Market Prophet Tom Lee Explains Why He Chose Ethereum Over Bitcoin

Tom Lee, managing partner and head of research at Fundstrat Global Advisors, shared his views on the differences between the new generation of individual investors and institutional investors on Amit Kukreja's podcast.

The experienced strategist clearly stated that the real reason behind his preference for Ethereum was the growth in the stablecoin sector.

Tom Lee, a long-time chief strategist at JPMorgan Chase, is known among US investors for his accurate predictions of market trends and frequent appearances on major media platforms like CNBC. However, he has also been the target of criticism for his consistently optimistic approach to the market.

In the podcast, Lee also touched on the characteristics of the era in which today's individual investors find themselves, attributing the change in this period to two main factors: the visibility provided to startups by independent media channels that came with the rise of social media, especially Twitter, and the resurgence of investor optimism about stocks that occurs every 20 years in the US.

Lee, known for his strong support for cryptocurrencies, was recently appointed chairman of Bitmine and played an active role in the company's $250 million Ethereum treasury strategy. This move resonated heavily in the crypto market.

While he praised Ethereum for its technical aspects, Lee explained the main reason:

“I love Ethereum because it's a programmable smart contract blockchain. But honestly, the real reason I chose Ethereum is the explosion of stablecoins. Circle, for example, had one of the best IPOs of the last five years. It's driven some funds to perform incredibly well, with a price-to-earnings ratio of 100x EBITDA. And this is a stablecoin company. Stablecoins are like the ChatGPT of the crypto world. They've entered the mainstream. This is evidence of Wall Street's efforts to 'stake' tokens. The crypto community, conversely, is tokenizing stocks, like the tokenization of the US dollar.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

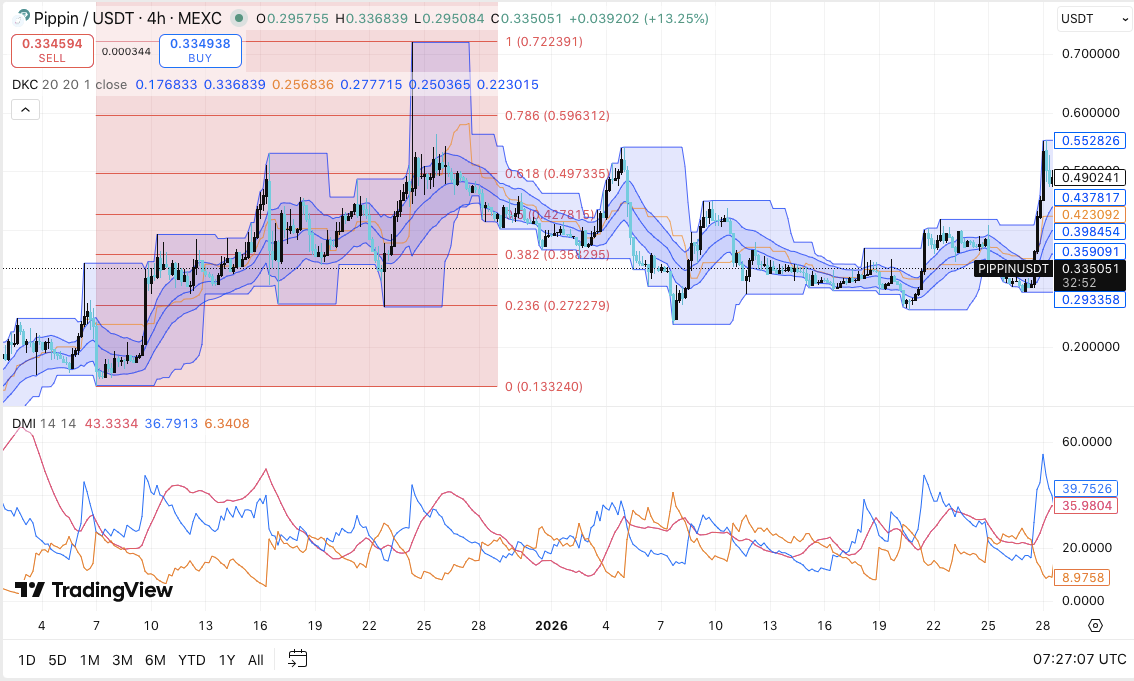

pippin Price Prediction: Whale Inflows Lift PIPPIN as Short-Term Trend Turns Higher

Cisco unveils new AI networking chip, taking on Broadcom and Nvidia