- Solana’s breakout above $170 could push prices toward the $175 – $180 resistance zone.

- Increasing trading volume and higher lows signal potential bullish momentum ahead.

- RSI near oversold levels suggests a possible rebound if buying pressure strengthens.

Solana’s price movement has captured the attention of traders as we approach February 20th, with the key question: will SOL rally, or is a dip coming?

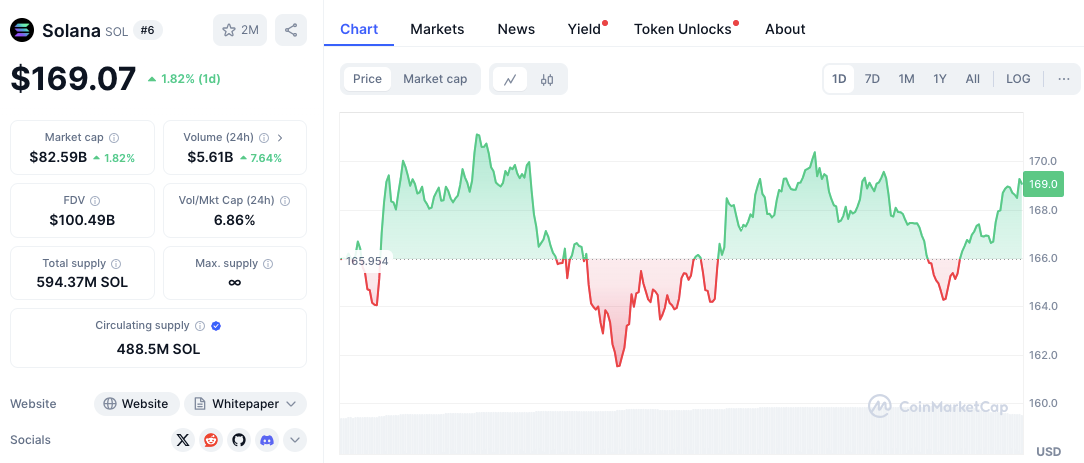

The asset is currently trading at $169.55 , reflecting a 2.15% increase in the last 24 hours. Its market capitalization is $82.82 billion, while the 24-hour trading volume surged by 8.55% to reach $5.66 billion

Solana’s Price Crossroads: Feb 20th Outlook

The price has fluctuated between $165.95 and $170, indicating active trading as traders position themselves for a potential move by February 20th.

Right now, key technical indicators and support levels suggest that Solana faces critical resistance zones, which could determine its next move in the coming days.

Immediate Solana Support Zones for February 20th

Solana has found short-term support around the $166 – $167 range, where recent price rebounds occurred. If a pullback happens leading up to February 20th, the next support lies at $163 – $164.

A further decline could test the $160 level, which holds psychological significance for traders.

Source: CoinMarketCap

Source: CoinMarketCap

On the upside, Solana is facing immediate resistance between $170 – $172. A successful breakout from this range could pave the way for further gains.

The next major resistance zone lies between $175 – $180, a region where sellers previously gained control. If bullish momentum remains strong in the lead up to Feb 20, the price could even target $185 – $190.

Related: Solana’s Crown Slipping? Cardano Heats Up as a Top Crypto Rival

Bullish Sentiment Builds for Solana Ahead of February 20th

Solana’s market sentiment leans bullish due to the increasing trading volume. The asset is also forming higher lows, signaling a possible breakout above $170. If this momentum sustains, SOL could challenge the $175 – $180 range in the near term.

However, the failure to hold above $170 as February 20th approaches may trigger a pullback, leading to a retest of support at $166 – $164. Additionally, profit-taking near the $175 – $180 resistance could slow further gains around this date.

SOL/USD daily price chart, Source: TradingView

SOL/USD daily price chart, Source: TradingView

RSI Nearing Oversold: Potential Solana Rally by February 20th?

From a technical perspective, the Relative Strength Index (RSI) is at 30.85, nearing oversold conditions. This suggests a potential rebound if buying pressure increases.

However, the Moving Average Convergence Divergence (MACD) remains bearish. The MACD line is positioned at -3.07, while the signal line lags at -8.22. This indicates that downward momentum persists without clear signs of reversal yet.

February 2025 Forecast: Context for Near-Term Feb 20th Prediction

For broader context, and beyond just February 20th, Coincodex Solana’s price forecast for February 2025 suggests a potential growth of 4.89%, pushing the average price to $178.25.

Related: Solana’s $2 Billion Token Unlock: Is Your SOL Portfolio Safe From March 1?

The anticipated trading range extends from $166.84 to $183.82, offering a possible return of 8.17% from the current price level.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.