Bitcoin $150,000 is a plausible near-term target if safe‑haven flows and renewed liquidity push BTC past the $120,000 breakout level; analysts cite macro-driven demand and fresh ECB liquidity as key catalysts that could accelerate a rapid move to $150,000.

-

Bitcoin breakout catalyst: Safe‑haven demand and central bank liquidity could drive BTC to $150,000.

-

Market momentum returned after late‑September weakness, with BTC reclaiming the $120,000 range and weekly gains above 6%.

-

Data shows DeFi tokens rallied; ZEC rose ~157% weekly while institutional interest (401(k) inclusion talk) may unlock significant capital.

Bitcoin $150,000 prediction: Bitcoin $150,000 target driven by safe‑haven flows and ECB liquidity; read analysis and expert quotes to act fast.

Analysts were eying a “quick” Bitcoin breakout to $150,000, as ARK Invest’s Cathie Wood compared the Hyperliquid token’s performance to Solana during the previous crypto cycle.

The digital asset market staged a significant recovery over the past week following the end-of‑September slump. Investor interest began to return, driven by a renewed appetite for safe‑haven assets amid US political uncertainty.

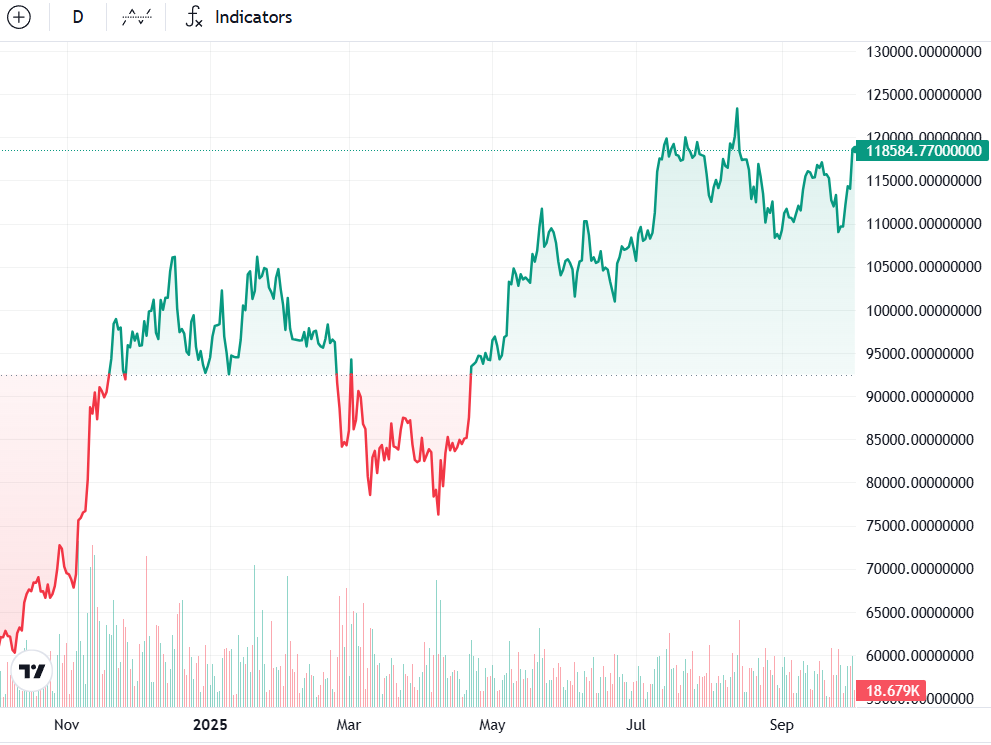

Growing demand for safe havens may see Bitcoin (BTC) follow gold’s rally and reach a new all‑time high near $150,000 before year‑end, Capriole Investments founder Charles Edwards said. Bitcoin reclaimed the $120,000 level for the first time since mid‑August and traded above $120,122 at time of writing.

BTC/USD, one-day chart. Source: Cointelegraph

What is driving the Bitcoin $150,000 breakout prediction?

Bitcoin $150,000 forecasts rest on two core drivers: renewed safe‑haven buying that follows macro shocks, and potential fresh liquidity from central banks. Analysts point to BTC’s reclaiming of $120,000 as a technical trigger that could spark a rapid rally toward $150,000.

How could safe‑haven demand push Bitcoin to $150,000?

Front‑loaded macro headlines and geopolitical uncertainty can redirect capital into perceived stores of value. Charles Edwards and other macro analysts argue that if investors treat BTC like digital gold, inflows could intensify quickly.

Arthur Hayes highlighted the possibility of large‑scale ECB liquidity, noting France’s central bank deficit could force expansive money printing by the European Central Bank and send fresh liquidity into risk and non‑sovereign assets.

What technical and institutional signs support a fast breakout?

Technically, recovering above $120,000 removes a key psychological resistance and can attract momentum trading. Data shows BTC rose over 6% in the last week, signaling renewed buyer conviction.

Institutionally, comments from asset managers — including estimates that 401(k) inclusion could unlock $122 billion — present a material demand case. André Dragosch of Bitwise estimates even small allocations by retirement managers could lift BTC materially.

Frequently Asked Questions

Will Bitcoin reach $150,000 before year‑end?

Analysts say it is possible if current momentum continues and macro liquidity increases; the scenario depends on safe‑haven flows, ECB policy, and sustained technical breakout above $120,000.

What role does central bank liquidity play?

Central bank easing can increase available cash for risk assets. Arthur Hayes suggested that European money printing could create cross‑asset liquidity that supports Bitcoin’s price appreciation.

Key Takeaways

- Safe‑haven flows matter: Macro shocks can redirect capital into Bitcoin quickly.

- Technical trigger: Reclaiming $120,000 is the breakout signal many analysts cite.

- Institutional demand: Talks of 401(k) inclusion and large allocations could supply significant new capital.

BTC/USD, one-month chart. Source: Cointelegraph

Conclusion

Bitcoin’s path to $150,000 depends on a mix of technical momentum, safe‑haven buying, and renewed liquidity from major central banks. Analysts quoted in this report — including Charles Edwards and Arthur Hayes — present a fact‑based scenario rather than a guarantee. Stay focused on confirmed breakouts and institutional flow indicators as the market evolves.

Tornado Cash website. Source: Tornado.Cash

Additional market notes

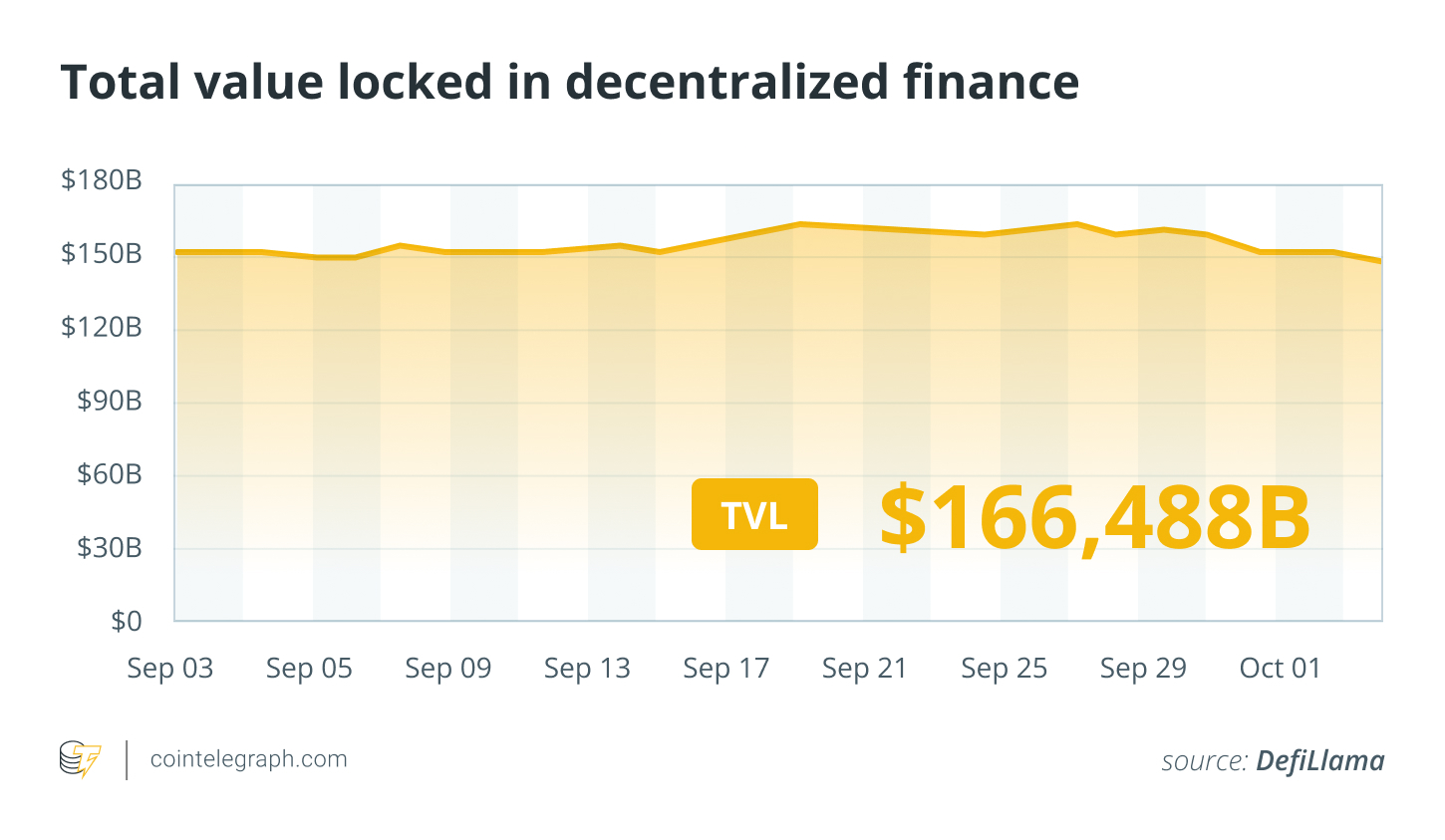

DeFi overview: Data from Cointelegraph Markets Pro and TradingView showed most of the top 100 crypto assets ended the week higher. Zcash (ZEC) led weekly gainers among the top 100, rising roughly 157% on the week, and DeXe (DEXE) climbed around 34%.

Total value locked in DeFi. Source: DefiLlama

Publication date: 2025-10-03 | Updated: 2025-10-03

Author: COINOTAG