The Hong Kong Stock Exchange's push for Bitcoin ETF is a balance between market opportunities and investor protection

According to Caixin, in April 2024, three Bitcoin spot ETFs and three Ethereum spot ETFs approved by the Hong Kong Securities Regulatory Commission were listed on the Hong Kong Stock Exchange. It is reported that the launch of Bitcoin ETFs by the Hong Kong Stock Exchange aims to balance market opportunities and investor protection. As regulatory thinking becomes clearer, efforts are being made to strike a balance between protecting investor interests and market development.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Data: A certain wallet withdrew 823,368 UNI tokens worth approximately $4.72 million from CEX within 5 hours.

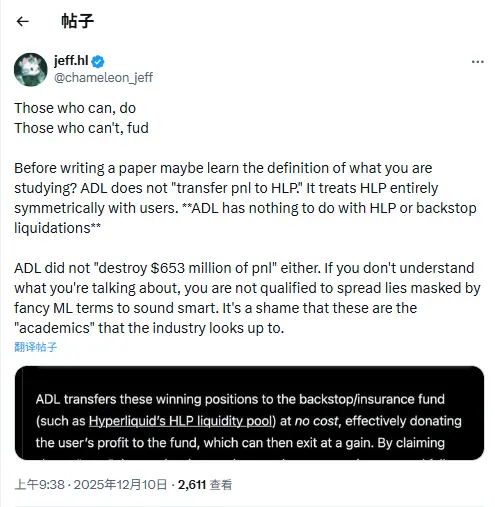

Data: Hyperliquid platform whales currently hold $4.828 billions in positions, with a long-short ratio of 0.94

Data analytics firm Inveniam announces acquisition of on-chain asset tokenization platform Swarm Markets