The total net outflow of Bitcoin spot ETFs was $471 million yesterday, with none of the twelve ETFs seeing a net inflow.

PANews, October 30 – According to SoSoValue data, the total net outflow of bitcoin spot ETFs yesterday (October 29, Eastern Time) was $471 million.

The bitcoin spot ETF with the largest single-day net outflow yesterday was Fidelity ETF FBTC, with a single-day net outflow of $164 million. Currently, FBTC's historical total net inflow has reached $12.5 billions.

Next was Ark Invest and 21Shares' ETF ARKB, with a single-day net outflow of $144 million. Currently, ARKB's historical total net inflow has reached $2.119 billions.

As of press time, the total net asset value of bitcoin spot ETFs is $149.975 billions, with the ETF net asset ratio (market value as a percentage of bitcoin's total market value) reaching 6.75%. The historical cumulative net inflow has reached $61.866 billions.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Can you receive a Polymarket airdrop by using AI agents to execute end-of-day strategies?

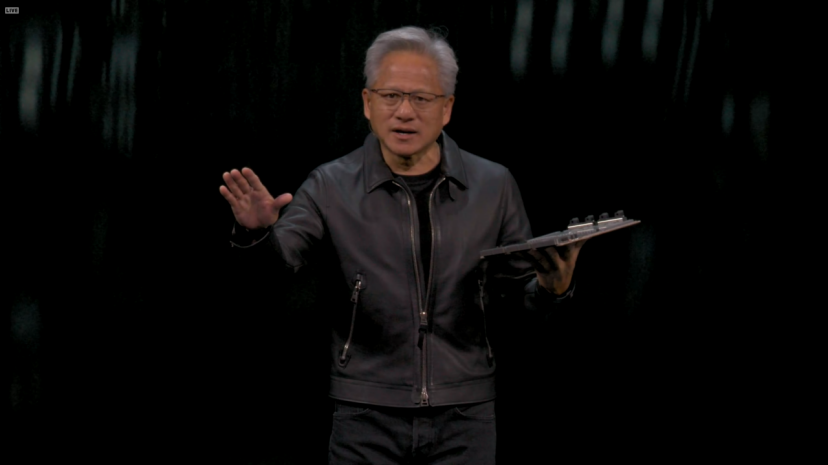

Give Nokia 1 billion, Jensen Huang wants to earn 200 billions

Jensen Huang unveiled some major announcements at the 2025 GTC.

When AI Agents Learn to Make Autonomous Payments: PolyFlow and x402 Are Redefining the Flow of Value on the Internet

x402 has opened the channel, while PolyFlow extends this channel to the real business and AI Agent world.

PolyFlow integrates x402 protocol to drive the next-generation AI Agent payment revolution

PolyFlow's mission is to seamlessly connect traditional systems with the intelligent world through blockchain technology, gradually reshaping everyday payments and financial activities to make every transaction more efficient and trustworthy—making every payment more meaningful.