JPMorgan: The US Stablecoin Battle Could Be a Zero-Sum Game

JPMorgan's analysis indicates that the U.S. stablecoin market may face zero-sum competition, where newly issued stablecoins merely redistribute market share rather than expand the market. Tether plans to launch the compliant stablecoin USAT, while Circle is consolidating USDC's position through the development of the Arc blockchain. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still in the process of iterative updates.

If there is no significant expansion, the new wave of stablecoin issuance may only redistribute market share rather than expand the market size, the bank stated.

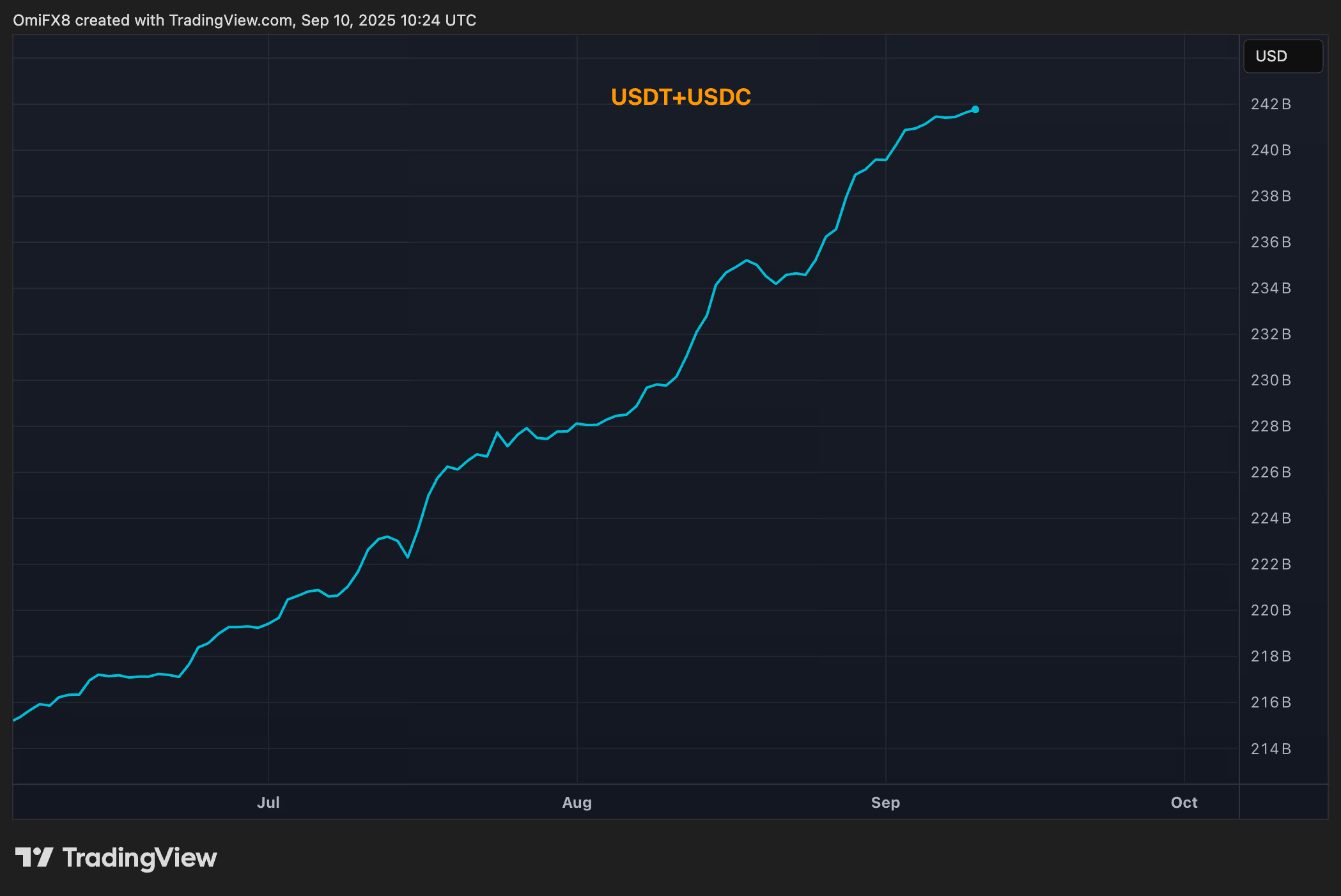

JPMorgan said that the $270 billions stablecoin market still remains in line with the overall cryptocurrency market capitalization, which means that newly issued stablecoins may only disrupt the allocation of market share.

Tether plans to launch a fully US-compliant stablecoin to compete with Circle’s USDC and attract institutional clients.

The report points out that Hyperliquid, PayPal, Robinhood, and Revolut are all issuing stablecoins, while Circle is building its own blockchain to maintain USDC’s central position in the crypto ecosystem.

According to JPMorgan’s research report, the $270 billions stablecoin industry, although it has grown significantly, still accounts for less than 8% of the total cryptocurrency market capitalization, a proportion that has remained unchanged since 2020.

The analyst team led by Nikolaos Panigirtzoglou wrote that this dynamic may turn the upcoming wave of US stablecoin issuance into a zero-sum competition, unless the crypto market itself expands significantly.

JPMorgan stated that Tether (USDT), which is mainly used overseas, plans to launch a compliant US token—USAT. Unlike USDT, about 80% of USDT’s reserves meet US requirements, while USAT’s reserves will fully comply with the new regulatory standards.

Stablecoins are a type of cryptocurrency whose value is pegged to other assets such as the US dollar or gold. They play an important role in the cryptocurrency market, providing payment infrastructure and being used for cross-border transfers. Tether’s USDT is the largest stablecoin, followed by Circle’s USDC (CRCL).

The report notes that stablecoin legislation passed in the US in July has already triggered a new wave of issuance for Circle’s USDC, which currently dominates the US market.

Analysts wrote that although new entrants are scrambling to secure positions before regulations are implemented, the growth of the stablecoin market remains tied to the overall cryptocurrency market capitalization.

JPMorgan said that Circle is also gradually losing market share, with competitors such as Hyperliquid, whose exchange alone accounts for nearly 7.5% of USDC usage. In addition, fintech giants PayPal (PYPL), Robinhood (HOOD), and Revolut are also launching their own tokens.

In response, Circle is developing a blockchain called Arc, specifically tailored for USDC transactions, to enhance speed, security, and interoperability, and to maintain USDC’s core position in crypto infrastructure.

The report adds that without significant expansion, the new wave of stablecoin competition may only redistribute market share rather than expand the market size.

A brokerage stated in a report earlier this month that the supply of USDC has soared to $72.5 billions, 25% higher than Wall Street firm Bernstein’s expectations for 2025.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

DoubleZero plans mainnet-beta launch

These 3 Cardano charts say ADA price is shooting for $1.25

Bitcoin price forecasts eye $110K target as $4.9T options expiry arrives

XRP revisits $3 support, but data shows bulls still in control