Solana Weighs Major Alpenglow Upgrade as Network Eyes Nasdaq Scale

The Solana Alpenglow upgrade addresses validator incentive misalignments and network congestion is currently up for community vote.

The Solana network is reviewing a new governance proposal, SIMD-0326, which introduces the Alpenglow Consensus protocol to accelerate block finality.

The initiative comes as Solana’s transaction volume is surging, positioning the network ahead of most major regional exchanges.

Solana Governance to Vote on Alpenglow for Faster Finality

According to the proposal, Alpenglow aims to replace Solana’s current system, which relies on proof-of-history combined with TowerBFT.

The upgrade introduces Votor, a streamlined voting protocol that can finalize blocks in one or two rounds depending on network conditions. Developers behind the proposal cite limitations in TowerBFT, including long confirmation times and gaps in formal safety guarantees.

Alpenglow is expected to cut block finality from 12.8 seconds to 100–150 milliseconds and reduce network congestion by eliminating excessive gossip messaging.

“Solana’s validator incentives are currently asymmetric: all validators perform the same work, but leadership (and rewards) are proportional to stake. Alpenglow fixes this- validators now do work proportional to their stake, aligning cost with reward,” Raye Hadi, a blockchain analyst with Ark Invest, said.

The plan is now in the community governance stage. Voting for the proposal is scheduled to take place between Epochs 840 and 420.

The protocol upgrade will move forward if it secures two-thirds of the votes in favor. This would mark a major step in Solana’s network evolution and address long-standing performance bottlenecks.

Solana Wants to Flip Nasdaq

This development comes as Solana recently hit a major milestone of processing 35 million transactions. This exceeds the daily combined volume of most major regional stock exchanges.

For context, the Tokyo Stock Exchange averages 5 million trades per day, the NSE sees 3 million, the Hong Kong Exchange sees 2.5 million, Shenzhen 1.7 million, Shanghai 1.5 million, Toronto 1.2 million, and London 600,000.

The network is now eyeing the US-based Nasdaq, which still outpaces Solana in both trade frequency and volume.

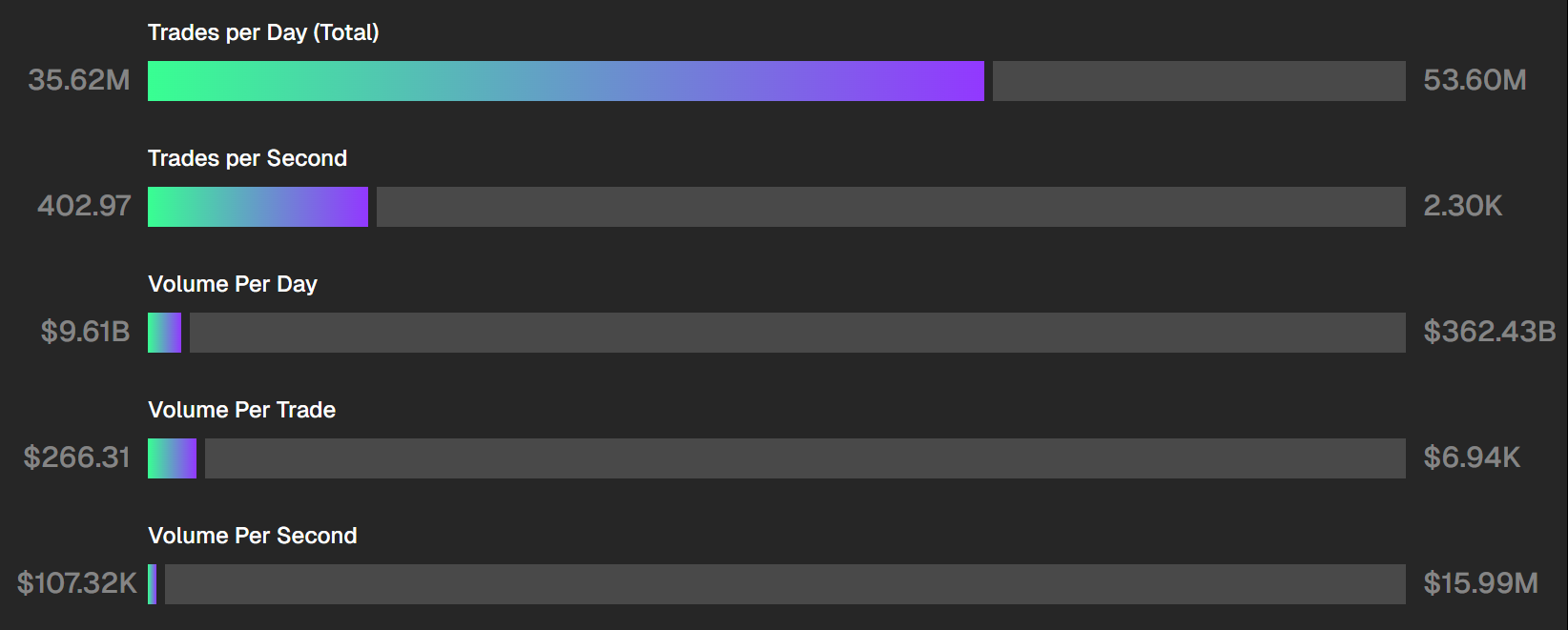

Nasdaq executes roughly 2,290 trades per second, while Solana averages 402. In terms of daily trading value, Nasdaq hits $362.43 billion, compared with Solana’s $9.61 billion.

Solana vs Nasdaq Key Trading Volume Metrics. Source:

FliptheNasdaq

Solana vs Nasdaq Key Trading Volume Metrics. Source:

FliptheNasdaq

Despite the gap, Solana remains confident in its roadmap, aiming to match the scale of Nasdaq through continued network upgrades and expanding influence in capital markets.

Market observers believe the combination of Alpenglow and growing adoption positions Solana to strengthen its competitive edge among traditional financial infrastructures.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Best Crypto To Buy As Saylor’s Strategy Adds 525 Bitcoin to Company Pile

Fair3 Foundation Mechanism In-Depth Analysis: How Did the Coin Circle's First "Decentralized Insurance" Form a Buying Pressure Flywheel?

A new initiative is gaining community attention: the Fair3 Fairness Foundation. This is an on-chain insurance mechanism established entirely by the community, independent of the project team and the trading platform. It is seeking to address a long-overlooked question: "What can we actually do when the risk truly materializes?"

Cathie Wood teams up with UAE for $300 million investment; another Nasdaq-listed company accumulates coins and transforms into a "Solana treasury"

Brera Holdings announced its transformation into a "Solana treasury" and rebranded as Solmate. After economist Laffer joined the company, Cathie Wood quickly decided to invest, having previously referred to Laffer as her "mentor." Solmate plans to pursue a dual listing in the UAE, leveraging local relationships to enhance its ability to accumulate SOL tokens.

Trump's son: Cryptocurrency will "save the dollar"

Eric Trump stated that attracting global capital into the U.S. digital asset market could provide new support for the U.S. dollar.