Standard Chartered: Concerns over Fed Independence May Push Bitcoin to Record Highs

Jinse reports that Standard Chartered analyst Jeff Kendrick stated that if concerns over the independence of the Federal Reserve persist, Bitcoin could rise to a record high. He noted that due to its decentralized ledger, cryptocurrency serves as a hedge against risks in the existing financial system. This was evidenced by U.S. Treasury risks following Trump's suggestion that he might dismiss Fed Chair Powell as he wanted rate cuts. Kendrick said that the yield premium investors receive for buying long-term Treasuries over short-term ones has risen sharply, benefiting Bitcoin. According to LSEG data, Bitcoin rose to a six-week high of $90,459. Standard Chartered projects that by the end of 2025, the price of Bitcoin will reach $200,000.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Japanese bond yields rise as market focuses on this week's economic data

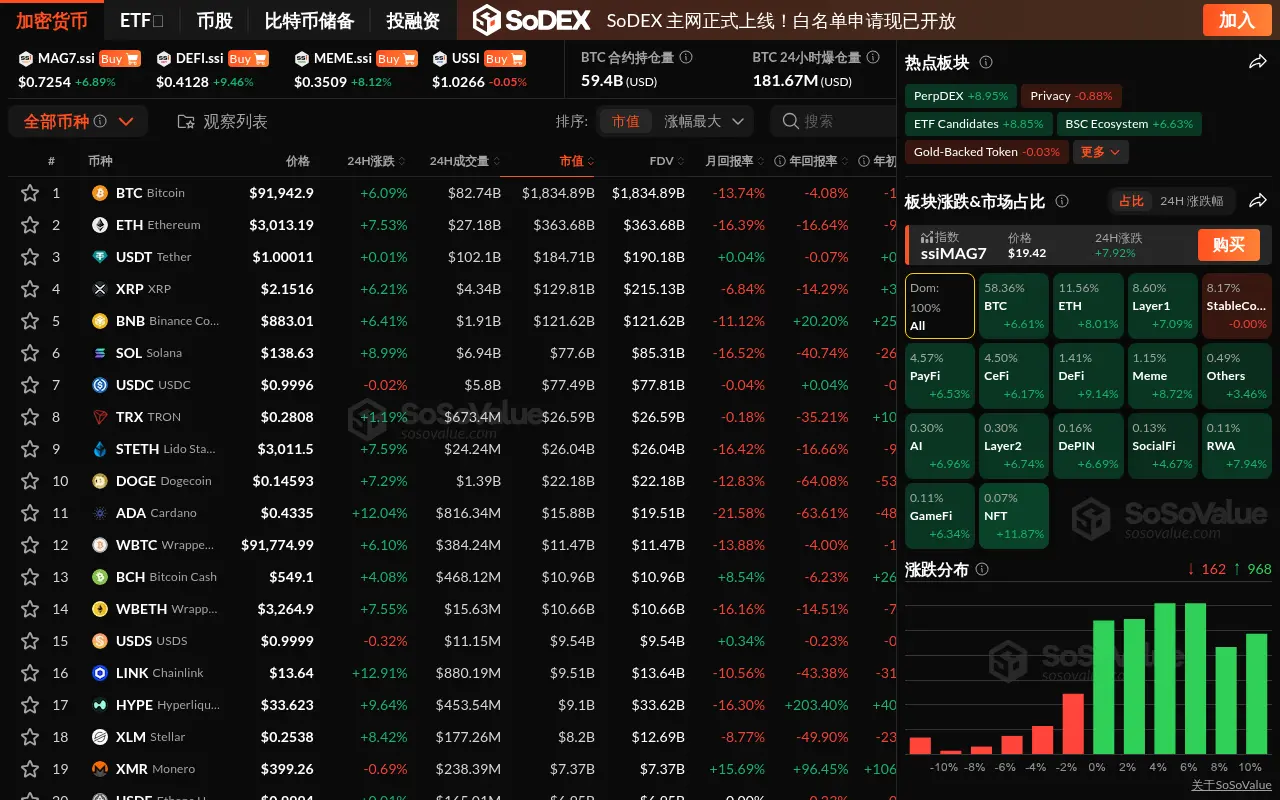

Data: The crypto market rebounds across the board, NFT sector leads with nearly 12% gain, BTC surpasses $91,000

Kalshi co-founder Lopes Lara becomes the world’s youngest self-made female billionaire

Renowned analyst: Whether Ethereum can break through $3,700 will determine if the bull market is over