Ethereum Price Turns Bullish Amid Solana Meme Coin Controversy

Ethereum is regaining strength as liquidity flows in from Solana. With a golden cross forming, ETH could break $3,020 and rally further.

Ethereum (ETH) price is turning bullish after weeks of trading below $3,000, a level it has not broken since February 2. The shift comes as capital appears to be flowing out of Solana and into Ethereum, with stablecoin inflows and rising TVL supporting its momentum.

Meanwhile, Ethereum’s price chart shows short-term EMAs moving higher, signaling a potential golden cross that could push ETH toward $3,020. If this trend continues, ETH could see a 22% rally, while a failed breakout may lead to another retest of key support levels.

Stablecoin Assets are Flowing From Solana to Ethereum

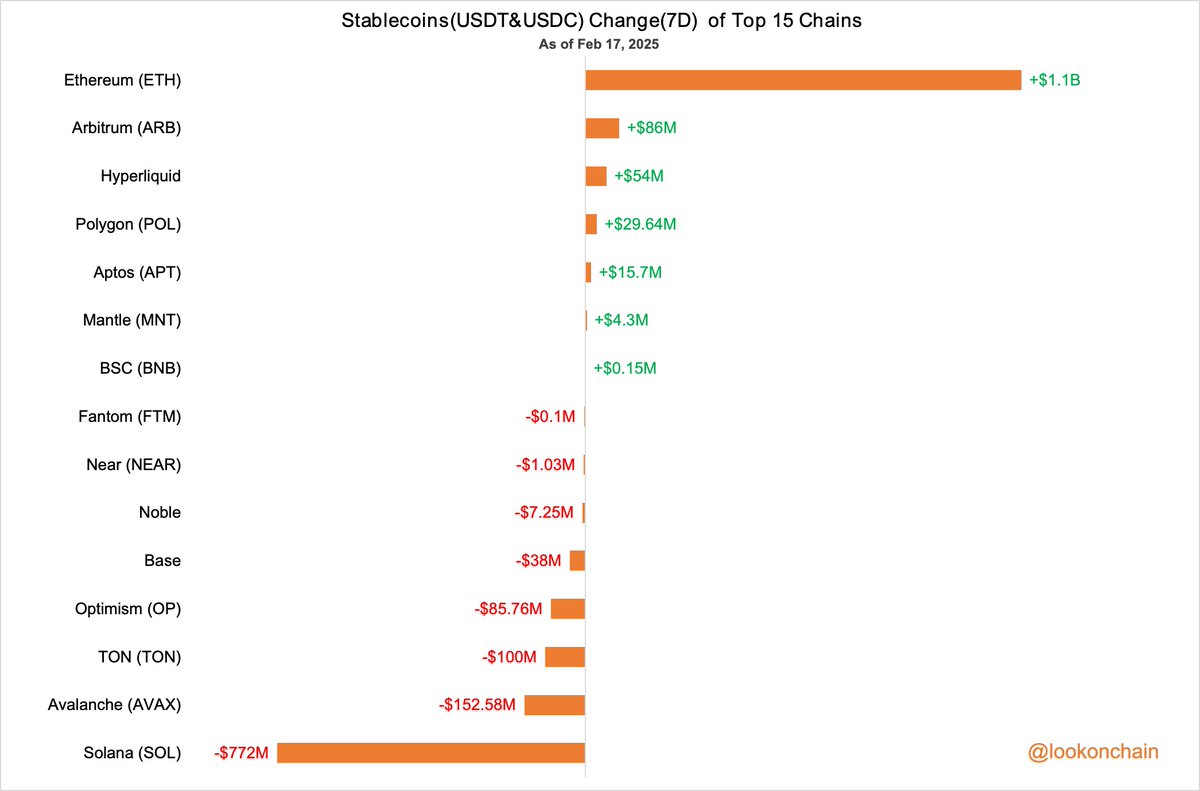

Amid controversy surrounding Solana meme coins, data from Lookonchain suggests capital is shifting toward Ethereum. In the past seven days, stablecoin holdings on Ethereum (USDC and USDT) increased by $1.1 billion, while $772 million in stablecoins exited Solana.

This comes after the launch of the LIBRA meme coin, which racked up many users and sparked concerns about the sustainability of the Solana ecosystem. With questions arising about key players like Jupiter, Pumpfun, and Meteora, investors appear to be rotating funds into Ethereum.

Stablecoins (USDC and USDT Change (7 Days) of Top 15 Chains. Source:

L

ookonchain

Stablecoins (USDC and USDT Change (7 Days) of Top 15 Chains. Source:

L

ookonchain

The data suggests that traders may be reducing exposure to Solana due to uncertainty around its meme coin scene and major protocols.

Meanwhile, Ethereum seems to be benefiting, attracting fresh liquidity that could fuel DeFi activity, trading, or new token launches. If this trend continues, Ethereum could see further inflows, while Solana may need to restore confidence to reverse the ongoing outflows.

Ethereum Network TVL Is On the Rise

This trend is also reflected in both chains’ Total Value Locked (TVL). Solana’s TVL peaked at $14.2 billion on January 18 but has been steadily declining since then.

In the last four days alone, it dropped from $10.95 billion to $10.5 billion, indicating capital outflows from Solana projects.

Solana TVL. Source:

DeFiLlama.

Solana TVL. Source:

DeFiLlama.

TVL measures the total assets locked in a blockchain’s DeFi protocols, representing liquidity and overall activity. A rising TVL suggests growing confidence and participation, while a decline indicates capital leaving the ecosystem.

Meanwhile, Ethereum TVL has been increasing, rising from $59.66 billion on February 2 to $63.7 billion by February 16.

Ethereum TVL. Source:

DeFiLlama.

Ethereum TVL. Source:

DeFiLlama.

This shift suggests that investors are favoring Ethereum over Solana, reinforcing the stablecoin data showing capital rotation.

If this trend continues, Ethereum could strengthen its position, while Solana may struggle to regain lost liquidity.

ETH Price Prediction: A Potential 22% Upside

Ethereum price chart shows its EMA lines are still bearish, with short-term EMAs below long-term ones. However, short-term lines are moving upward, and a golden cross could form soon.

If that happens, ETH could test resistance at $3,020, breaking above $3,000 for the first time since February 2. Continued momentum could push ETH up to $3,442, marking a potential 22% rise from current levels.

Additional external factors in the short term, such as the upcoming Pectra upgrade, could also support this upward trend.

ETH Price Analysis. Source:

TradingView.

ETH Price Analysis. Source:

TradingView.

On the downside, if the downtrend strengthens, Ethereum could retest support at $2,551.

Losing this level might trigger a deeper drop to $2,160. Bears need to break key support zones, while bulls must sustain momentum for a breakout above resistance.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

A decade-long tug-of-war ends: "Crypto Market Structure Bill" sprints to the Senate

At the Blockchain Association Policy Summit, U.S. Senators Gillibrand and Lummis stated that the "Crypto Market Structure Bill" is expected to have its draft released by the end of this week, with revisions and hearings scheduled for next week. The bill aims to establish clear boundaries for digital assets by adopting a classification-based regulatory framework, clearly distinguishing between digital commodities and digital securities, and providing a pathway for exemptions for mature blockchains to ensure that regulation does not stifle technological progress. The bill also requires digital commodity trading platforms to register with the CFTC and establishes a joint advisory committee to prevent regulatory gaps or overlapping oversight. Summary generated by Mars AI. The accuracy and completeness of this summary, generated by the Mars AI model, is still being iteratively updated.

Gold surpasses the $4,310 mark—Is the "bull frenzy" returning?

Boosted by expectations of further easing from the Federal Reserve, gold has risen for four consecutive days. Technical indicators show strong bullish signals, but there remains one more hurdle before reaching a new all-time high.

Trend Research: Why Are We Still Bullish on ETH?

Against the backdrop of relatively accommodative expectations in both China and the US, which suppress asset downside volatility, and with extreme fear and capital sentiment not yet fully recovered, ETH remains in a favorable "buy zone."