Analysis: Fed rate cuts can reduce recession potential, but no way to get to zero

On August 7, Steven Blit, U.S. economist at TS Lombard, said that if the Federal Reserve doesn't act sooner rather than later, people will be looking for signs that the economy is heading into a recession rather than looking for indicators of the recession itself. The constant stream of weak data is not a felony against growth, but it can cause problems. If the Fed stagnates or holds back waiting for a data boost, they will repeat the same mistake, and the likelihood of entering a recession later this year climbs to 75%.

The actual likelihood is even lower given the expectation that the Fed will soon signal a 50 basis point rate cut in September. By the end of the year, they could cut rates by 100 basis points. If the Fed acts, the likelihood of a recession will be lower, but not zero.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Cathie Wood: The crypto market may have bottomed out, Bitcoin remains the top choice for institutions

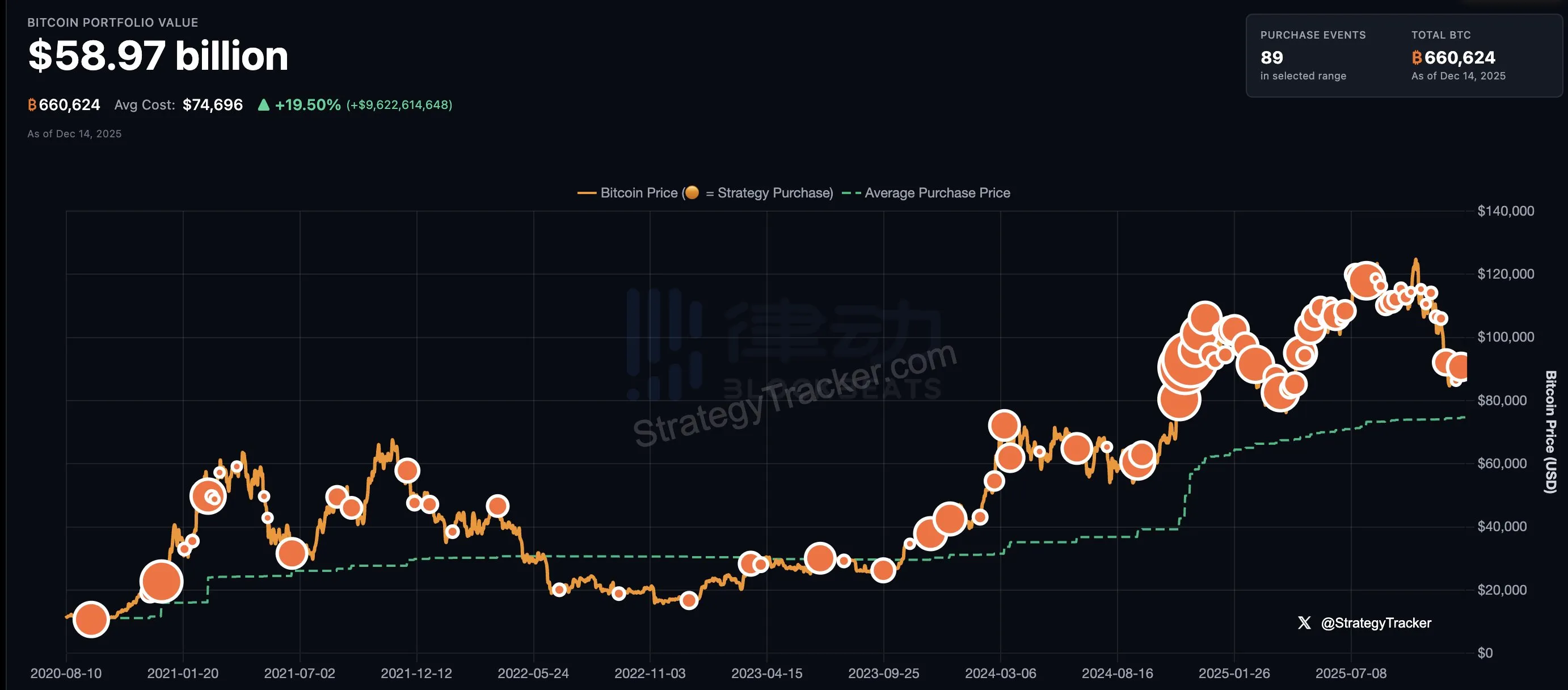

Michael Saylor releases Bitcoin Tracker information again, possibly hinting at another BTC accumulation

Analyst: Bitcoin’s key support level is at $86,000; a breach could trigger a deeper correction

Aevo confirms that the old Ribbon DOV vaults were attacked and lost $2.7 million, and will compensate active users.