Fed turns hawkish? Barclays: Powell aims to "break the expectation of inevitable rate cuts," and data supports more rate cuts

Barclays believes that the market's hawkish interpretation of Powell's remarks is a misjudgment.

Barclays believes the market's hawkish interpretation of Powell's remarks is a misjudgment.

Written by: Dong Jing

Source: Wallstreetcn

The market's "hawkish" interpretation of the latest remarks by Federal Reserve Chairman Powell may be a misjudgment. Barclays believes that Powell's real intention is to correct the market's overconfidence that "rate cuts are a done deal."

After the October FOMC meeting, the Federal Reserve Chairman stated at a press conference that inflation still faces upward pressure in the short term, employment faces downside risks, and the current situation is quite challenging. The committee remains divided on whether to cut rates again in December, and a rate cut is not set in stone. The market interpreted this statement as hawkish, leading to a sell-off in 2-year U.S. Treasury bonds, a sharp rise in yields, and a pullback in U.S. stocks.

On October 31, according to Chasing Wind Trading Desk, Barclays Bank put forward a clear opposing view in its latest research report, arguing that the market's panic may be a misjudgment. Powell's real intention is not to turn hawkish, but to manage the market's overly "certain" expectations of rate cuts.

The analyst team led by Anshul Pradhan at Barclays believes this is a communication strategy aimed at breaking the market's assumption that rate cuts are a foregone conclusion regardless of the data. The latest economic data show that labor demand continues to slow and underlying inflation is not far from the 2% target, both of which support the Fed's continued rate cuts.

Barclays pointed out in the research report that the current market pricing is too hawkish and fails to fully reflect the risk that the labor market could weaken significantly, as well as the risk that a new Fed chair might take a more dovish stance.

Not a Hawkish Shift, but Breaking the Market "Consensus"

Barclays stated in the report: "We believe the main motivation is to refute the market's assumption that a December rate cut is a done deal, rather than a hawkish shift in the Fed's response to data."

In other words, the Fed wants to reiterate that its decisions are data-dependent, not dictated by market expectations. Powell made it clear that the Fed will respond to the slowdown in labor demand, which is exactly what is happening.

The report emphasizes that the latest economic data not only do not support a hawkish stance, but actually provide grounds for further rate cuts.

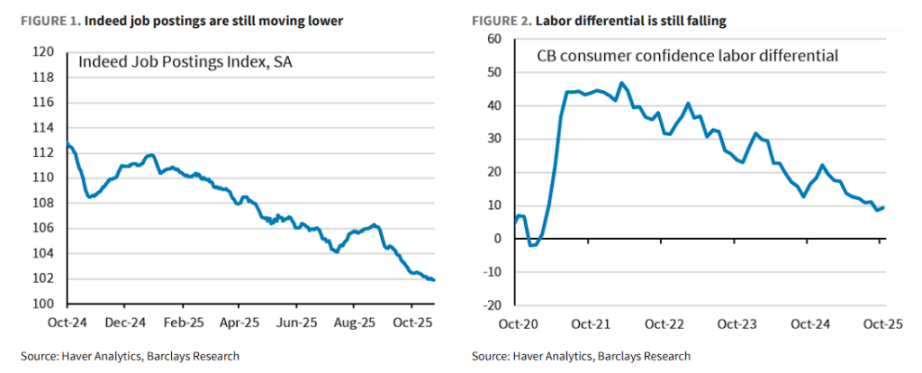

In terms of the labor market, leading indicators such as Indeed job postings and the jobs plentiful vs hard to get differential all show that demand is slowing.

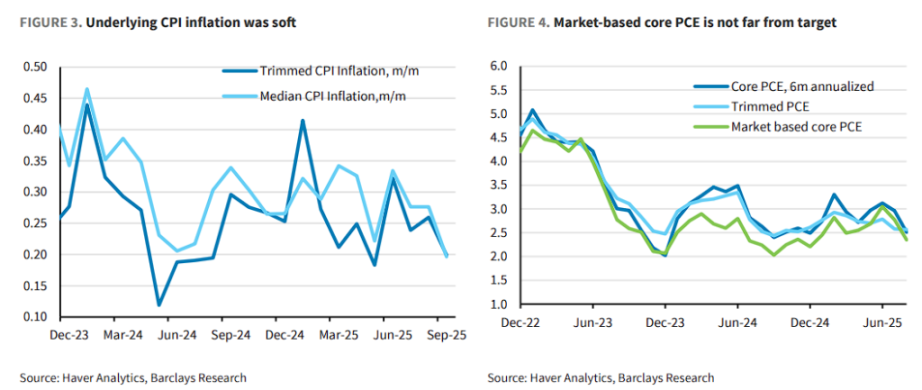

On inflation, Powell also acknowledged the recent weakness in data. Core inflation indicators have shown a downward trend. Barclays' analysis suggests that once the impact of tariffs is excluded, market-based core PCE inflation is already close to the 2% target.

"Overall, if underlying inflation is only a few tenths of a percentage point above the target, and the unemployment rate is only a few tenths of a percentage point above the natural unemployment rate (NAIRU), then policy should be neutral."

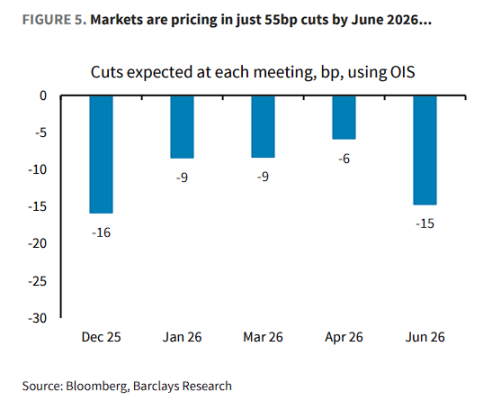

This means that, given the current data, restrictive monetary policy is no longer necessary. Barclays observed that the market is currently only pricing in a cumulative 55 basis points of rate cuts by June 2026, which is "too one-sided."

The current market expects only a 35 basis point rate cut by March 2026 and a 55 basis point cut by June, bringing the rate to 3.3%. The distribution implied by the options market shows that there is disagreement over the number of rate cuts in March and June, with the modal expectation being only one rate cut by June.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin risks ‘20%-30%’ drop as crypto markets liquidate $1.1B in 24 hours

Why is Zcash’s ZEC the only crypto pumping right now?

XRP price keeps losing ground despite upcoming Ripple Swell event

DeFi and TradFi must put aside their differences