on whether you believe AI or EVs will deliver stronger growth in the coming years — and on your personal risk tolerance.

2. Why is Nvidia valued higher than Tesla?

Nvidia’s market cap has climbed above $4 trillion, making it the most valuable company globally, because of extraordinary demand for its AI chips. Tesla’s valuation, though still over $1 trillion, reflects its leadership in EVs but has been pressured by slowing deliveries and rising competition.

3. Which stock has more long-term potential?

Both offer compelling opportunities. Nvidia is central to the AI revolution, while Tesla is driving the EV transition. The answer depends on which megatrend — AI or EVs — you believe will dominate the future.

4. What could drive Nvidia’s stock higher in the future?

Strong demand for AI chips, continued expansion into data centers, growth in gaming and visualization, and adoption of its automotive AI platform are key catalysts that could push the stock higher.

5. What could drive Tesla’s stock higher in the future?

A successful launch of a lower-cost EV, progress on its robotaxi and full self-driving technology, and expansion of its energy business could all reignite growth and investor confidence.

Register now and explore the wonderful crypto world at Bitget!

Disclaimer: The opinions expressed in this article are for informational purposes only. This article does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. Qualified professionals should be consulted prior to making financial decisions.