SPX6900 (SPX) Leads Market Gains with 10% Surge as Golden Cross Nears

SPX is poised for a big move as it nears a golden cross and continues to rise, backed by increasing buying pressure. Traders are closely watching for further gains.

Meme coin SPX is today’s top gainer, surging nearly 10% over the past 24 hours and outperforming the broader market.

While most major assets have remained consolidated over the past week, the meme coin has continued to post fresh daily gains, capturing traders’ attention.

Capital Flows Into SPX as Meme Coin Readies for Golden Cross

The SPX token is on the verge of forming a golden cross, with its 50-day simple moving average (SMA) poised to break above the 200-day SMA.

SPX Golden Cross. Source:

TradingView

SPX Golden Cross. Source:

TradingView

An asset’s 50-day SMA measures its average closing price over the past 50 days, smoothing short-term price fluctuations. When an asset’s price crosses above it, its value grows.

On the other hand, the 200-day SMA measures the average price of an asset over the last 200 days. It is a long-term trend indicator, and when the price rallies above, it indicates a long-term uptrend.

A golden cross emerges when the 50-day SMA crosses the 200-day SMA. This crossover is a bullish sign confirming a shift from a downtrend to an uptrend. It suggests that the asset’s price will rise, and traders often interpret it as a signal to go long.

If buying pressure persists and the SPX succeeds in forming the golden cross, it could be a catalyst that pushes it to multi-month highs.

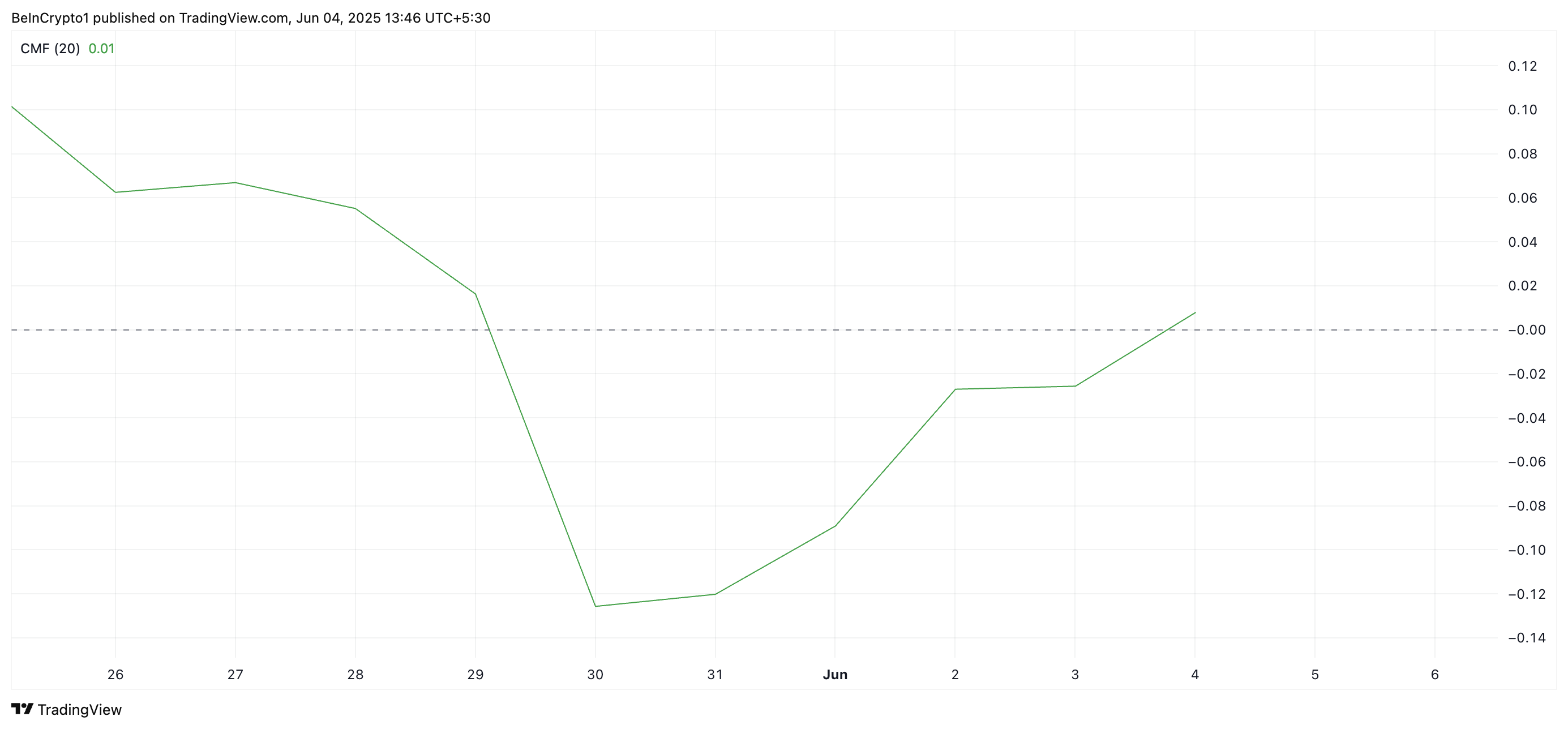

Moreover, the Chaikin Money Flow (CMF) indicator suggests that SPX’s double-digit price surge is backed by buying pressure. As of this writing, the CMF stands at 0.01, having just crossed above the neutral zero line, a sign that accumulation now significantly outweighs selling activity.

SPX CMF. Source:

TradingView

SPX CMF. Source:

TradingView

This indicates capital inflow in SPZ and reinforces the support behind its price rally.

SPX Maintains Bullish Momentum

An assessment of the SPX/USD one-day chart shows that the altcoin trades significantly above its 20-day exponential moving average (EMA). Currently at $0.70, this key moving average forms a dynamic support level below SPX’s price, preventing it from any significant price dips.

The 20-day EMA measures an asset’s average price over the past 20 trading days, giving weight to recent prices. When an asset trades above it, it indicates short-term bullish momentum and suggests the price is trending upward.

If this continues, SPX could break above the $1.19 resistance and climb toward $1.27.

SPX Price Analysis. Source:

TradingView

SPX Price Analysis. Source:

TradingView

However, if demand stalls and selloffs resume, the SPX token could shed recent gains and fall to $1.06.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Mars Morning News | Ethereum Fusaka upgrade officially activated; ETH surpasses $3,200

The Ethereum Fusaka upgrade has been activated, enhancing L2 transaction capabilities and reducing fees; BlackRock predicts accelerated institutional adoption of cryptocurrencies; cryptocurrency ETF inflows have reached a 7-week high; Trump nominates crypto-friendly regulatory officials; Malaysia cracks down on illegal Bitcoin mining. Summary generated by Mars AI. The accuracy and completeness of this summary are still undergoing iterative updates.

Do you think stop-losses can save you? Taleb exposes the biggest misconception: all risks are packed into a single blow-up point.

Nassim Nicholas Taleb's latest paper, "Trading With a Stop," challenges traditional views on stop-loss orders, arguing that stop-losses do not reduce risk but instead compress and concentrate risk into fragile breaking points, altering market behavior patterns. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively improved by the Mars AI model.

With capital outflows from crypto ETFs, can issuers like BlackRock still make good profits?

BlackRock's crypto ETF fee revenue has dropped by 38%, and its ETF business is struggling to escape the cyclical curse of the market.

Incubator MEETLabs today launched the large-scale 3D fishing blockchain game "DeFishing". As the first blockchain game on the GamingFi platform, it implements a dual-token P2E system with the IDOL token and the platform token GFT.

MEETLabs is an innovative lab focused on blockchain technology and the cryptocurrency sector, and also serves as the incubator for MEET48.