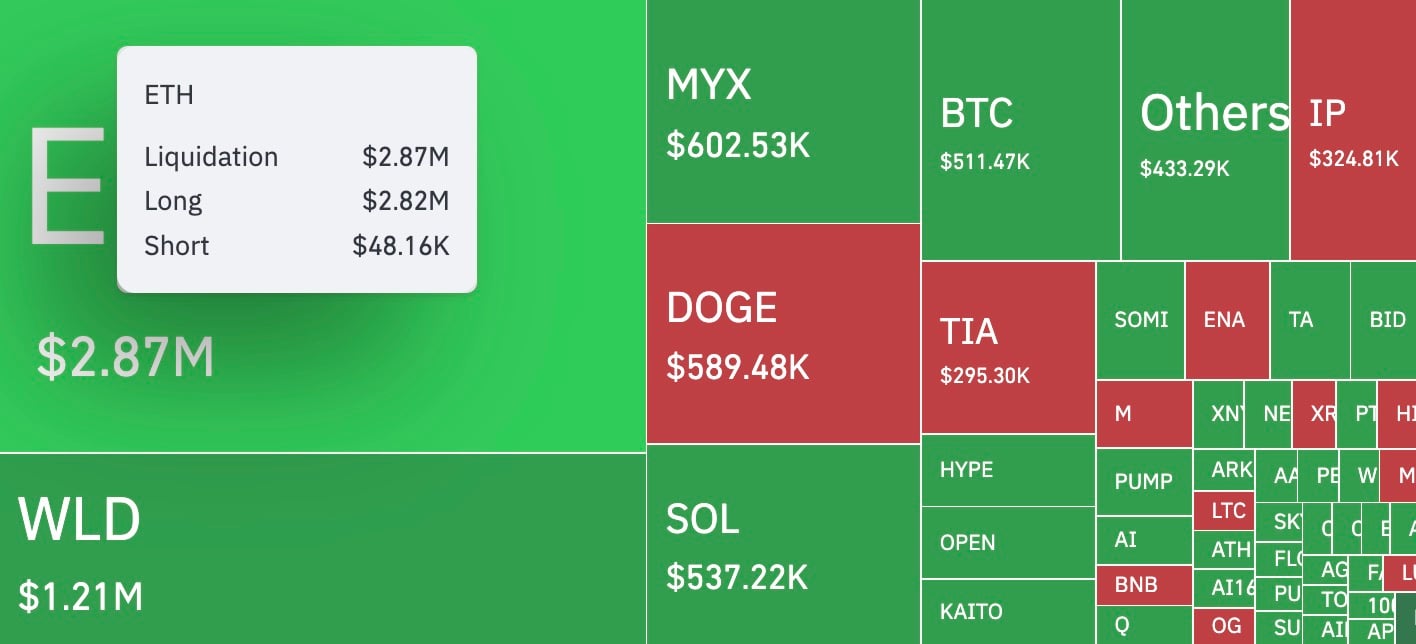

Ethereum liquidations occurred after a sudden one‑minute price dip triggered margin calls, wiping out roughly $2.87 million in ETH positions — ~99% longs. This rapid unwind shows how small, sharp moves on derivatives markets can force large long liquidations and momentary price volatility.

-

$2.87M in ETH positions liquidated within an hour (≈99% longs).

-

$2.82M long vs $48,160 short: a 5,855% imbalance that coincided with a price spike to $4,328.

-

Market context: Bitcoin ~$511K and Solana ~$537K in total liquidations; 24h total liquidations across markets noted at $341.46M, $139.91M and $201.55M.

Ethereum liquidations spike: $2.87M wiped out in one hour, mostly longs. Read the quick analysis and trading implications. Stay informed with COINOTAG updates.

What caused the sudden Ethereum liquidations?

Ethereum liquidations were triggered by a sharp one‑minute price decline that pushed ETH to about $4,328, prompting cascade margin calls on heavily leveraged long positions. Over an hour, CoinGlass data recorded $2.87 million in liquidations, nearly all longs, highlighting susceptibility to short intraday spikes.

How did leverage and orderbook dynamics amplify the ETH move?

High leverage concentrates risk near tight stop levels. When the one‑minute candle moved lower, stop orders and automated margin calls executed en masse. CoinGlass shows $2.82 million in long liquidations versus $48,160 in shorts — a 5,855% imbalance — which magnified orderbook pressure and the transient price drop.

Source: CoinGlass

Why did ETH recover quickly after liquidations?

The decline to ~$4,328 was brief and likely an overshoot caused by concentrated stops. Short‑term liquidity providers and market makers stepped in, pushing ETH back above $4,350 within minutes. The rebound indicates this was a localized deleveraging event rather than a directional trend change.

What were broader market liquidation figures?

For perspective, Bitcoin recorded roughly $511,000 in total liquidations and Solana about $537,000 during the same window. Across 24 hours, reported liquidation totals reached $341.46 million, $139.91 million and $201.55 million in various categories — underscoring continued intraday volatility in derivatives markets.

Frequently Asked Questions

How much was liquidated in ETH during the event?

Approximately $2.87 million in ETH positions were liquidated within an hour, with roughly $2.82 million being long positions and about $48,160 in short positions.

Could this trigger a longer ETH selloff?

Not necessarily; the quick rebound above $4,350 suggests a localized unwind. However, concentrated leverage can cause repeated short‑term volatility until positions are deleveraged.

Who provided the liquidation data?

Data referenced is reported by CoinGlass and aggregated derivatives statistics; this article cites those figures as plain text for context and verification.

Key Takeaways

- Immediate cause: A one‑minute price dip to ~$4,328 triggered cascade liquidations.

- Leverage risk: Heavy long exposure magnified losses — ~$2.82M in longs vs ~$48K in shorts.

- Market impact: Rapid rebound shows a localized reset, but highlights persistent intraday liquidity risk.

Conclusion

This event underscores that Ethereum liquidations are often driven by concentrated leverage and short‑term price moves rather than long‑term trend shifts. Traders should monitor margin levels and orderbook depth to manage risk. For continuing coverage and timely updates, follow COINOTAG reporting and official derivatives statistics.

Published: 2025-09-09 · Updated: 2025-09-09 · Author: COINOTAG