Grayscale Ethereum Trust discount to NAV quietly switches to a premium ahead of anticipated spot ETF launch

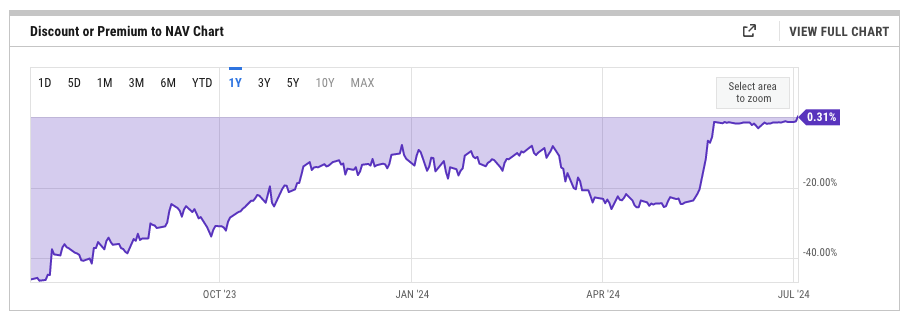

The Grayscale Ethereum Trust (ETHE) discount to net asset value (NAV) has quietly become a premium ahead of an anticipated spot ETF launch.The ETHE premium to NAV hit 0.31% on July 3, according to YCharts data.

The Grayscale Ethereum ETH -4.94% Trust (ETHE) is no longer trading at a discount to net asset value (NAV) ahead of the anticipated launch of spot Ethereum exchange-traded funds in the U.S.

Having previously traded at a discount for the last three years, ETHE reached a premium to NAV of 0.31% on July 3, ahead of the Independence Day holiday, according to YCharts data .

Premium or discount to NAV indicates how much above or below the market price of each share is compared to the value of the ether it represents.

The ETHE discount had been narrowing since the crypto bear market bottom of December 2022, as speculation grew surrounding the U.S. Securities and Exchange Commission’s approval of spot Ethereum ETFs following the launch of their Bitcoin counterparts in January.

Despite widening again between March and May, the ETHE discount narrowed sharply following the SEC’s approval of eight 19b-4 forms for spot Ethereum ETFs from BlackRock, Fidelity, Bitwise, VanEck, Ark Invest, Invesco, Franklin Templeton and Grayscale on May 23.

However, the issuers still need to have their S-1 registration statements become effective before trading can begin. This is expected to happen within the next few weeks , but ETHE remained at a slight discount to NAV until now.

ETHE discount to NAV. Image: YCharts .

The Ethereum Bitcoin Trust previously traded at a discount because the shares cannot currently be redeemed, meaning the only option for shareholders is to sell them to other prospective buyers. However, it historically traded at a premium until a crypto credit crunch in 2021.

The closing of the discount is indicative of the likely imminent launch of the spot Ethereum ETFs, with investors seemingly buying up the discounted shares ahead of a potential ETF conversion of the Ethereum Trust — as was the case with the Grayscale Bitcoin Trust (GBTC) before its conversion to an ETF in January.

ETHE currently holds $9.5 billion in assets under management, according to Grayscale.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

$8.8 billion outflow countdown: MSTR is becoming the abandoned child of global index funds

The final result will be revealed on January 15, 2026, and the market has already started to vote with its feet.

Deconstructing DAT: Beyond mNAV, How to Identify "Real vs. Fake HODLing"?

There is only one iron rule for investing in DAT: ignore premium bubbles and only invest in those with a genuine flywheel of continuously increasing "crypto per share."

Empowered by AI Avatars, How Does TwinX Create Immersive Interaction and a Value Closed Loop?

1. **Challenges in the Creator Economy**: Web2 content platforms suffer from issues such as opaque algorithms, non-transparent distribution, unclear commission rates, and high costs for fan migration, making it difficult for creators to control their own data and earnings. 2. **Integration of AI and Web3**: The development of AI technology, especially AI Avatar technology, combined with Web3's exploration of the creator economy, offers new solutions aimed at breaking the control of centralized platforms and reconstructing content production and value distribution. 3. **Positioning of the TwinX Platform**: TwinX is an AI-driven Web3 short video social platform that aims to reconstruct content, interaction, and value distribution through AI avatars, immersive interactions, and a decentralized value system, enabling creators to own their data and income. 4. **Core Features of TwinX**: These include AI avatar technology, which allows creators to generate a learnable, configurable, and sustainably operable "second persona", as well as a closed-loop commercialization pathway that integrates content creation, interaction, and monetization. 5. **Web3 Characteristics**: TwinX embodies the assetization and co-governance features of Web3. It utilizes blockchain to confirm and record interactive behaviors, turning user activities into traceable assets, and enables participants to engage in platform governance through tokens, thus integrating the creator economy with community governance.

Aster CEO explains in detail the vision of Aster privacy L1 chain, reshaping the decentralized trading experience

Aster is set to launch a privacy-focused Layer 1 (L1) public chain, along with detailed plans for token empowerment, global market expansion, and liquidity strategies.