CaliberCos Stock Soars 2,500% on LINK Treasury Bet

CaliberCos shocked markets with a Chainlink treasury bet, fueling a 2,500% surge. Despite unprecedented gains, analysts caution the firm’s declining revenues and losses leave CWD a volatile, speculative play rather than durable value.

On Tuesday, CaliberCos Inc., the Arizona-based alternative asset manager, announced that it completed its first purchase of Chainlink (LINK) tokens under a new Digital Asset Treasury Strategy. The move triggered an unprecedented rally, with CWD shares soaring by 2,500% intraday.

Despite the bold shift positioning CaliberCos at the intersection of real estate and blockchain infrastructure, analysts caution that financial instability, extreme volatility, and limited institutional coverage leave the stock a high-risk bet.

First Nasdaq Firm Anchoring LINK Treasury

CaliberCos is the first Nasdaq-listed company to anchor a corporate treasury policy around Chainlink. CaliberCos described its initial LINK acquisition as a system test for internal processes, with plans for gradual accumulation over time.

Funding will come from an equity credit line, cash reserves, and equity-based securities.

CEO Chris Loeffler said the strategy “reinforces our conviction in Chainlink as the infrastructure connecting blockchain with real-world assets.”

The company emphasized that the framework includes tax, accounting, custody, and governance structures, aiming to differentiate itself from more speculative crypto plays. Management framed the pivot as part of a broader effort to position CaliberCos as a blockchain-native financial firm.

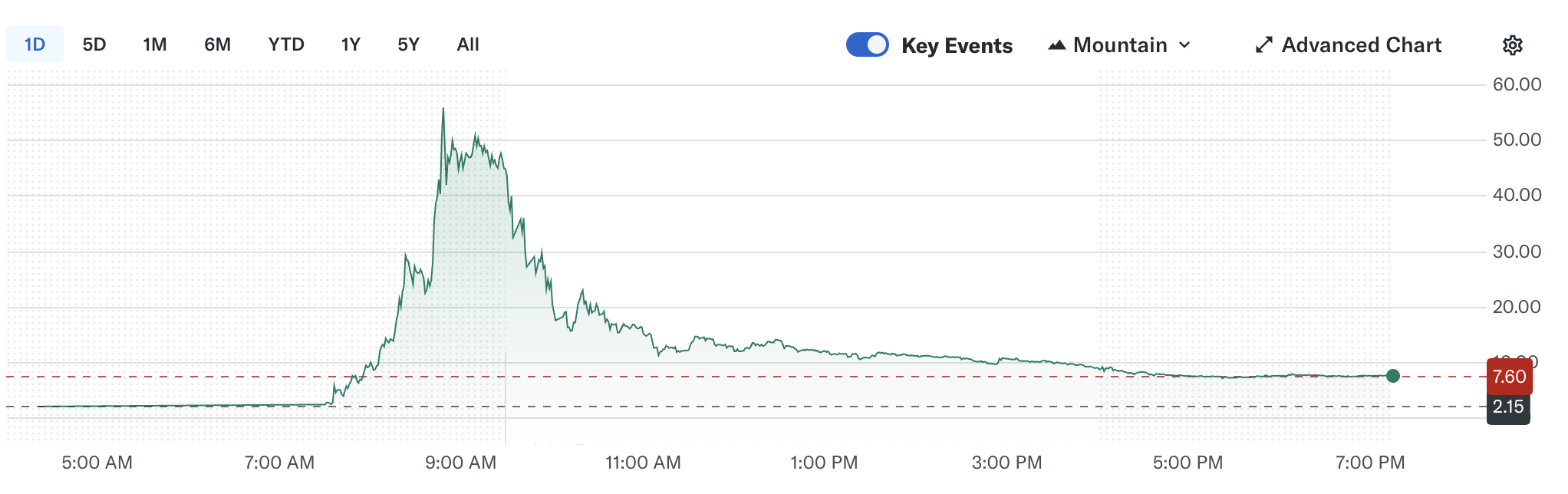

CWD stock erupted on the announcement, with more than 79 million shares traded versus a typical daily average of under 10 million. Its shares—previously trading near $2.10—surged more than 2,500% intraday to a peak of $56 before settling at $7.60 by the close.

The rally followed earlier momentum on August 28, when the stock jumped from $1.70 to $4.40 after CaliberCos first disclosed plans to adopt Chainlink as a treasury asset, drawing sharp attention from retail traders and speculative investors.

Despite Tuesday’s rally, CaliberCos shares remain down more than 80% over the past 12 months. Analysts currently rate the stock Hold, with a $2.50 price target that lags far behind current trading levels after the announcement.

CWD stock performance over the past day / Source:

CWD stock performance over the past day

CWD stock performance over the past day / Source:

CWD stock performance over the past day

Crypto Rally Meets Harsh Fundamentals

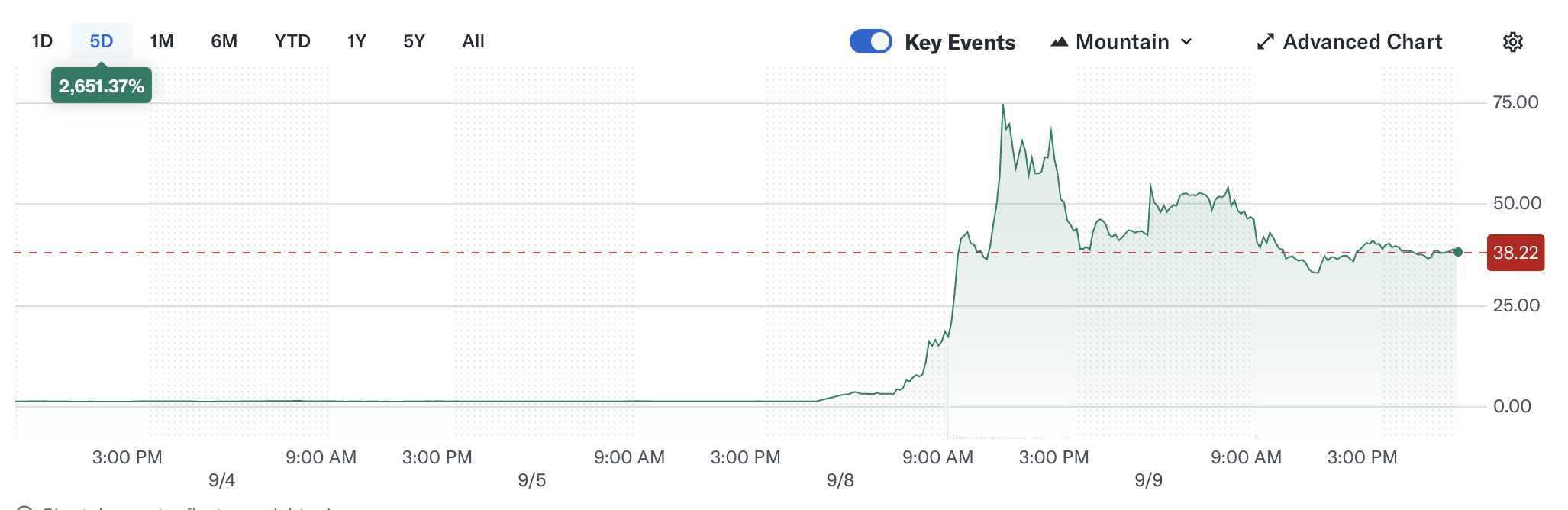

CaliberCos’ update came amid a wave of corporate treasury experiments with digital assets. Eightco, a peer, had unveiled plans just a day earlier to fund Worldcoin purchases, sparking a 1,400% surge in its shares. Both moves highlight the rise of retail enthusiasm for companies tying balance sheets to crypto assets, even when financial distress lingers.

Eightco stock performance over the last week / Source:

Eightco stock performance over the last week

Eightco stock performance over the last week / Source:

Eightco stock performance over the last week

Many analysts, however, flagged CaliberCos’ declining revenues and heavy leverage as significant headwinds. They warned that the valuation is narrative-driven and exposed to speculative swings, making CWD a risky proxy for crypto adoption rather than a stable long-term investment.

Revenues fell more than 40% in 2024, while net losses widened by over 50%. Limited analyst coverage and opaque governance add to the risks.

According to market commentators, the stock remains suitable mainly for “meme stock enthusiasts” rather than institutional investors seeking durable value.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Can the 40 billion bitcoin taken away by Qian Zhimin be returned to China?

Our core demand is very clear—to return the assets to their rightful owners, that is, to return them to the Chinese victims.

Bitcoin Surges but Stumbles: Will Crypto Market Recover?

In Brief Bitcoin fails to maintain its position above $93,000 and faces heavy selling pressure. Altcoins experience sharp declines, with some showing mixed performance trends. Shifts in U.S. spot Bitcoin ETF flows highlight cautious investor behavior.

Qubic and Solana: A Technical Breakthrough by Studio Avicenne