Why Aptos Could See More Downside After Unlocking $51 Million in APT

APT faces downward pressure as 11 million coins are unlocked, with a potential drop to $4.52 if bearish momentum persists.

Today kicked off with Aptos unlocking 11.31 million APT coins worth approximately $51 million, increasing its circulating supply.

With the surge in supply, combined with the dip in the broader market, and the growing desire among traders to make a profit, APT faces increased selling pressure that could worsen its price fall.

Aptos Price Weakens Amid Rising Selling Activity

APT currently trades at $4.58, noting a 2% decline over the past 24 hours. During this same period, its trading volume has increased by 10%, indicating a rise in the number of coins changing hands.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

APT Price/ Trading Volume. Source:

APT Price/ Trading Volume. Source:

When an asset’s price falls while trading volume climbs, it signals heightened selling pressure. This pattern suggests that more investors are offloading their positions rather than buying. Hence, the trend signals that the APT market is experiencing stronger downward momentum with rising seller dominance.

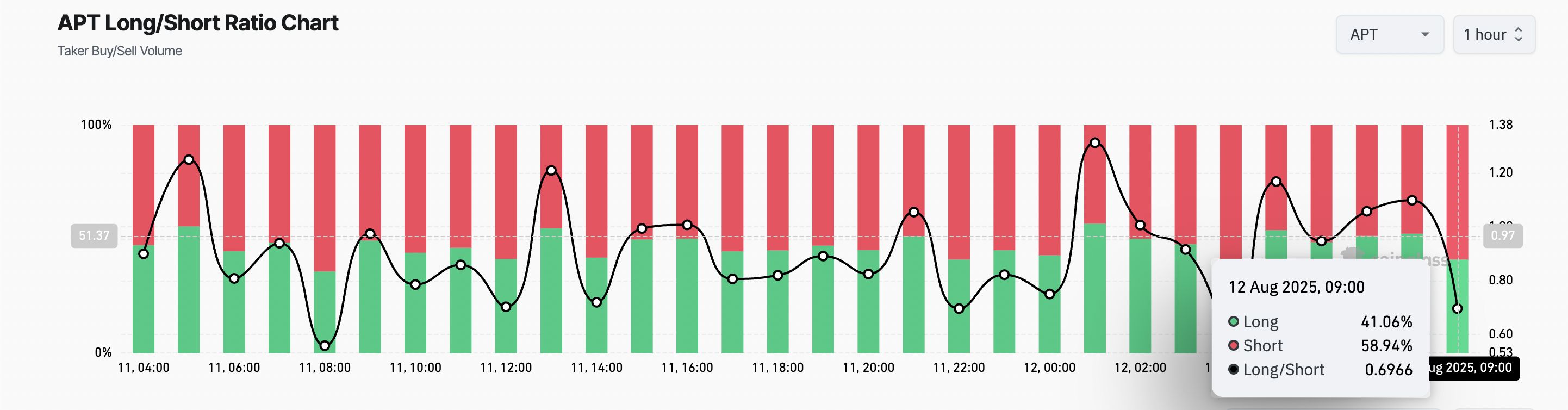

In addition, the coin’s falling long/short ratio supports this bearish outlook. Observed on an hourly chart, this sits at 0.69 at press time.

APT Futures Open Interest. Source:

APT Futures Open Interest. Source:

The long/short metric measures the proportion of long bets to short ones in an asset’s futures market. A ratio above one signals more long positions than short ones. This indicates a bullish sentiment, as most traders expect the asset’s value to rise.

On the other hand, a long/short ratio below 1 means that more traders are betting on the asset’s price to decline than those expecting it to rise.

APT’s long/short ratio indicates increasing demand for short positions, as traders position themselves to capitalize on the growing downward pressure.

Can Aptos Hold the Line?

On the daily chart, APT currently trades at its 20-day Exponential Moving Average (EMA). This puts the altcoin at significant risk, where the direction it takes next could set the tone for its near-term price action.

The 20-day EMA measures an asset’s average price over the past 20 trading days, giving weight to recent prices. When an asset climbs above it, it signals strengthening momentum and a potential uptrend, indicating that buyers are gaining control.

Conversely, falling below this level suggests weakening momentum and a possible shift toward bearish sentiment, with sellers taking the lead.

If APT’s price breaks decisively below the 20-day EMA, it would confirm that the bears have regained full market control. Such a move could trigger further selling pressure, pushing APT’s price down under $4.52.

APT Price Analysis. Source:

APT Price Analysis. Source:

Conversely, if the 20-day EMA holds firm as a support floor, it could provide the foundation for a price rebound. Buyers stepping in at this level may drive APT’s price above $5.01.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Bank of England keeps interest rates unchanged as expected and slows the pace of balance sheet reduction.

The Bank of England reiterated its cautious stance on future interest rate cuts, emphasizing that inflationary pressures remain significant. The government's autumn budget may become the decisive factor for the interest rate cut path for the remainder of the year.

Highlights of the Federal Reserve FOMC Statement and Powell's Press Conference

This FOMC decision and Powell’s speech sent a clear signal: the Federal Reserve is resuming rate cuts, but at a more cautious pace, with the core focus on balancing inflation stickiness and the risk of a slowdown in employment.

Initial Jobless Claims Data Stages a "Magic Show": From the Highest in Nearly Four Years to the Largest Drop in Nearly Four Years in an Instant!

Just a week ago, initial jobless claims had surged to their highest level in nearly four years, sparking market concerns over a spike in layoffs. However, the latest data released today presents a dramatic turnaround.

Tokenized Deposits Used to Optimize Cross-Border Settlements