Bitcoin inflows surge to $543 million after Powell's dovish comments

Key Takeaways

- Digital asset investment products saw $533m inflows, the largest in five weeks.

- New Ethereum ETFs have seen $3.1bn of inflows, partially offset by $2.5bn Grayscale Trust outflows.

Share this article

Crypto products saw inflows totaling $533 million last week, marking the largest inflows in five weeks.

As reported by CoinShares, this surge followed Jerome Powell’s remarks at the Jackson Hole Symposium, suggesting a potential interest rate cut in September.

Bitcoin (BTC) was the primary beneficiary, with $543 million in inflows, mostly occurring on Friday after Powell’s comments. This indicates Bitcoin’s sensitivity to interest rate expectations.

As reported by Crypto Briefing, spot BTC exchange-traded funds (ETFs) in the US amassed over $500 million in net flows last week. BlackRock’s IBIT led the pack capturing $310 million in cash, while Fidelity’s FBTC came in second by attracting roughly $88 million.

Ethereum (ETH) experienced $36 million in outflows, despite new Ethereum ETFs traded in the US registering $60.7 million in inflows last week.

The net outflows were seen mainly because of Grayscale’s ETHE $118 million in fleeing capital. A month after ETH ETF launches, new Ethereum ETFs have seen $3.1 billion inflows, partially offset by $2.5 billion outflows from the Grayscale Trust.

Moreover, Solana (SOL) funds saw just $100,000 in inflows last week, as its month-to-date flows are at negative $34.3 million. Meanwhile, ETH’s year-to-date flows sit at $832 million, significantly fueled by the $120 million seen in August so far.

Regionally, the US led with $498 million in inflows, followed by Hong Kong and Switzerland with $16 million and $14 million respectively. Germany saw minor outflows of $9 million, making it one of the few countries with net outflows year-to-date.

Notably, Brazil and Canada sustain the largest amount of monthly inflows except the US, with $39.5 million and $47.5 million invested in crypto funds respectively.

Blockchain equities recorded inflows for the third week, totaling $4.8 million. Meanwhile, trading volumes, while lower than in recent weeks, remained high at $9bn for the week.

Share this article

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Exclusive Interview with Bitget CMO Ignacio: Good Code Eliminates Friction, Good Branding Eliminates Doubt

A software engineer’s philosophy of branding.

App delays and launch sniping: Base co-founder’s token issuance sparks community dissatisfaction

While most major altcoins are showing weakness, Jesse has chosen to issue a token at this time, and the market may not respond positively.

"Crypto bull" Tom Lee: The crypto market correction may be nearing its end, and bitcoin is becoming a leading indicator for the US stock market.

"Crypto bull" Tom Lee stated that on October 10, an abnormality in the cryptocurrency market triggered automatic liquidations, resulting in 2 million accounts being liquidated. After market makers suffered heavy losses, they reduced their balance sheets, leading to a vicious cycle of liquidity drying up.

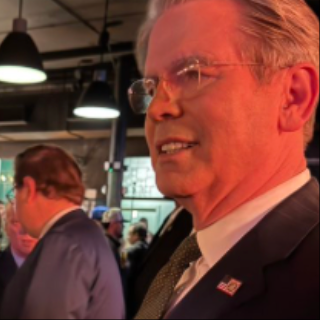

Besant unexpectedly appears at a "Bitcoin-themed bar," crypto community "pleasantly surprised": This is the signal

U.S. Treasury Secretary Janet Yellen made a surprise appearance at a bitcoin-themed bar in Washington, an act regarded by the cryptocurrency community as a clear signal of support from the federal government.