Emerging Chains Lead Q2 2025 TVL Growth

- Worldcoin Agency emerged as the TVL growth leader.

- Newcomer CORN achieved 1,728% TVL increase.

- MOVE saw over 1,148% TVL growth in Q2 2025.

Worldcoin Agency, CORN and Movement Labs led Q2 2025 with significant total value locked (TVL) growth, outpacing established networks by large margins.

Illustrating a shift in capital allocation, the rapid growth of Worldcoin, CORN, and MOVE in Q2 2025 suggests heightened investor interest in emerging platforms.

Worldcoin Agency achieved over 2,055% increase in total value locked (TVL), marking its prominence in the cryptocurrency sector. Emerging Chains Lead Q2 2025 TVL Growth , a newcomer, witnessed a remarkable 1,728% rise, indicating its promising future prospects in the industry. The robust performance of Movement Labs, boasting a 1,148% TVL growth, further demonstrates significant trends in public blockchain expansion , as emerging players gain traction.

Key figures including Sam Altman, CEO of Worldcoin Agency, and developers from Movement Labs played pivotal roles in these gains. Altman, known for his past work at OpenAI, spearheaded digital identity initiatives, while Movement Labs focused on promoting Move language adoption outside traditional environments.

The surge in TVL for these chains hints at increased staking, lending, and on-chain activities, attracting both institutional DeFi investments and speculative capital. Established networks like Ethereum and Solana observed comparatively modest growth, highlighting the shifting landscape.

Fiancial consequences emerge as novel platforms gain traction, threatening the dominance of older networks. Regulatory implications remain uncertain, with no new guidance from key global bodies, yet the disruptive nature of these changes cannot be overlooked. On-chain statistics underscore these altering dynamics, urging stakeholders to closely monitor these progressions.

Predictions suggest potential regulatory scrutiny as these newcomers reshape the market landscape, with possible technological advancements influencing future capital influxes. Historical TVL surges in platforms like BSC provide a framework for interpreting current trends, indicating strategic investment shifts in this evolving market.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Meta faces antitrust probe in Italy over AI integration in WhatsApp

Share link:In this post: Italy’s antitrust watchdog (AGCM) is investigating Meta for integrating its AI assistant into WhatsApp without user consent. The regulator suspects the tech firm abused its dominant position by forcing users toward its AI, potentially harming competitors. AGCM warns that this integration may limit consumer choice and distort market competition under EU law.

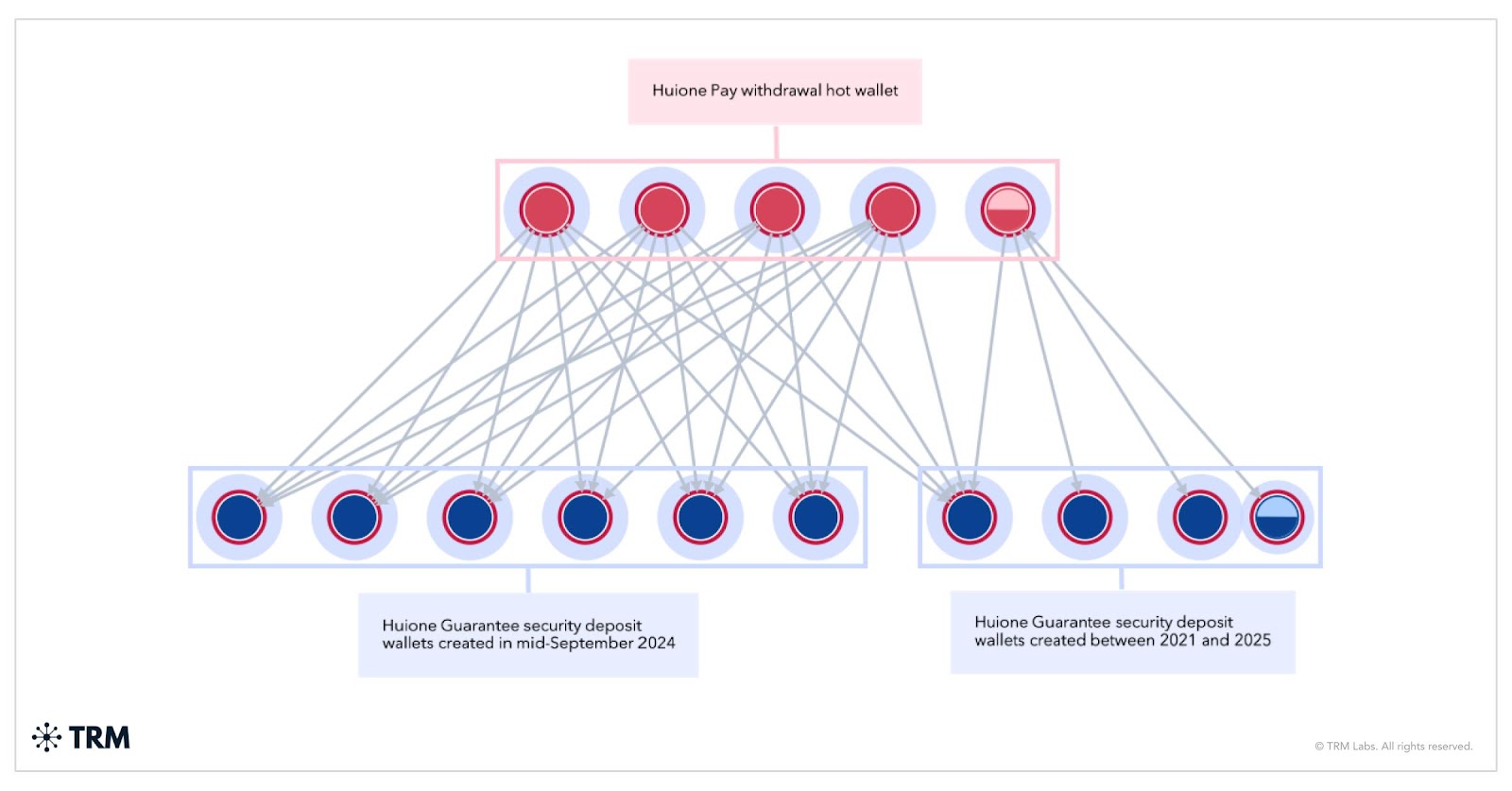

Telegram-banned $35B scam marketplaces find life away from US regulators

Share link:In this post: Telegram banned Huione Guarantee and Xinbi Guarantee after a $35B scam crackdown, but operations quickly shifted to Tudou Guarantee. TRM Labs and Elliptic revealed Huione vendors migrated to alternate platforms, with Tudou seeing a 70x surge in daily transactions. Despite US sanctions and enforcement, Huione Pay, USDH stablecoin, and affiliated services continue operating under new Telegram identities.

Polygon Labs calms fears about reports that its network went down for hours

Share link:In this post: Polygon Labs confirmed its network remained active despite Polygonscan showing no new blocks for over an hour. The issue was caused by a display glitch during a backend update on Polygonscan, not an actual network outage. The incident sparked renewed concerns about overreliance on third-party tools like explorers and RPC providers.

Federal Reserve keeps interest rates unchanged again, as expected

Share link:In this post: The Federal Reserve kept interest rates steady at 4.25% to 4.5%, delaying any cuts until at least September. Trump criticized the Fed’s decision, blaming tariffs for rising costs and demanding lower rates. Borrowers face high rates on credit cards, mortgages, car loans, and student loans, with no relief in sight.