-

XRP experienced a 6% decline over the past week but has shown signs of recovery with a 3% increase in the last 24 hours, indicating a potential market stabilization.

-

Whale activity among addresses holding between 10 and 100 million XRP has remained stable, reflecting cautious investor sentiment following a brief accumulation phase.

-

Currently, XRP is testing crucial resistance at $2.13 and support at $1.96, with the looming threat of a death cross on the EMA lines possibly signaling further downside risks.

This article examines the recent fluctuations in XRP’s price, current whale activity, and critical resistance and support levels that may impact its future movement.

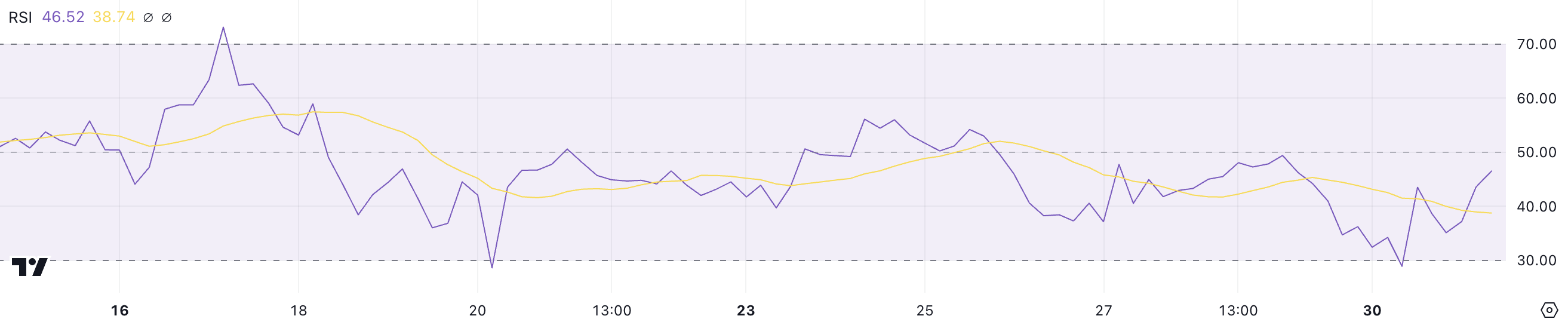

XRP RSI Recovered From an Oversold Zone

XRP’s Relative Strength Index (RSI) has rebounded to 46.5, moving away from the oversold territory of 30, which it hit at the year-end. This improvement indicates that selling pressure may be easing, and the price could be on the verge of stabilizing.

An RSI of 46.5 reflects a moderately bearish momentum but suggests that XRP is transitioning towards a neutral zone, illustrating possible indecision among traders as they weigh the coin’s short-term outlook above the $2 mark.

The RSI serves as a vital momentum indicator, offering insights into market dynamics. Levels above 70 indicate an overbought condition and potential price pullbacks, while levels below 30 denote oversold conditions that hint at possible recovery. With XRP’s RSI currently in a neutral area, the volatility may decrease unless a significant change in buying or selling trends occurs.

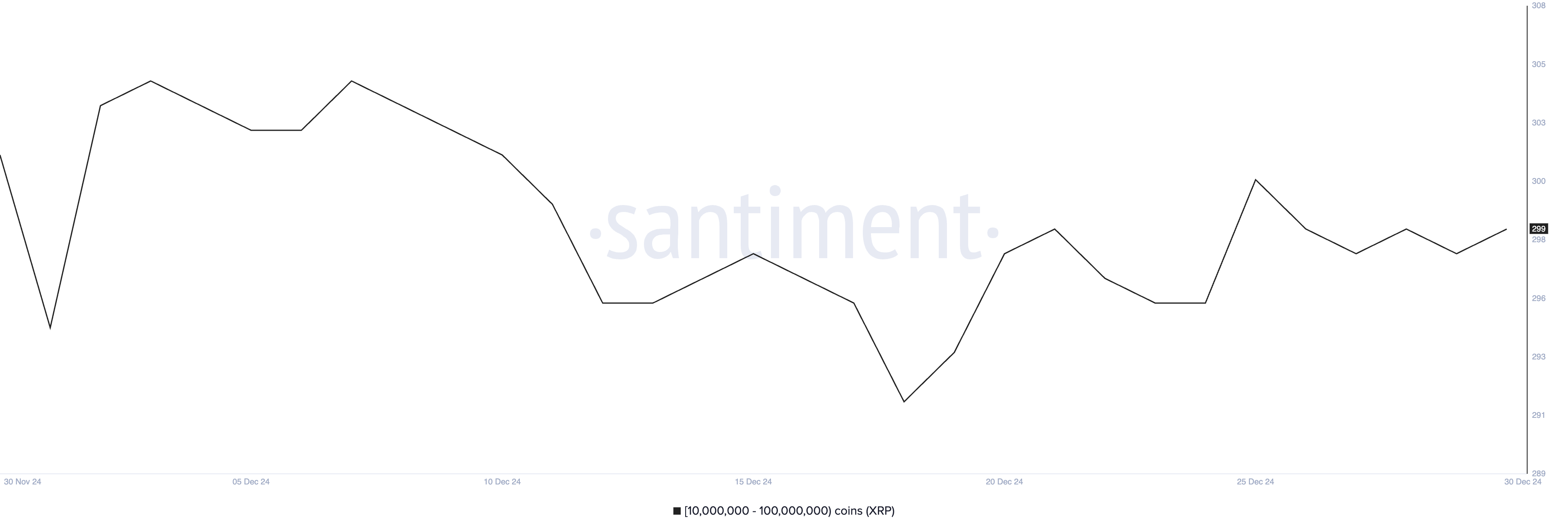

Whales Accumulated XRP During Christmas

Recent data indicates that the number of XRP whale addresses—those holding between 10 million and 100 million XRP—has stabilized in recent days. Following a brief peak of 301 addresses during the Christmas holiday, the number has settled between 298 and 299, suggesting a period of balance in whale activity.

Stable whale activity reflects a cautious sentiment among these significant holders, who play a crucial role in influencing market dynamics. A lack of aggressive buying or selling suggests XRP prices may remain within a narrow range with lower volatility in the near term.

Monitoring whale behavior can offer insights into potential market movements. Consistent whale accumulation could lead to upward momentum, while fluctuations in their activities might introduce volatility. Presently, the steady distribution suggests that unless there’s a significant shift, XRP’s price may continue to trade sideways.

XRP Price Prediction: Will It Stay Above $2?

XRP is currently trading in a tight range, facing significant resistance at $2.13 and support at $1.96 as it attempts to maintain its price above the $2 threshold. If XRP manages to break the resistance at $2.13, it could trigger further upward momentum, eventually targeting $2.33. A strong bullish phase could be confirmed if the price climbs above $2.53.

However, technical indicators, particularly the Exponential Moving Average (EMA), signal caution with a potential death cross forming soon. This bearish configuration hints that XRP could fall below the critical support at $1.96, with new tests potentially down to $1.89 and failing to hold this level may lead to a drastic decline to $1.63.

Conclusion

In summary, XRP is navigating a challenging landscape with mixed signals reflected in its price action and RSI readings. While short-term recovery appears possible, the stability in whale activity underscores a predominantly cautious market environment. Investors should watch key resistance and support levels closely as they will play pivotal roles in determining XRP’s trajectory over the coming weeks.