Research: More and more experienced Ethereum users are choosing to trade privately on the blockchain

More and more experienced Ethereum users are choosing to trade privately on the blockchain — relying on so-called dark pools to avoid trading bots set up to front-run transactions, but potentially obscuring the openness and transparency that are supposed to be the hallmark of decentralized public networks, according to new research from Blocknative.

Private transactions, which are sent directly to validators or block proposers rather than to a public memory pool, now account for about half of Ethereum in terms of total gas usage, a reflection of the computing power required to process transactions. In September 2022, when Ethereum transitioned to a proof-of-stake network, the proportion was around 7%, but it began to surge this year and has remained around 15% since the beginning of 2024.

The result of this trend is that "private trade order flow is only accessible to permissioned network participants," which could become a centralizing force if a small number of sophisticated participants receive more rewards, Blocknative wrote in a blog post discussing the findings. "Private traffic is visible to only a few participants," Blocknative CEO Matt Cutler said in an interview. "Some people can see things, and some people can't, which creates opportunities and advantages."

For professionals who have observed such statistics before, these data may look a little strange. A more typical way to measure the prevalence of private activity is the number of transactions, which is currently around 30%. As recently as 2022, it was closer to 4.5%. But Blocknative said private transactions tend to be more complex and therefore require more "gas." "By shifting the focus to the amount of gas used by private transactions, we can get a more accurate understanding of network dynamics," Blocknative wrote in the post.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

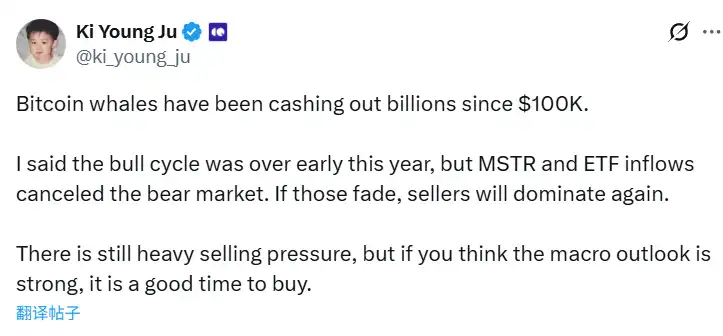

CryptoQuant CEO: Treasury companies and ETF inflows have ended the bear market

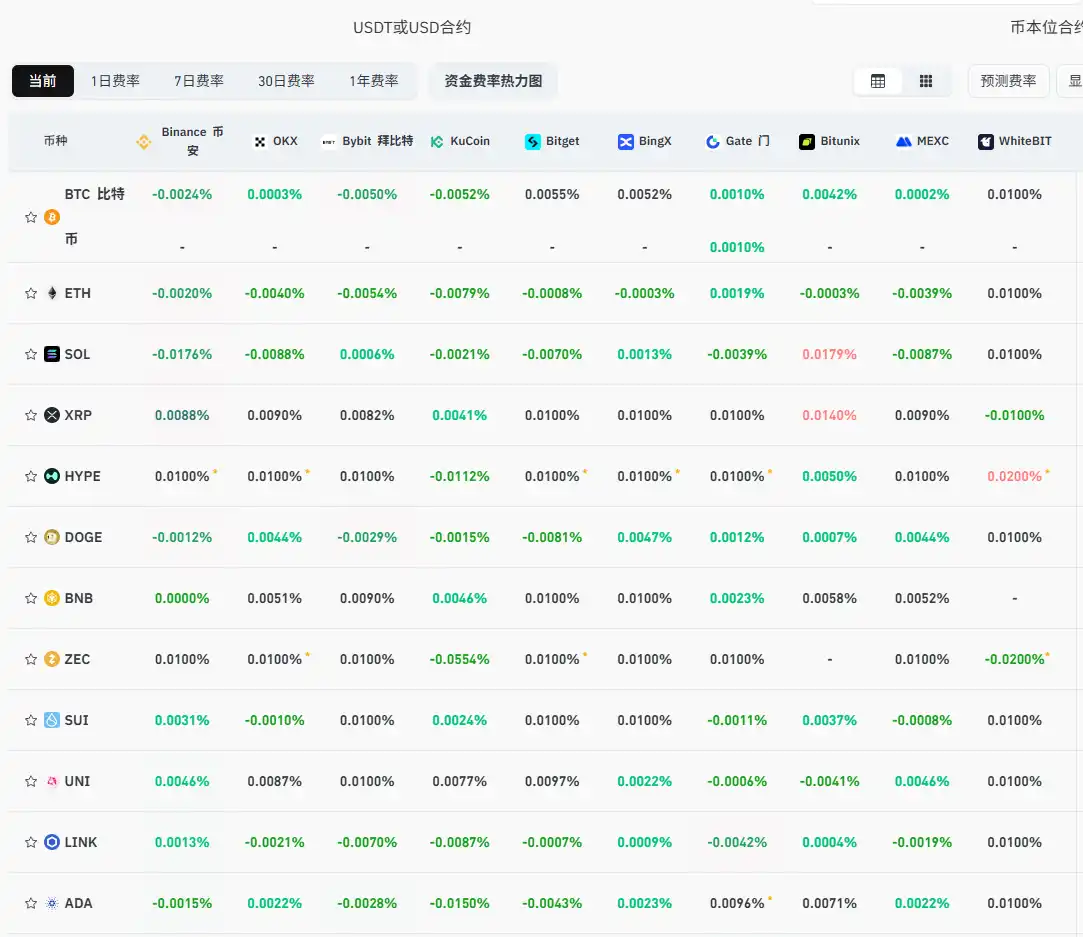

Current mainstream CEX and DEX funding rates indicate the market has returned to a fully bearish outlook