Why the US Presidential Election May Matter for Bitcoin Price

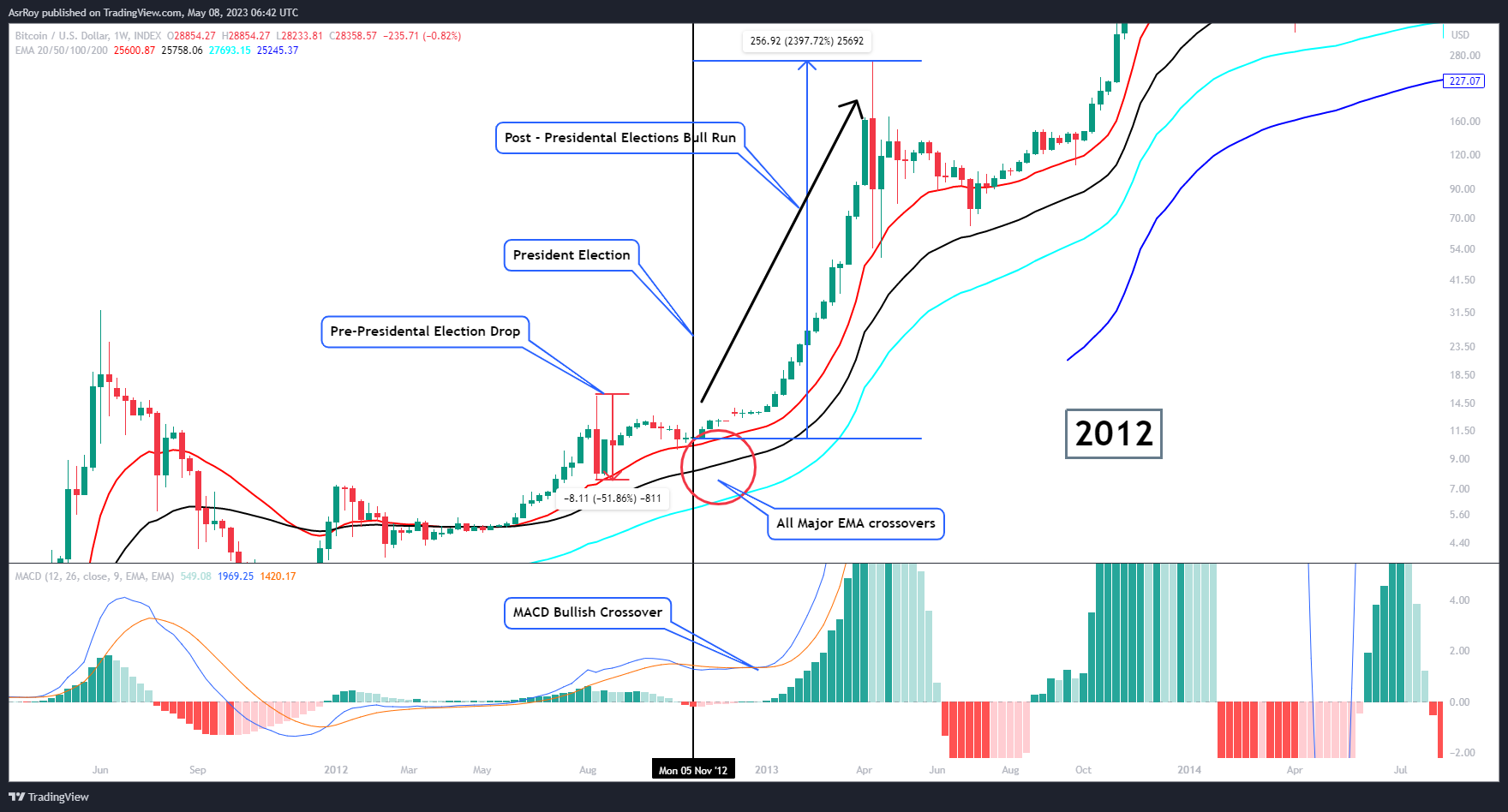

Crypto analyst Aditya Siddhartha links one of the most significant Bitcoin (BTC) uptrends that occurred in 2012 to the US presidential election.

Сидхарта noted , that Bitcoin's 2012 bull run was preceded by a significant 52% price drop. However, after the bullish MACD crossover and all the major exponential moving average (EMA) bullish crossovers, the market started to gather momentum, starting an upward march.

In 2012, the MACD and EMA indicators provided positive signals, boosting investor confidence and fueling a surge in demand for BTC. This led to a bull run after the presidential election, with the price of Bitcoin increasing by an impressive 11,800%.

Similarly, in 2016, the price of Bitcoin fell 41% before the presidential election. After the bullish MACD crossover and all major bullish EMA crossovers, the market gained momentum, leading to a new uptrend.

READ MORE:

How Exchange Traded Funds Can Manipulate Bitcoin PriceAfter the election, the price of Bitcoin rose by 2,800%, which was driven by increased demand from investors and growing awareness of Bitcoin's potential as a store of value and digital asset.

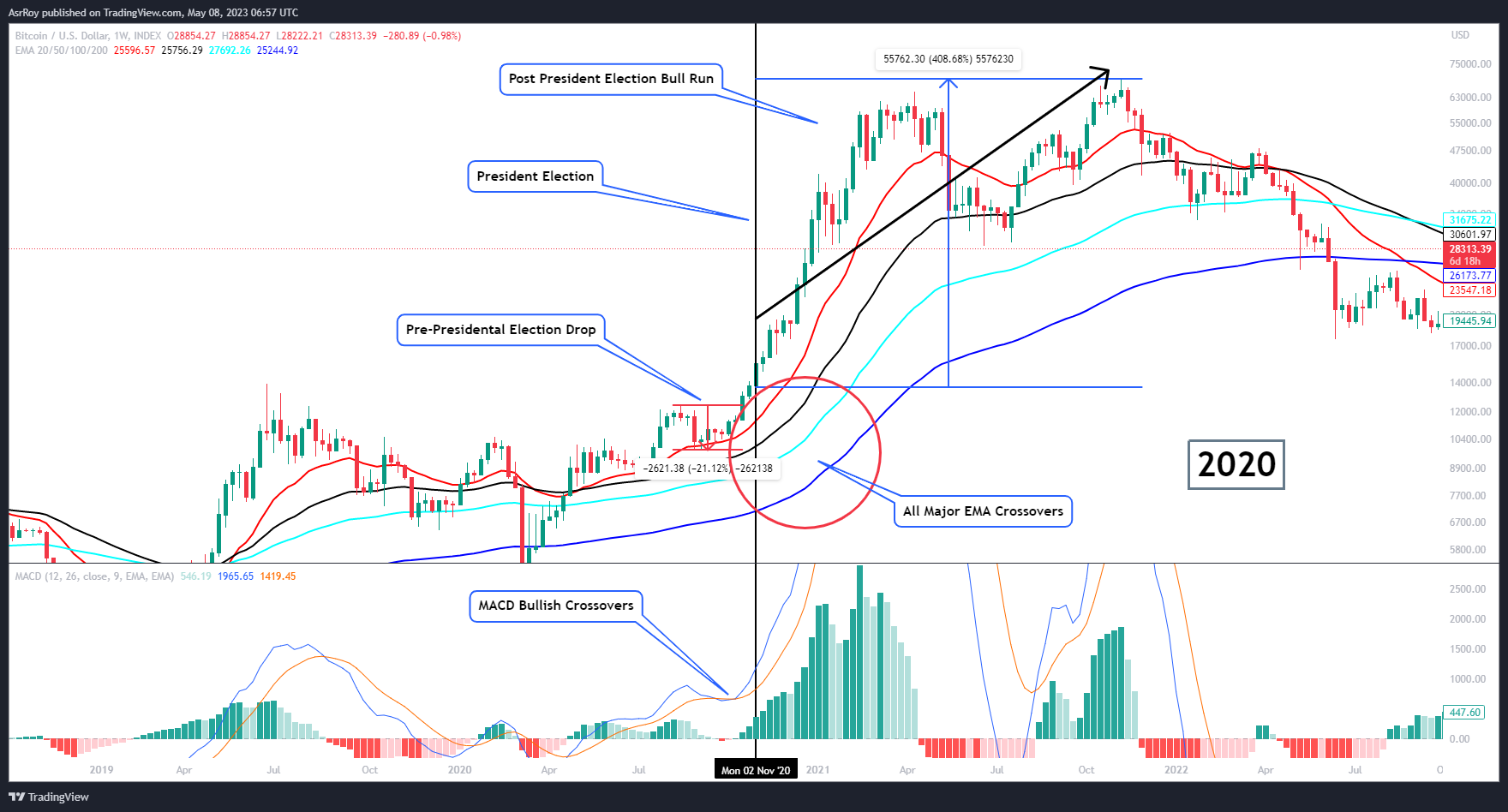

In 2020, Bitcoin saw a 22% drop before the presidential election, which was largely due to the uncertainty surrounding the election results and their potential economic impact. After the election, however, the price of Bitcoin saw a 410% increase.

After the elections scheduled for this year, the analyst predicts that the MACD bullish crossover and all major EMA bullish crossovers will once again signal positive market movements, increasing investor confidence and demand for Bitcoin. He expects that after the election, the price of Bitcoin could rise to the $180,000-$200,000 range.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Wall Street interprets the Federal Reserve decision as more dovish than expected

The market originally expected a "hawkish rate cut" from the Federal Reserve, but in reality, there were no additional dissenters, no higher dot plot, and the anticipated tough stance from Powell did not materialize.

The Federal Reserve cuts rates again but divisions deepen, next year's path may become more conservative

Although this rate cut was as expected, there was an unusual split within the Federal Reserve, and it hinted at a possible prolonged pause in the future. At the same time, the Fed is stabilizing year-end liquidity by purchasing short-term bonds.

Betting on LUNA: $1.8 billion is being wagered on Do Kwon's prison sentence

The surge in LUNA’s price and huge trading volume are not a result of fundamental recovery, but rather the market betting with real money on how long Do Kwon will be sentenced on the eve of his sentencing.

What is the overseas crypto community talking about today?

What have foreigners been most concerned about in the past 24 hours?