Big Volatility During the Rate-Cut Cycle: Will Bitcoin Rise First and Then Fall?

The Federal Reserve has begun a rate-cutting cycle, which could trigger a parabolic surge; however, this bull market may end with a historic crash.

The Federal Reserve has begun a rate-cutting cycle, and a parabolic surge may be on the horizon, but this bull market could end in a historic crash.

Written by: Frank Corva

Translated by: AididiaoJP, Foresight News

As we enter a historically bullish period for bitcoin prices, the Federal Reserve has cut interest rates by 25 basis points, which could add a fiat liquidity booster to the bull market—though this bull run may ultimately end in a historic crash.

Historically, bitcoin’s price tends to peak about 20 months after a bitcoin halving. The last bitcoin halving occurred in April 2024, which means we may see the cycle top this December.

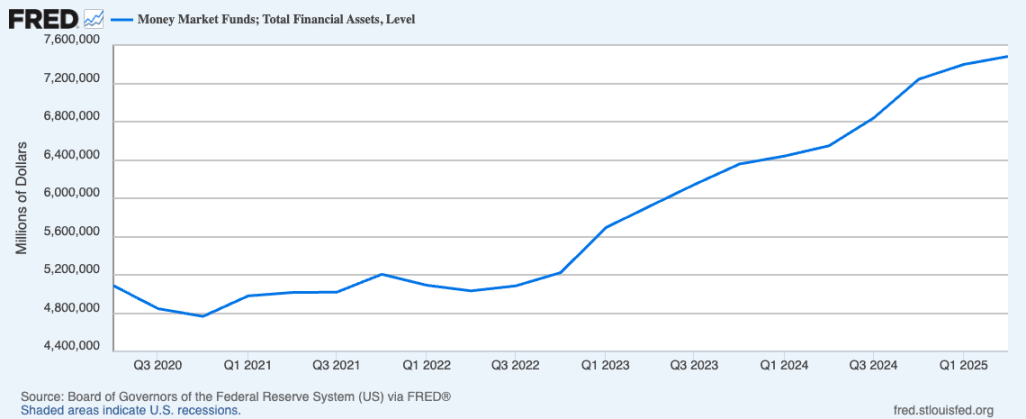

The likelihood of this scenario is increasing, as Federal Reserve Chair Powell cut rates by 25 basis points today, giving the roughly $7.4 trillion in money market funds a reason to move off the sidelines and into assets like bitcoin—especially now that exposure to bitcoin is easier to obtain via spot bitcoin ETFs and bitcoin treasury companies.

Powell also stated today that there may be two more rate cuts before the end of the year, which would further reduce the returns of money market funds and could drive investors toward inflation-resistant assets like bitcoin and gold, as well as higher-risk assets such as technology and AI-related stocks.

This could catalyze the final stage of a “melt-up,” similar to the performance of tech stocks at the end of 1999 before the bursting of the internet bubble.

Additionally, echoing the views of Henrik Zeberg and David Hunter, I believe the bull market that began at the end of 2022 is entering its final parabolic surge phase.

Using traditional financial indices as a reference, Henrik Zeberg believes the S&P 500 will break through 7,000 points by the end of the year, while David Hunter thinks it will rise to 8,000 points (or higher) in the same timeframe.

More importantly, according to macro strategist Octavio (Tavi) Costa, we may be witnessing the collapse of the US dollar’s 14-year support level, which means we could see a significant weakening of the dollar in the coming months—further supporting the bullish case for inflation-resistant and risk assets.

What will happen in 2026?

Starting early next year, we may witness the largest crash across all markets since the October 1929 collapse of the US financial markets that triggered the Great Depression.

Henrik Zeberg’s reasoning includes stagnation in the real economy, with some evidence being the number of houses on the market.

David Hunter believes we are at the end of a long-term, debt-driven cycle spanning half a century, which will conclude with unprecedented deleveraging in modern history, as he shared on Coin Stories.

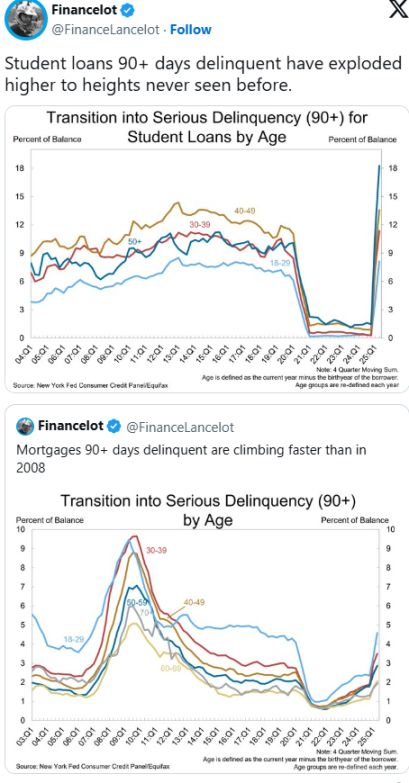

Other signals, such as loan payment defaults, also indicate that the real economy is stagnating sharply, which will inevitably impact the financial economy.

Bitcoin’s decline is not inevitable, but highly likely

Even if we do not face a global macro crash, if history repeats itself, bitcoin’s price will face historic selling pressure in 2026.

That is, bitcoin’s price fell from nearly $69,000 at the end of 2021 to about $15,500 at the end of 2022, and from nearly $20,000 at the end of 2017 to just over $3,000 at the end of 2018.

In both cases, bitcoin’s price touched or fell below its 200-week simple moving average (SMA), shown as the light blue line in the chart below.

Currently, bitcoin’s 200-week simple moving average is around $52,000. If bitcoin’s price experiences a parabolic surge in the coming months, it could rise to a high of $65,000, then fall to that price point or lower at some point in 2026.

If we do see the kind of crash that’s being predicted, bitcoin’s price could fall well below that threshold.

Nevertheless, no one knows what the future holds, and it’s worth remembering that while history doesn’t necessarily repeat itself, it often rhymes.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The US "Bitcoin Act" plans to acquire one million bitcoins within five years.

Opinion: The GENIUS Act Has Become Law, Banks Should Not Attempt to Rewrite It Now

When there is competition, consumers are the real winners.

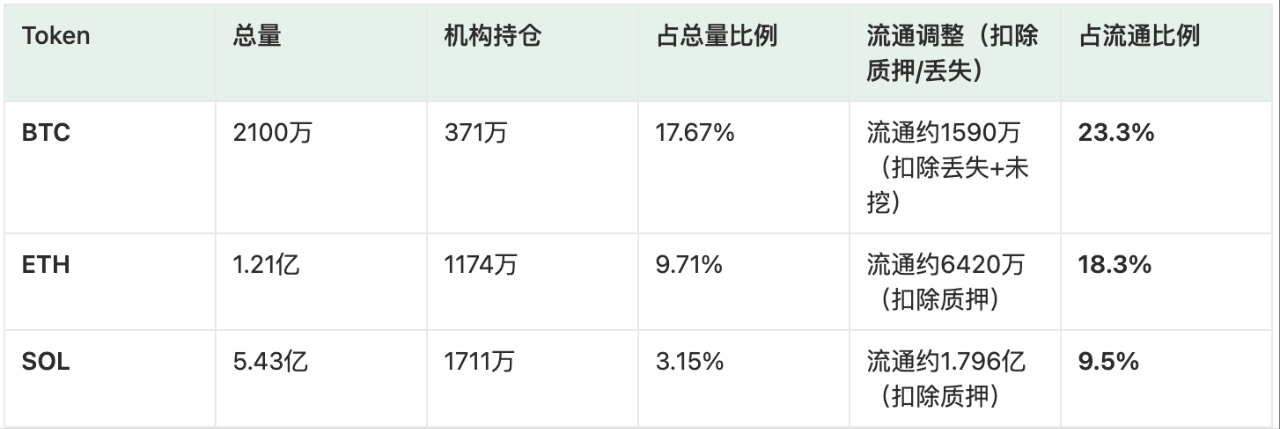

How much further can the institutional bull market go after the rate cut?

The project philosophies of Bitcoin, Ethereum, and Solana correspond to three human instincts when facing the future: survival, order, and liquidity, respectively.

Overtake partners with World to bring Proof-of-Human to the OVERTAKE trading marketplace

When identity verification is combined with custodial payments, the reliability of transactions is significantly enhanced, which has the potential to drive large-scale user adoption and long-term market expansion.