What is COAI Crypto? Can ChainOpera AI Sustain Its Rally Amid BNB Chain Hype?

If you’ve been watching the crypto markets lately, you may have noticed the remarkable performance of COAI crypto. Over the past week, this new token has skyrocketed in value, quickly climbing the ranks to become one of the hottest assets on Binance Smart Chain. But what’s really behind the COAI crypto boom—and can it last? In this article, we’ll break down what COAI crypto is, how it works, the details of its recent price rally, technical insights, and whether this project is truly legitimate in today’s fast-evolving market.

Source: CoinMarketCap

What is COAI?

COAI is the native token of ChainOpera AI, a platform designed to bridge artificial intelligence (AI) and blockchain technology through a decentralized ecosystem of AI agents. Launched only a few months ago, COAI powers an AI-driven payment and data platform that operates on BNB Chain. The project enables seamless transactions and service coordination between AI users and providers, leveraging the scalability and low fees of the BSC network. As of June 2024, ChainOpera AI’s ecosystem reportedly services over 3 million AI users and 300,000 BNB payers, demonstrating rapid adoption and a solid base of utility.

How Does COAI Work?

COAI functions as a universal settlement and utility token across the ChainOpera AI network. Its use cases include:

-

AI Payment Services: Users pay for AI agent services using COAI, streamlining and incentivizing AI-to-AI and user-to-AI transactions.

-

Ecosystem Incentives: The token is employed in rewarding developers, facilitating data exchanges, and supporting governance features on the platform.

-

Cross-Platform Integration: By deploying on BNB Chain, COAI is able to leverage liquidity and users from a rapidly growing ecosystem, boosted by the active support and promotion from Binance and its founder, CZ.

The project stands out for combining live AI user engagement with blockchain utility, generating a consistent demand for the token as its network grows.

What Is Fueling COAI’s Rally?

The extraordinary price surge of COAI is a product of both internal development and broader ecosystem trends:

-

Project Momentum: Since its May launch, ChainOpera AI has swiftly expanded its user base, now reaching millions of AI users and hundreds of thousands of payers. This organic growth bolstered the demand for COAI, setting the foundation for its rally.

-

Favorable Market Timing (“BNB Season”): The launch and expansion of COAI coincide with heightened enthusiasm for Binance Smart Chain projects. This “BNB Season,” catalyzed by CZ’s endorsement of the chain, has brought increased liquidity and investor focus to tokens operating on BSC, including COAI.

-

Strategic Listings: The rally intensified after the COAI token was listed on Aster Exchange with 5X leverage on October 6, followed by earlier integrations with Bybit and Binance Alpha. These listings unlocked significant liquidity inflows and strengthened price discovery for COAI.

COAI Price Technical Analysis

A technical review underscores both the recent pullback and COAI’s ongoing bullish structure:

-

Short-Term Chart: On the 30-minute chart, COAI recently experienced a retracement after its explosive rally. However, the formation of a bullish flag pattern suggests the potential for another upward move and a retest of this week’s high around $3.266. Should COAI break above this resistance, technical projection indicates that prices could target the $5.00 zone.

-

Market Structure: With high trading volumes and active liquidity provision, COAI’s price action remains volatile yet structurally strong, benefiting from new exchange listings and sustained community interest.

Is COAI Legitimate?

COAI’s explosive growth and active community have put it under the spotlight, but investors should also consider key risks:

-

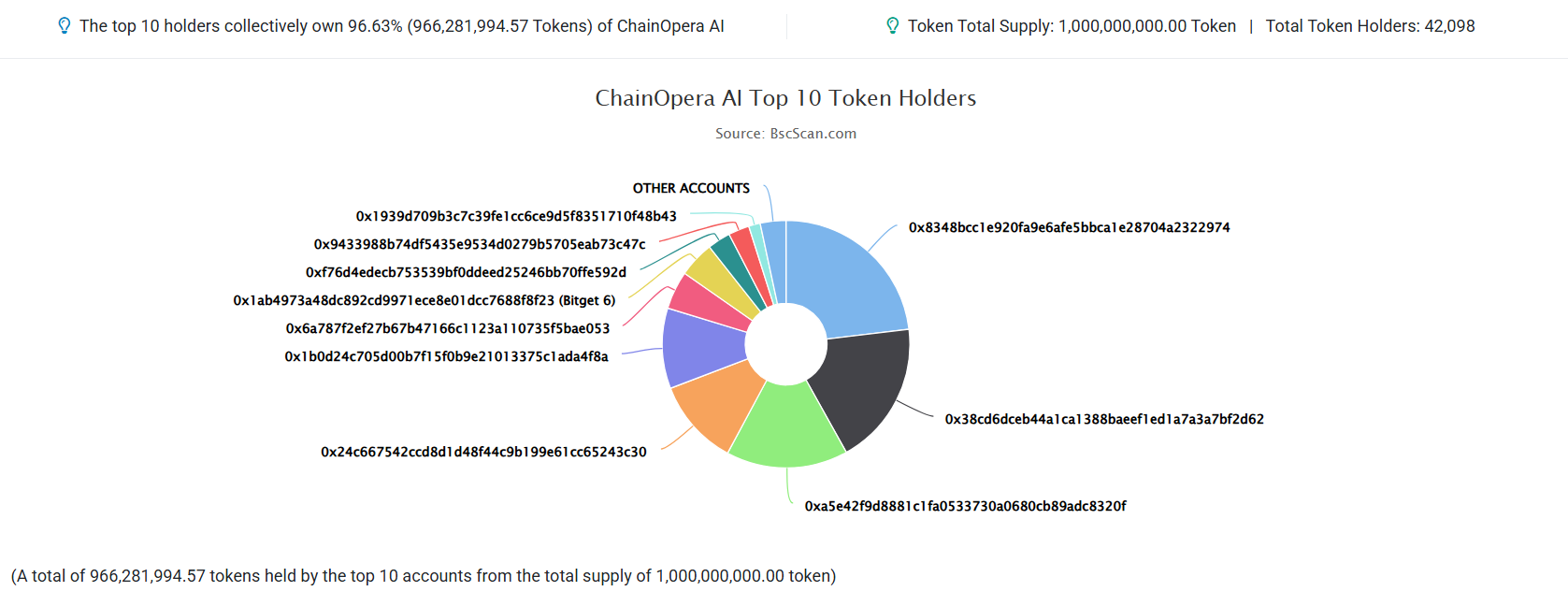

Token Distribution Concerns: The concentration of ownership is significant: the top 10 wallet addresses hold over 96% of the total COAI supply, while the top 100 accounts for 99.74%. Such a distribution implies considerable control by a small number of holders, raising the risk of price manipulation or sudden sell-offs.

-

Sustainability Question: Much of COAI’s current momentum can be attributed to external factors, such as the broader “BNB Season” hype. It remains to be seen whether the project’s internal fundamentals—user engagement, organic adoption, and unique AI integration—will be enough to sustain demand when external enthusiasm cools.

-

Valuation and Supply Risks: Tokens with high fully diluted valuations (FDV) and low circulating supply often face challenges maintaining post-hype investor interest. Long-term success will depend on ChainOpera AI’s ability to convert short-term price action into lasting ecosystem growth.

Conclusion

COAI stands as one of the most dynamic newcomers in the AI and BNB Chain intersection, boasting rapid user growth, robust integration, and significant short-term gains. However, while technical indicators and market traction suggest further potential, the project’s concentrated token distribution and reliance on external sentiment introduce notable risks. As always, potential investors are advised to exercise diligent risk assessment and monitor both ecosystem developments and market trends before making any investment decisions in COAI.

Create an account on Bitget and trade BTC today!

Disclaimer: The opinions expressed in this article are for informational purposes only. This article does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. Qualified professionals should be consulted prior to making financial decisions.