Solana Faces Critical Breakdown: Could the Price Fall to $80?

- Solana’s price struggles after the trendline breakout, potentially heading to $80 support.

- TVL drops from $12B to $7.13B, signaling waning confidence in Solana’s ecosystem.

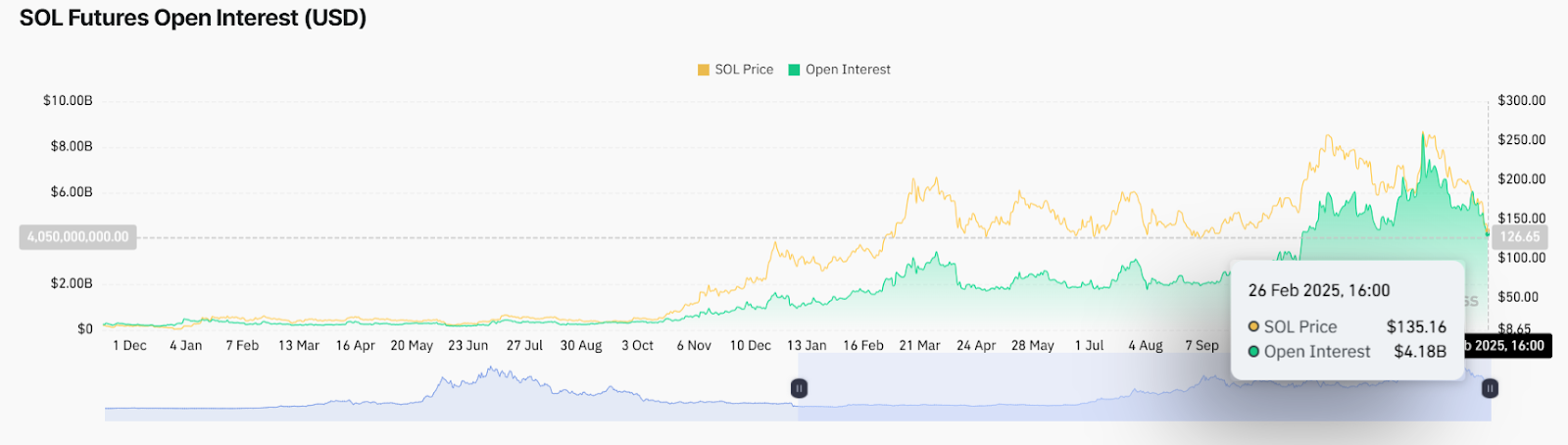

- Open interest declines, reflecting reduced speculative activity and bearish sentiment.

Solana (SOL) has been affected badly by the volatile market, impacting its price in recent months. At press time, the trading value of $135.16 SOL demonstrates only -0.06% daily price change while keeping investors intrigued about its forthcoming developments. Solana’s price analysis examines multiple variables, such as market trends, technical measurements, futures trading measures, and crypto project value metrics.

Price Action Analysis and Technical Indicators

Since its December peak, the price of Solana has shown downward movement, exceeding $250 until it settled around $135.16. The weekly chart shows a vital trendline breakout, which signals that additional price drops will occur. Solana failed to sustain the trendline retest following its decrease below this barrier, demonstrating that the market lost its ability to turn the bearish trend around. Solana shows signs of falling after the rejection of the trendline which indicates a potential price decline of $80.

Source: TradingView

The Relative Strength Index (RSI) indicates that Solana is oversold, given its current value of 28.24. When market participants start buying Solana, a price change toward bullish momentum may happen. The Moving Average Convergence Divergence (MACD) indicator shows ongoing bearish patterns because the MACD line continues to rest below the signal line. Based on the combined signals, Solana’s imminent price rise will likely be brief until an influential trigger emerges.

Open Interest Analysis and TVL and On-Chain Activity Indicators

The peak open interest value of over $6.65 billion in Solana futures contracts was registered when the price reached its current value before decreasing to $4.18 billion. Based on the decline of open interest, markets show reduced speculative behavior indicating traders are withdrawing funds or repositioning at different levels. As Solana experienced declining market prices, this bearish sentiment became evident through the reduction of open interest in its future contracts.

Source: TradingView

Solana’s Total Value Locked (TVL) experienced a significant reduction after reaching $12 billion in January now at $7.13 billion. The overall TVL decrease in Raydium combined with declining decentralized app (dApp) adoption, including Jupiter DEX and Jito liquid staking, represents the main reason for this drop. A combination of falling Solana ecosystem activity and diminishing on-chain transactions demonstrates investors losing confidence, which weakens its market value.

Market Outlook for Solana

Solana’s bearish market stance emerges through its price patterns, technical signal indicators, and declining open interest and TVL measures. After breaking through an important support level, Solana remains in a precarious situation and cannot reclaim it. However, the current price position in the “premium zone” could create market overvaluation leading to a potential price correction. All bearish movements toward $80 seem probable since the cryptocurrency lacks buying sentiment and shows negative technical signals.

The post Solana Faces Critical Breakdown: Could the Price Fall to $80? appeared first on Cryptotale.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

This Week's Preview: Macro "Flood Release" Week—Delayed CPI and the Bank of Japan's "Rate Hike Pursuit"

Key global market data will be released this week, including the U.S. non-farm payroll report, CPI inflation data, and the Bank of Japan's interest rate decision, all of which will significantly impact market liquidity. Bitcoin prices are fluctuating due to macroeconomic factors, while institutions such as Coinbase and HashKey are striving to break through via innovation and public listings. Summary generated by Mars AI This summary was generated by the Mars AI model. Its accuracy and completeness are still being iteratively improved.

Weekly Hot Picks: The Fed Cuts Rates and Indirectly "Injects Liquidity"! Silver Replaces Gold as the New Favorite?

The Federal Reserve is cutting interest rates and starting bond purchases, while Japan and other regions may turn to rate hikes. Silver repeatedly hits record highs, SpaceX is set for a 1.5 trillion IPO, and Oracle becomes the litmus test for the AI bubble. The Russia-Ukraine peace process is stuck on territorial issues, the US seizes a Venezuelan oil tanker... What exciting market events did you miss this week?

Key Highlights to Watch at Solana Breakpoint 2025

How does Solana seize market share in an increasingly competitive landscape?

Crucial Alert: ZRO Leads This Week’s $100M+ Token Unlocks – What Investors Must Know