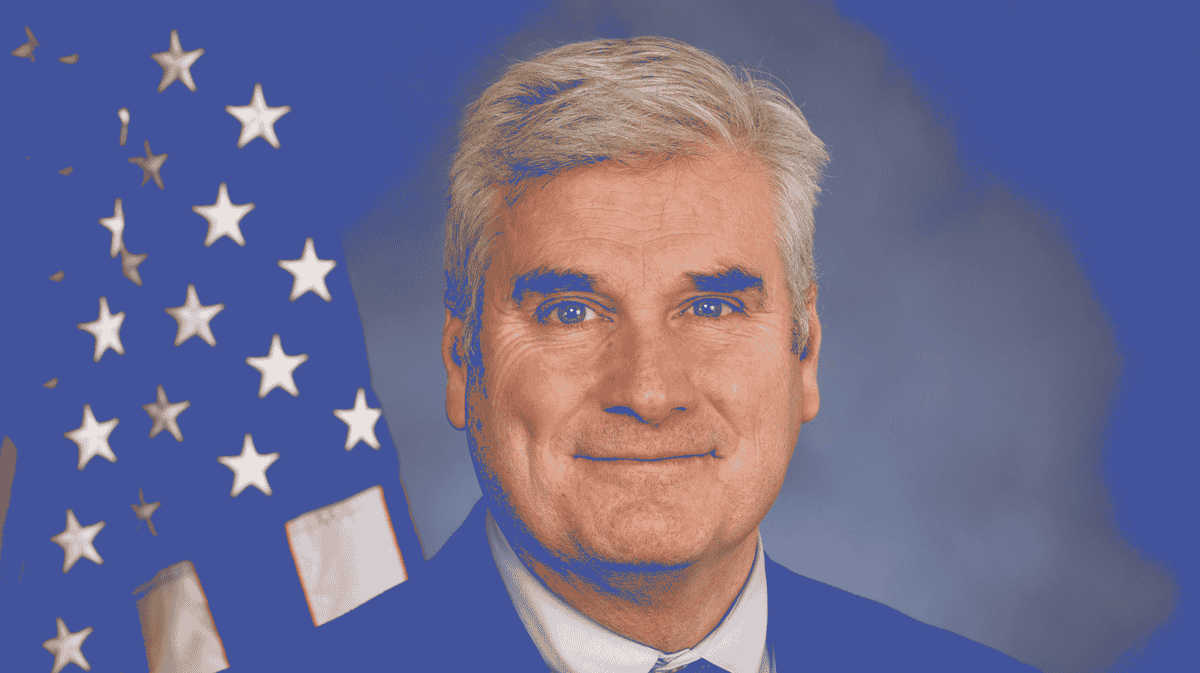

Reps. Emmer, Soto reintroduce Securities Clarity Act as Congress eyes crypto legislation

Quick Take Rep. Tom Emmer’s bill could be a “precursor” for market structure legislation that lawmakers are hoping to get passed into law. The bill, called the Securities Clarity Act, looks to differentiate between an asset and a securities contract.

House Majority Whip Tom Emmer has reintroduced a bill that could be a "precursor" to market structure legislation that lawmakers hope to pass into law.

Reps. Emmer, R-Minn., and Darren Soto, D-Fla., reintroduced the Securities Clarity Act on Wednesday. The act aims to provide clear standards for the digital asset industry.

"Entrepreneurs need clarity to calculate risk accurately, create new investment opportunities and grow our economy," Emmer said in a statement . "Our legislation will help provide these answers and allow American investors to fully participate in digital asset technology without sacrificing consumer protections.”

"Specifically, the Securities Clarity Act specifies that any asset sold as the object of an investment contract, now defined as an 'investment contract asset' is distinct from the securities offering it was originally a part of," lawmakers said.

The bill was included in the text of a large market structure bill called the Financial Innovation and Technology for the 21st Century Act, or FIT21, according to the statement. That bill passed out of the House last year with 71 Democrats voting in support of the bill, including former Speaker of the House Rep. Nancy Pelosi of California.

House Financial Services Committee Chair French Hill, R-Ark., said on Wednesday at The Digital Chamber DC Summit that a revised draft of FIT21 could be coming "in the next few weeks."

The bigger picture

Ron Hammond, senior director of government relations at the Blockchain Association, told The Block that the bill's reintroduction could serve as a "bipartisan precursor" to broader legislation. He called the Securities Clarity Act a key step toward the eventual market structure bill that Congress is expected to unveil in the coming weeks.

Hammond also noted bipartisan support in Washington following votes to repeal a controversial tax rule that garnered some Democratic support, including from Senate Minority Leader Chuck Schumer.

"Fair to say this continued momentum will be evident in the eventual crypto votes in Congress,” Hammond said.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

When "decentralization" is abused, Gavin Wood redefines the meaning of Web3 as Agency!

A decade-long tug-of-war ends: "Crypto Market Structure Bill" sprints to the Senate

At the Blockchain Association Policy Summit, U.S. Senators Gillibrand and Lummis stated that the "Crypto Market Structure Bill" is expected to have its draft released by the end of this week, with revisions and hearings scheduled for next week. The bill aims to establish clear boundaries for digital assets by adopting a classification-based regulatory framework, clearly distinguishing between digital commodities and digital securities, and providing a pathway for exemptions for mature blockchains to ensure that regulation does not stifle technological progress. The bill also requires digital commodity trading platforms to register with the CFTC and establishes a joint advisory committee to prevent regulatory gaps or overlapping oversight. Summary generated by Mars AI. The accuracy and completeness of this summary, generated by the Mars AI model, is still being iteratively updated.

Gold surpasses the $4,310 mark—Is the "bull frenzy" returning?

Boosted by expectations of further easing from the Federal Reserve, gold has risen for four consecutive days. Technical indicators show strong bullish signals, but there remains one more hurdle before reaching a new all-time high.