Written by: Ponyo

Translated by: Saoirse, Foresight News

Key Points

-

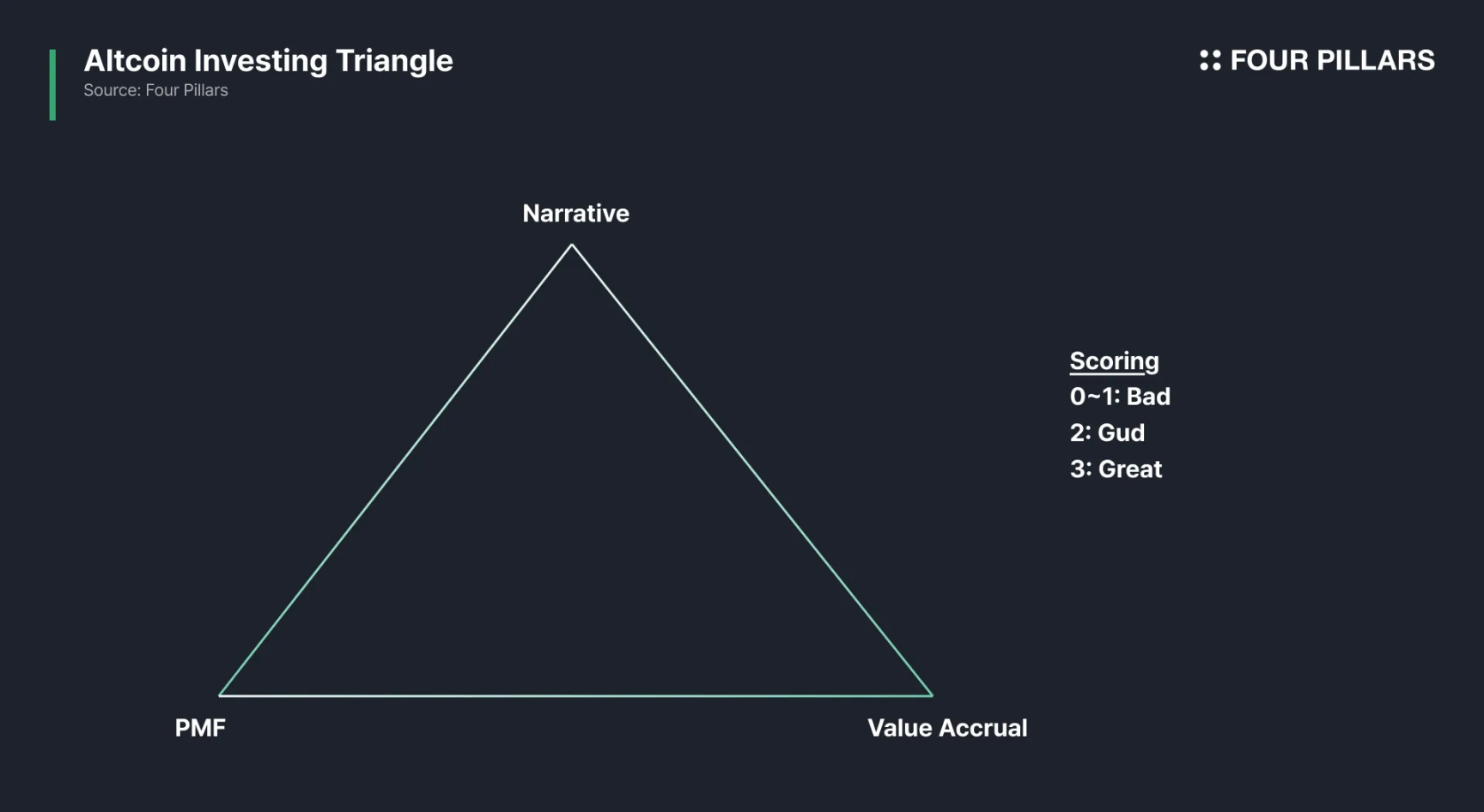

The success of a token depends on three key elements: narrative, product-market fit (PMF), and value capture.

-

Most tokens stall at the "two out of three" stage: narratives are easy to construct, product-market fit is highly challenging but not make-or-break; value capture is even more complex—stakeholder games, legal compliance, and listing considerations all make the design and timing of value capture mechanisms tricky.

-

Only a handful of tokens (such as HYPE) can satisfy all three elements. Many protocols that perform strongly in other areas still encounter bottlenecks in value capture; even with solid fundamentals, this can limit the token's upside. In some cases, tokens with weak fundamentals may perform well, and vice versa.

-

The investment triangle model is easy to understand but hard to implement. Metrics can be manipulated, protocol documents often obscure key details, and tokenomics mechanisms may change on the fly as projects progress. Market narratives iterate rapidly, so tokens that currently fail or excel in all three elements may have completely different trajectories in the future.

In the early days of crypto, tokens could skyrocket in price based on narrative alone, but those days are long gone. Today, a token's success depends on three dimensions: 1) a strong narrative; 2) product-market fit; 3) a robust token value capture mechanism.

Projects that excel in all three dimensions are considered "excellent," those that meet two are "good," and those that meet only one or none are "poor."

This is the core mental framework I use to evaluate tokens.

Analysis of the Three Dimensions

1. Narrative

This refers to the "story" recognized by market participants. Without a narrative, a project struggles to gain attention.

2. Product-Market Fit (PMF)

The core is real users, real fee income, and real demand. While different products have different metrics, the key is "users who pay continuously"—revenue and user retention are paramount. Note that most metrics such as Total Value Locked (TVL), wallet numbers, transaction counts, and raw trading volume are easily manipulated, so multiple data dimensions must be cross-verified. For example, for a perpetual decentralized exchange, both trading volume and open interest should be monitored: if open interest is low but trading volume is high, it usually signals wash trading.

3. Token Value Accumulation

If a token cannot actually capture protocol value, it is worthless. Common value accumulation mechanisms include fee sharing, token buybacks, buyback and burn, and mandatory usage scenarios. Personally, I consider buybacks the best option (see "Revenue Sharing is Dead, Long Live Buyback and Burn" for details). But value accumulation is closely tied to protocol revenue: even if the accumulation mechanism is well-designed, if the protocol itself has weak revenue, the token cannot be validated by value.

These principles may seem obvious, and most people think they already understand them, yet still fall into the trap of "narrative + user adoption = token appreciation."

Lifecycle Characteristics

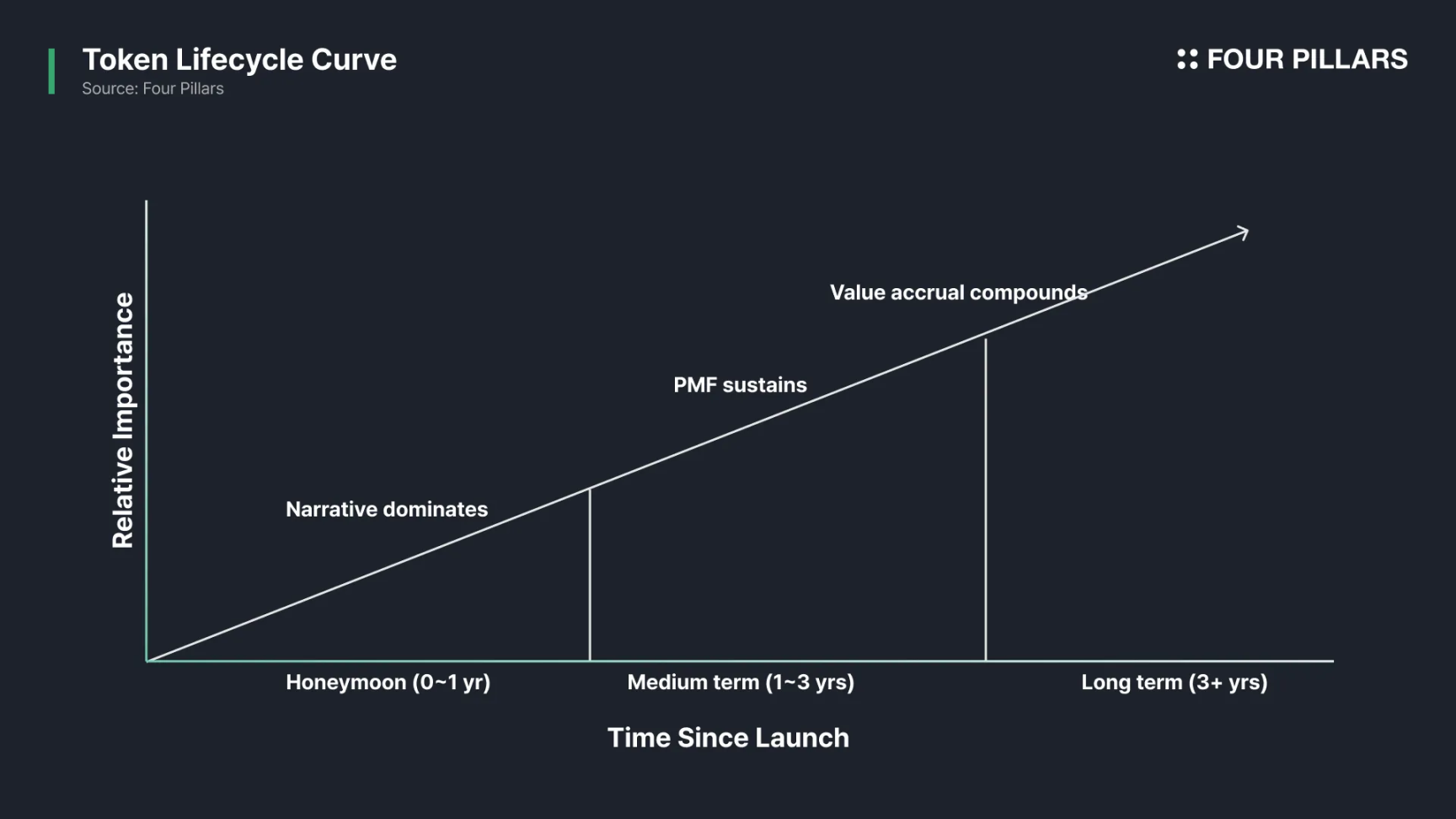

The investment triangle is not a static model; the influence of the three dimensions varies at different stages of a token's lifecycle:

-

Narrative (short-term): At the project's launch, the team needs to rely on narrative to attract liquidity, attention, and a user base.

-

Product-Market Fit (mid- to long-term): Narrative can buy time and funding for a project, but cannot bring user retention—only products that truly fit market needs can achieve long-term development.

-

Value Capture (mid- to long-term): If the token is unrelated to protocol cash flow, even if the product's user base keeps growing, insiders may still dump tokens, causing losses for holders.

Why is "All Three" So Difficult?

Most tokens can only satisfy two out of the three dimensions at best. Among them, building a narrative is relatively easy; product-market fit is highly challenging but has clear standards—either it solves a market pain point or it doesn't. Value capture is the most underestimated aspect, as it quickly evolves into a "game" among all stakeholders:

-

Project founders: seek capital reserves and liquidity;

-

Users: want lower fees and more incentives;

-

Token holders: care only about token price appreciation;

-

Market makers: need more market-making capital support;

-

Exchanges: pursue low risk and a good compliance image;

-

Lawyers: want to reduce legal disputes.

These demands often conflict. When teams try to balance all interests, the token ends up "mediocre"—not due to lack of ability, but as an inevitable result of incentive mechanisms.

Case Studies

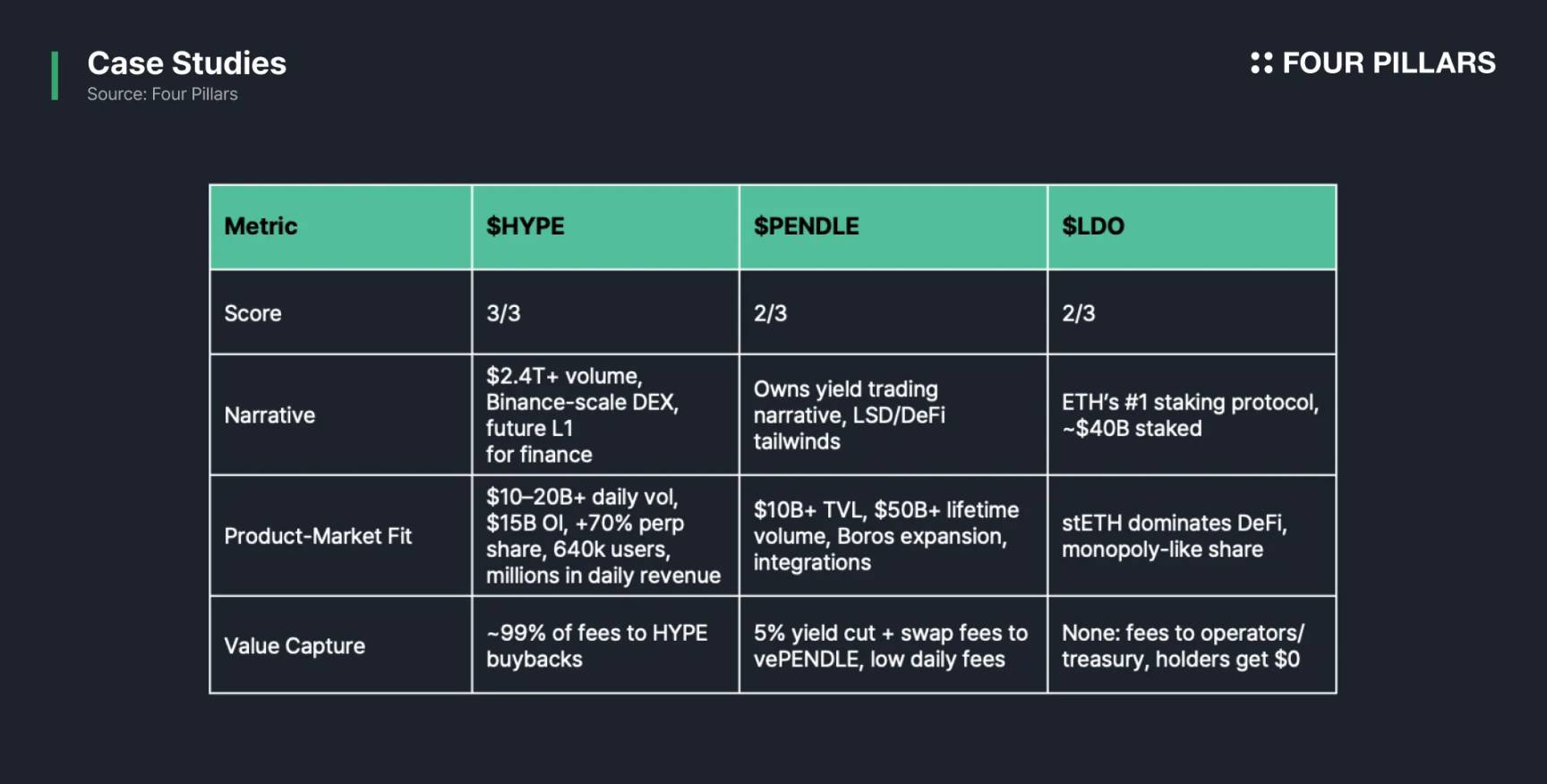

HYPE: All Three Achieved

-

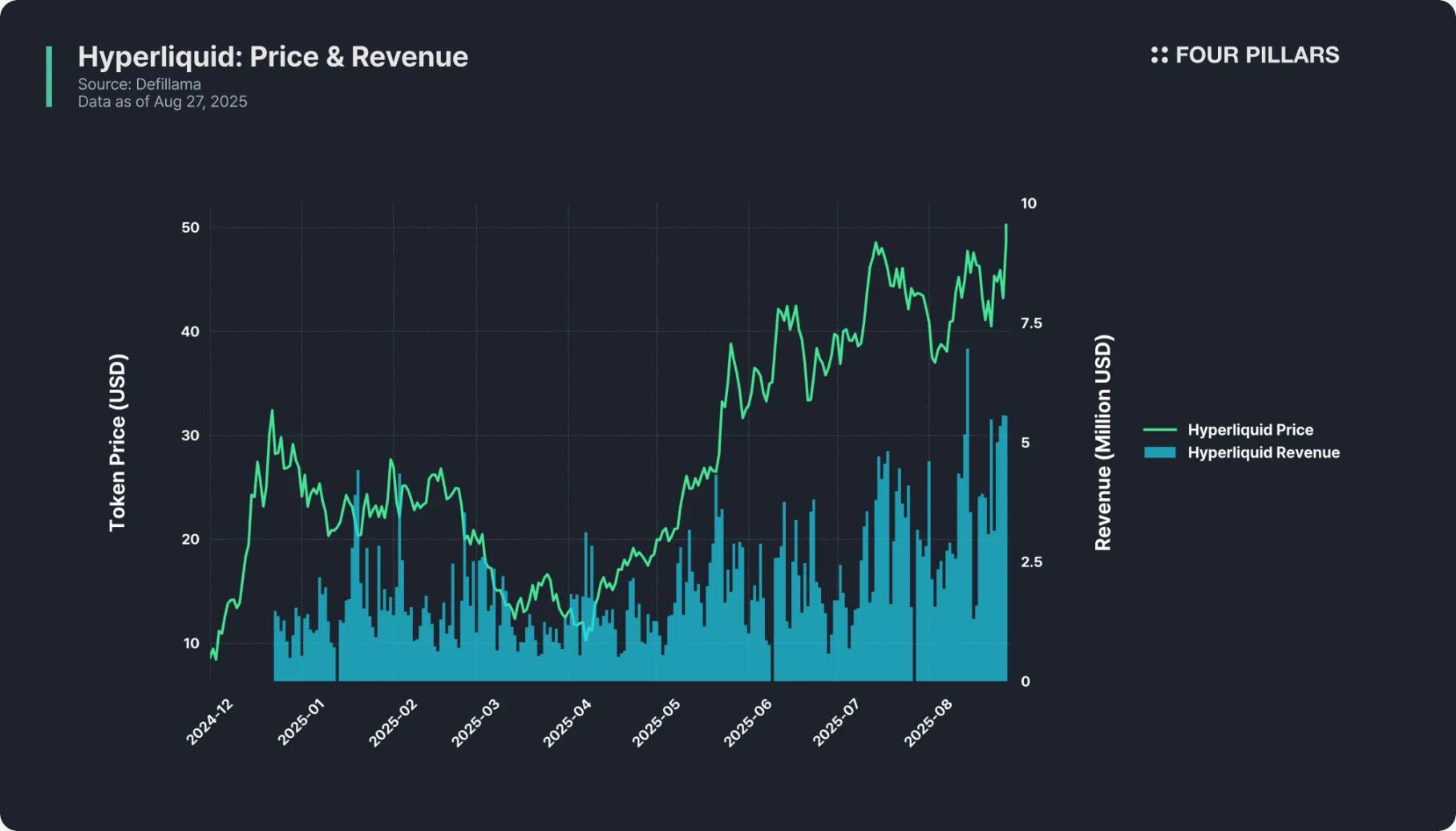

Narrative: As a unique "Binance-level" decentralized exchange, its cumulative trading volume has exceeded 2.4 trillion USD, and it is positioned as a "Layer 1 (base blockchain) capable of supporting all types of financial businesses in the future."

-

Product-Market Fit: Daily clearing volume of 10-20 billion USD, open interest of about 15 billion USD, over 60% market share in the decentralized perpetual market, 640,000+ users, and daily revenue of several million USD.

-

Value Capture: 99% of fees (1% goes to the HLP fund) are used to buy back HYPE, with every transaction's profit flowing back into the token value system.

Hyperliquid (HYPE) is a model of the "trinity," perfectly covering all three dimensions.

LDO: Two Achieved

-

Narrative: As the largest Ethereum staking protocol, with a staking scale of about 40 billion USD, it is synonymous with "liquid staking." Ethereum staking is one of the strongest narratives in crypto today, and Lido is at the core of this narrative.

-

Product-Market Fit: Significant advantages—stETH (the liquid staking token issued by Lido) has penetrated the entire DeFi ecosystem, Lido holds an almost monopolistic market share, the product experience is mature, and user trust is high.

-

Value Capture: Completely absent. Although Lido charges a 10% fee on staking rewards, all of it goes to node operators and the protocol treasury; LDO holders receive no income—the token only has governance functions. For example, Lido's revenue exceeded 100 millions USD last year, but LDO holders received nothing.

Although Lido is a leading protocol in the industry, its token has become a "bystander," a typical "two out of three" case.

PENDLE: Two Achieved

-

Narrative: Occupies a core position in the "yield trading" track—users can split yield-bearing assets into PT (principal tokens) and YT (yield tokens), and trade yield rights on the Pendle platform. As the pioneer and leading project in this track, Pendle has deeply benefited from the "DeFi + liquid staking" market boom.

-

Product-Market Fit: Total value locked exceeds 10 billion USD, cumulative trading volume exceeds 50 billion USD, supports multi-chain deployment, and its Boros product has opened up new markets, highly recognized by yield traders and liquidity providers.

-

Value Capture: Has shortcomings. Pendle charges a 5% cut on yields and distributes part of the trading fees to vePENDLE stakers, but the nature of yield trading means user activity is low—most users "set strategies and hold long-term," resulting in daily fees of only tens of thousands of USD, which is disproportionate to its large TVL and market cap.

Pendle relies on narrative and product-market fit, but its income shortfall limits its value capture capability. In addition, its product has a high barrier for ordinary users—the logic of yield trading is complex and hard for non-crypto veterans to understand, which also limits its growth ceiling in the short term.

0-1 Achieved: 99% of Tokens

The vast majority of tokens fall into this range: either they only have a narrative but no real users, or the product is live but has no value capture mechanism, or they are just governance tokens that no one cares about. Except for a few projects like XRP and Cardano that break market rules through "community faith," almost all altcoins follow the "greater fool theory"—price appreciation depends only on "the next buyer," not real value support.

6. Future Outlook

The investment triangle model is easy to understand but hard to implement. Metrics can be manipulated, protocol documents often hide key details, and tokenomics mechanisms may change at any time; market narratives iterate rapidly, so tokens that currently fail or excel in all three elements may have completely different trajectories in the future.

In addition, the difficulty of investing in altcoins lies in "huge individual differences": most tokens struggle to outperform BTC, ETH, or SOL. But once you find a truly "all three achieved" rare token, the returns can be life-changing—a single successful investment can help investors escape losses and even completely change their wealth trajectory. This is the charm of crypto investing, and the reason why, despite all the challenges, people continue to participate. Good luck.