HBAR Whales Quietly Buy the Dip While Retail Turns Bearish; Rally Ahead?

HBAR is down from its recent highs, but under the surface, whale wallets are growing and exchange outflows are rising. Coupled with strong OBV momentum, the data hints at a possible reversal — if key support holds.

Despite a sharp 10% correction from its five-month high, Hedera (HBAR) price is starting to show signs of internal strength that could set the stage for a surprise bounce.

While retail traders continue to short the asset, data reveals whales have been quietly adding to their stacks, hinting that the recent dip might be more of a shakeout than a breakdown.

Whales Accumulate, Netflows Validate

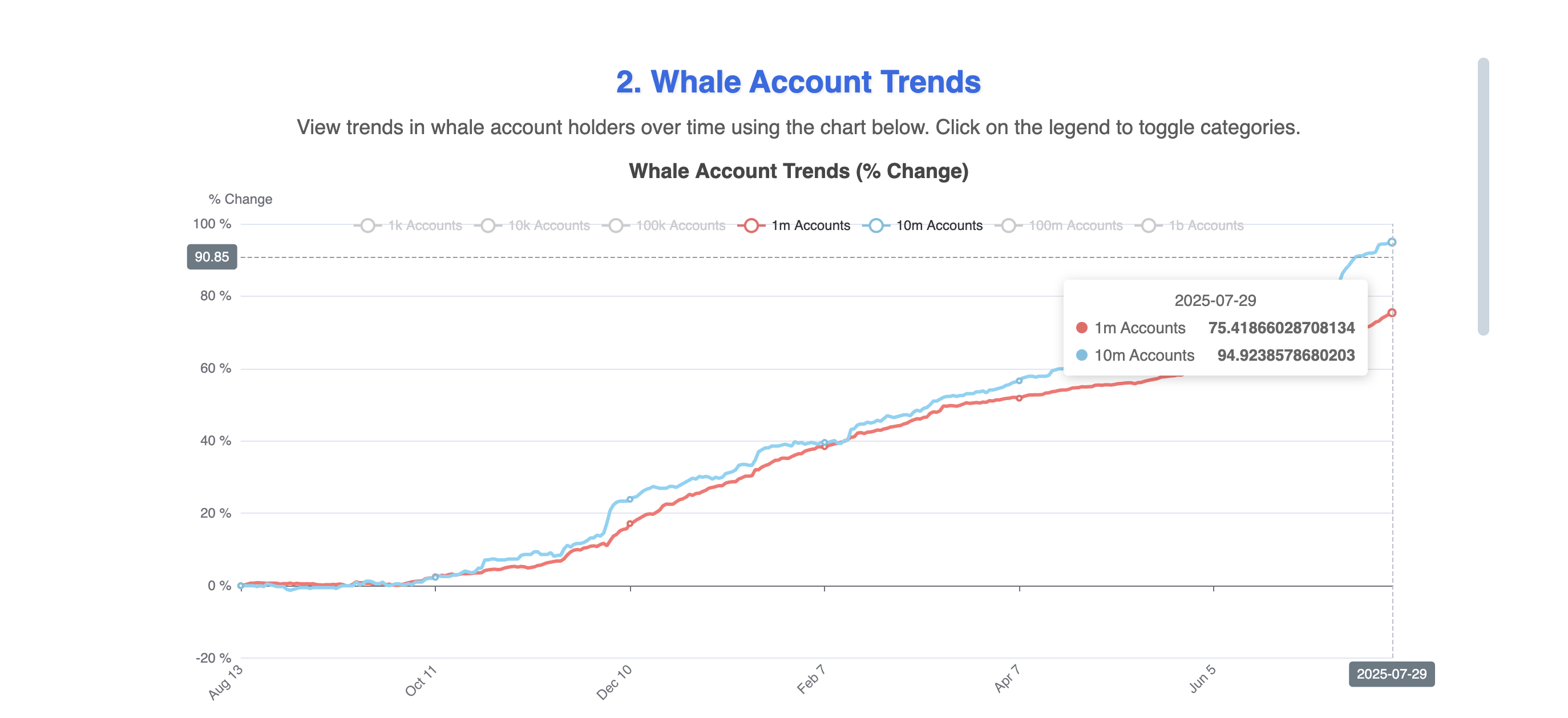

HBAR price may be down from its $0.30 high, but big players are seeing it as a buy-the-dip opportunity. Since July 20, the number of wallets holding at least 1 million HBAR has jumped almost 5%, and those with 10 million or more are up almost 4.5%. That kind of activity from whales usually signals quiet accumulation, not panic.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

HBAR whales accumulating:

HBAR whales accumulating:

HBAR whales accumulating:

HBAR whales accumulating:

What confirms this move? Spot exchange netflow.

The spot netflow chart suggests that in July, exchanges have predominantly seen HBAR outflows, hinting at growing accumulation.

HBAR price and netflows:

HBAR price and netflows:

HBAR price and netflows:

HBAR price and netflows:

This metric tracks how much HBAR is entering or exiting exchanges. A strong outflow trend means holders are withdrawing tokens, less likely to be sold. In simple terms, whales are buying and moving coins off-exchange, which often sets up bullish conditions.

OBV Momentum Aligns With Whale Buying

The On-Balance Volume (OBV) chart adds another layer of validation. OBV measures the cumulative volume flow, essentially tracking whether volume is coming from buyers or sellers. A rising OBV during a price climb shows real buying support.

HBAR price and rising OBV:

HBAR price and rising OBV:

HBAR price and rising OBV:

HBAR price and rising OBV:

For HBAR, OBV has been trending higher since early July, and even after the recent dip, it hasn’t cracked. That’s key. The whale buying and netflow behavior wouldn’t mean much if volume wasn’t backing it.

But OBV confirms it: the demand behind the scenes is still very much alive. This strengthens the accumulation narrative and hints that the dip may be running out of steam.

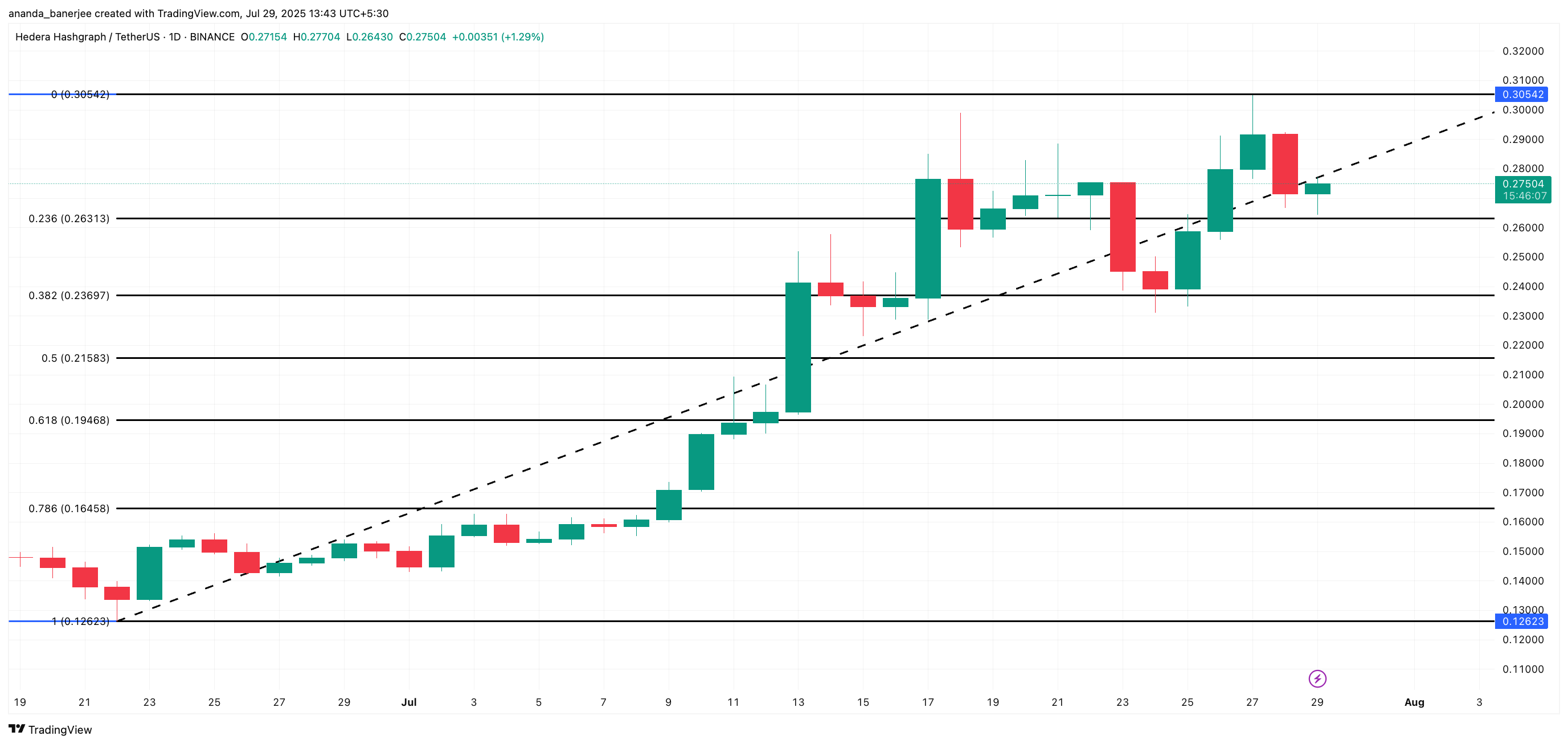

HBAR Price Holds Key Support, But Needs a Trigger

HBAR is currently holding just above the 0.236 Fibonacci retracement at $0.26, a level it must protect. Above this, a breakout beyond $0.30 is possible if momentum returns, led by increased whale positioning and outflows. However, $0.26 remains the key support, and a dip under that renders the bullish hypothesis weak.

HBAR price analysis:

HBAR price analysis:

HBAR price analysis:

HBAR price analysis:

While the above chart captures the broader swing, from $0.12 to $0.30, a bird’s eye view of the chart also reveals a few key levels that HBAR might need to break in order to inch towards the 5-month high.

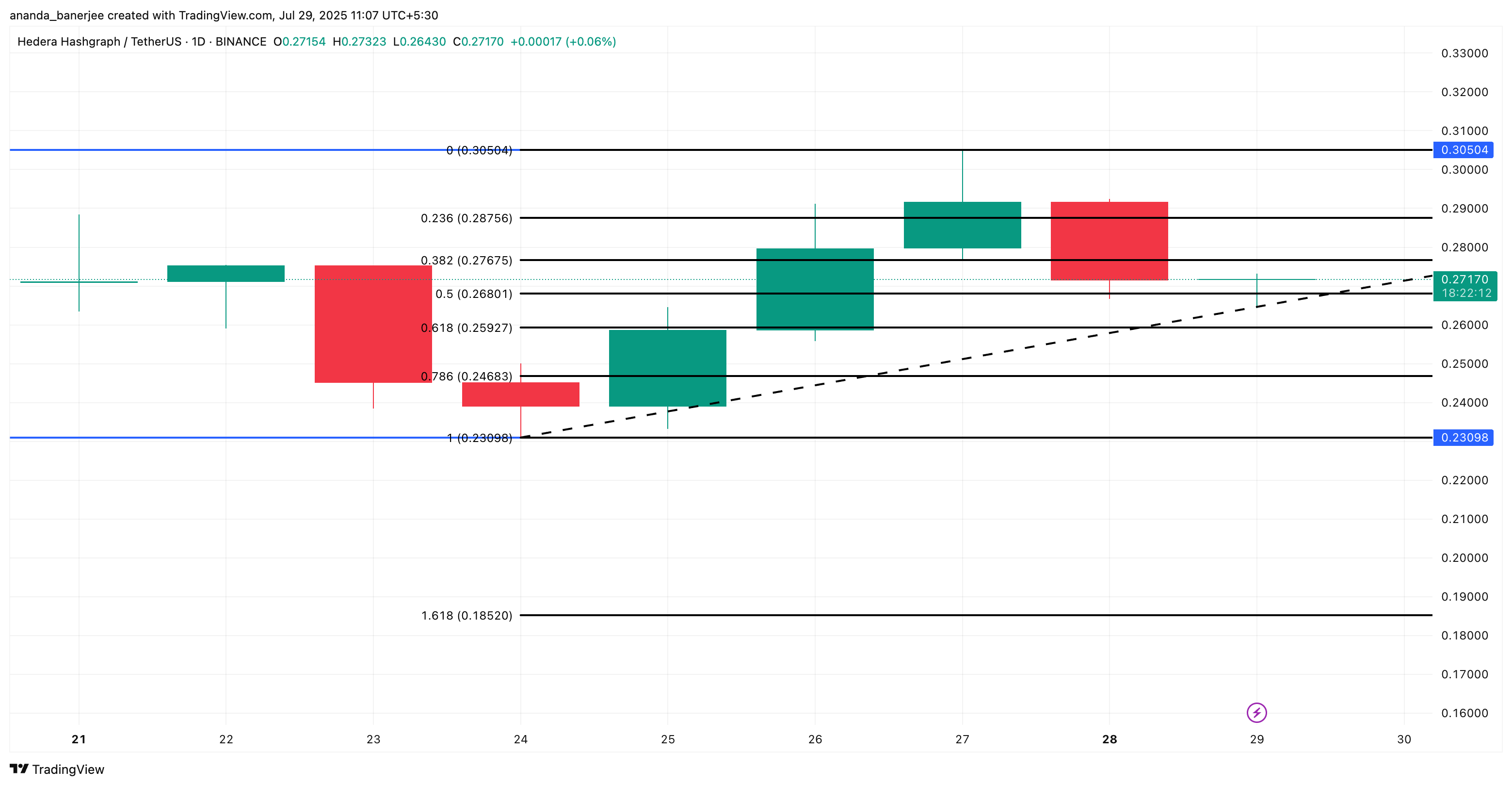

HBAR price action and a shorter swing:

HBAR price action and a shorter swing:

HBAR price action and a shorter swing:

HBAR price action and a shorter swing:

Per the shorter swing chart, $0.28 remains a key level for HBAR to break. And the $0.26 level serves as the key support, aligning with the bigger swing or the primary chart.

All signs point to strength beneath the surface; whales are buying, supply is draining, and OBV hasn’t broken down. Yet, price hasn’t popped. That suggests the market’s waiting on a trigger, possibly a shift in retail sentiment.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Castle Island Ventures partner: I don’t regret spending eight years in the cryptocurrency industry

A cryptocurrency practitioner who once held libertarian ideals became disillusioned after reflecting on a career spent building "financial casinos," sparking a profound reflection on the divergence between the original aspirations and the current reality of the crypto space.

Powell: Employment is weakening, inflation remains high, and no one is talking about rate hikes now

Powell pointed out that the U.S. labor market is cooling, with hiring and layoffs slowing down and the unemployment rate rising to 4.4%. Core PCE inflation remains above the 2% target, but service inflation is slowing. The Federal Reserve has cut interest rates by 25 basis points and started purchasing short-term Treasury bonds, emphasizing that the policy path needs to balance risks between employment and inflation. Future policies will be adjusted based on data. Summary generated by Mars AI. This summary is produced by the Mars AI model, and the accuracy and completeness of its generated content are still in the process of iterative improvement.

$RAVE TGE Countdown: When Clubbing Becomes an On-Chain Economic Activity, the True Web3 Breakthrough Moment Arrives

RaveDAO is rapidly growing into an open cultural ecosystem driven by entertainment, becoming a key infrastructure for Web3 to achieve real-world adoption and mainstream breakthrough.

A "hawkish rate cut" that's not so "hawkish," and balance sheet expansion that's "not QE"

The Federal Reserve has cut interest rates by another 25 basis points as expected, still projecting one rate cut next year, and has launched an RMP to purchase $40 billion in short-term bonds.