Bitcoin’s breakout above $120,000 could trigger a swift rally to $150,000 before year-end as investors shift into safe-haven assets; analysts cite market liquidity, government fiscal moves and renewed institutional flows as potential catalysts for this rapid move.

-

Bitcoin could reach $150,000 quickly after a confirmed breakout above $120,000.

-

Safe-haven flows, ECB liquidity and retirement-plan allocations are key drivers.

-

On-chain data and weekly market breadth show recovery: BTC up ~6% last week; ZEC led top-100 gains at +157%.

Bitcoin breakout to $150,000: BTC may surge quickly after a $120,000 breakout—read analysis, expert views, and market data to act fast.

What is driving the Bitcoin breakout narrative toward $150,000?

Bitcoin breakout talk centers on renewed investor demand for safe-haven assets amid macro uncertainty. Market participants point to U.S. political events, expanding central bank balance sheets and renewed institutional allocation as the primary catalysts that could push BTC from $120,000 to $150,000 within a short window.

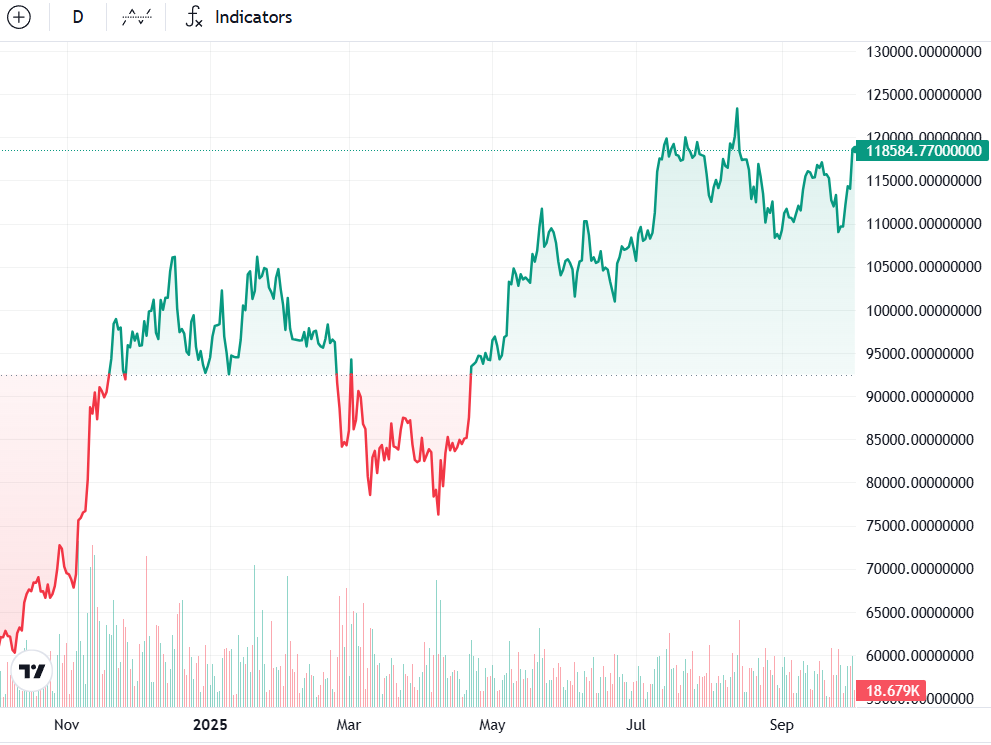

BTC/USD, one-day chart. Source: Cointelegraph

How likely is a rapid move from $120,000 to $150,000?

Analysts including Charles Edwards view a “very quick” move as plausible once BTC clears the $120,000 range. Short-term momentum, rising bid depth and renewed flows into spot and derivatives markets raise the odds. Data shows Bitcoin rose over 6% last week, recovering above $118,500 and then trading above $120,122 at time of reporting.

Why would safe-haven demand impact Bitcoin’s price?

Safe-haven demand amplifies when traditional markets face political or fiscal shocks. The recent U.S. government shutdown and concerns over expanding central bank deficits in Europe increase expectations for liquidity. Market voices, including Arthur Hayes and others, have pointed to potential ECB money printing as a tailwind funneling liquidity into risk assets like Bitcoin.

What other market headlines could influence BTC in the near term?

Key headlines shaping sentiment include: institutional adoption narratives (401(k) inclusion discussions and large-cap allocations), regulatory legal outcomes (high-profile cases such as Tornado Cash), and competitive token launches in DeFi that shift trader attention. Each item can affect short-term volatility and directional conviction.

BTC/USD, one-month chart. Source: Cointelegraph

How did expert commentary shape the market outlook this week?

Charles Edwards (Capriole Investments) forecasted a potential rapid climb to $150,000 after breakout confirmation. Cathie Wood (ARK Invest) compared Hyperliquid’s early performance to Solana’s early cycle, highlighting investor interest in new protocol tokens. Rob Hadick (Dragonfly) and Sergej Kunz (1inch) offered insight on tokenized stocks and exchange evolution, influencing capital allocation expectations.

What legal and regulatory events matter for crypto sentiment?

High-profile legal developments—such as the motion for acquittal filed for Tornado Cash co-founder Roman Storm—directly affect privacy-focused protocol perceptions and regulatory risk pricing. Outcomes in U.S. courts and policy shifts at regulators like the SEC carry immediate sentiment and structural implications for institutional participation.

Tornado Cash website. Source: Tornado.Cash

When could institutional flows materially lift Bitcoin prices?

Institutional flows accelerate when allocators gain regulatory clarity and product access. Projections cited by industry researchers estimate that even modest retirement-plan allocations (for example, 1% of 401(k) volumes) could unlock tens of billions in fresh capital. Timing depends on product rollouts and custodial infrastructure readiness.

Rob Hadick speaking to Cointelegraph at TOKEN 2049. Source: Andrew Fenton/Cointelegraph

Frequently Asked Questions

Can Bitcoin reach $150,000 this year?

Yes. Analysts say a confirmed breakout above $120,000 combined with strong liquidity flows and renewed institutional allocations could send BTC to $150,000 within weeks. This scenario depends on continued market breadth and macro-driven safe-haven demand.

What are the main risks to a rapid BTC rally?

Main risks include regulatory crackdowns, sharp macroeconomic tightening, large liquidations in derivatives markets, and sudden declines in on-chain demand. Legal outcomes and policy moves can shift momentum quickly.

How are DeFi and tokenization trends affecting crypto capital flows?

Tokenized equities and DeFi innovation can redirect institutional activity toward specialized infrastructure, sometimes off public chains. This reduces or reshapes liquidity available to general-purpose networks like Ethereum while creating new venues for capital deployment.

Sergej Kunz at Token2049. Source: Cointelegraph

Key Takeaways

- Momentum setup: BTC breaking and holding above $120,000 increases probability of a fast move to $150,000.

- Macro catalysts: Safe-haven flows and central bank liquidity could funnel new capital into Bitcoin.

- Watch signals: Monitor on-chain demand, derivatives open interest, ETF/retirement product uptake, and regulatory news for directional confirmation.

Conclusion

Bitcoin’s recent recovery and expert commentary have renewed talk of a potential $150,000 target if a decisive breakout above $120,000 occurs. Market participants should track liquidity cues, institutional adoption signals, and regulatory developments. COINOTAG will continue monitoring price action and structural drivers as the story unfolds.