Date: Sunday, March 09, 2025 | 07:12 PM GMT

In the cryptocurrency market today, the ongoing downtrend that started after the November rally is getting more intense as Ethereum (ETH) drops sharply to $2,000, falling from its December 6 high of $4,000.

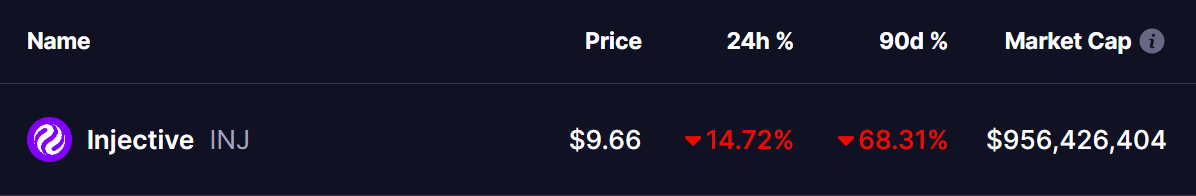

This extended correction is putting significant bearish pressure on altcoins, including Injective (INJ), which has seen a steep decline of over 15% today and extending its 90-day drop to 68%, severely impacting investor sentiment.

Source: Coinmarketcap

Source: Coinmarketcap

INJ Hits Key Support

Analyzing the weekly chart, we can see that INJ has been trading within a falling wedge pattern since March 2024. The latest downturn saw its price plummet from the upper resistance trendline at $35.50 (Dec 02, 2024) to its current level of $9.66, marking a significant correction.

Right now, INJ is testing critical support at the lower boundary of the falling wedge and a strong horizontal support zone (marked in green on the chart). Historically, falling wedge patterns are known to be bullish reversal signals, provided the support holds.

If buyers step in at this level, we could see a bounce toward the upper resistance trendline around $20, potentially confirming a reversal

The MACD indicator at the bottom of the chart is showing deep bearish momentum. However, it is nearing oversold conditions, which often precede trend reversals. A bullish crossover in MACD could further validate a recovery scenario.

Final Thoughts

INJ’s current price action suggests it is at a make-or-break moment. If the green shaded support holds, we may see a relief rally toward $20 or even higher, depending on overall market conditions. However, if INJ breaks below this level, it could trigger further downside, potentially revisiting lower price zones.

Traders should watch for increased buying volume and a MACD crossover as potential confirmation signs for a bullish move.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always conduct your own research before making investment decisions.