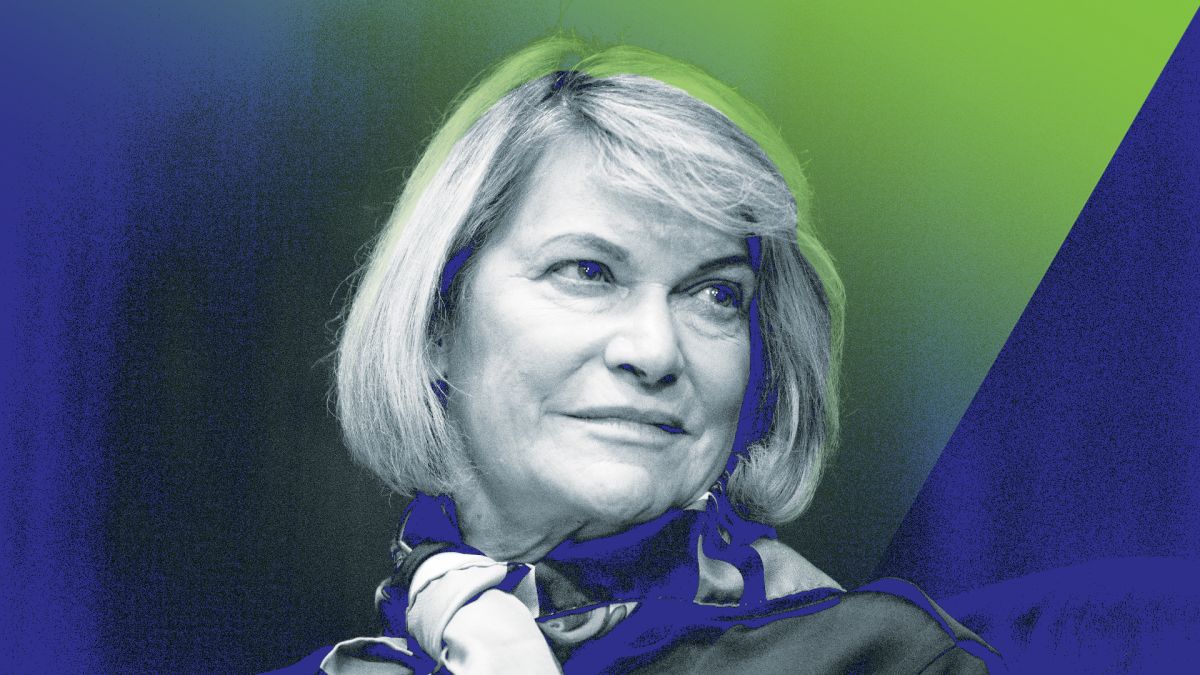

Sen. Lummis introduces bill requiring Fannie Mae and Freddie Mac to consider crypto as an asset for mortgages

Quick Take The Wyoming Senator said her legislation, the 21st Century Mortgage Act, would help people build wealth, in a statement on Tuesday. The crypto-friendly lawmaker pointed to younger Americans struggling to buy homes and their use of cryptocurrency.

Republican Sen. Cynthia Lummis introduced a bill that would put into law an order from a U.S. housing agency directing Fannie Mae and Freddie Mac to evaluate cryptocurrency as an asset for mortgages.

The Wyoming Senator said her legislation, the 21st Century Mortgage Act, would help people build wealth, in a statement on Tuesday.

"This legislation embraces an innovative path to wealth-building keeping in mind the growing number of young Americans who possess digital assets," Lummis said. "We’re living in a digital age, and rather than punishing innovation, government agencies must evolve to meet the needs of a modern, forward-thinking generation.”

Last month, U.S. Federal Housing Finance Agency Director William Pulte ordered both Fannie Mae and Freddie Mac to "prepare a proposal for consideration of cryptocurrency as an asset for reserves in their respective single-family mortgage loan risk assessments." Fannie Mae and Freddie Mac were created by Congress and are tasked with providing liquidity and stability to the mortgage market in part by buying mortgages from lenders.

Lummis said her bill would require Fannie Mae and Freddie Mac to include crypto "recorded on a cryptographically-secured distributed ledger" for assessing mortgage risk for single-family home loans. The legislation also prohibits the forced conversion of cryptocurrency holdings into U.S. dollars.

However, the proposal has sparked pushback from Democratic lawmakers concerned about the volatility of digital assets. In a letter to Director Pulte last week, Sen. Elizabeth Warren, other Democrats and Independent Sen. Bernie Sanders warned that incorporating cryptocurrencies into mortgage underwriting could be risky for the broader financial system.

"Expanding underwriting criteria to include the consideration of unconverted cryptocurrency assets could pose risks to the stability of the housing market and the financial system," they said.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Castle Island Ventures partner: I don’t regret spending eight years in the cryptocurrency industry

A cryptocurrency practitioner who once held libertarian ideals became disillusioned after reflecting on a career spent building "financial casinos," sparking a profound reflection on the divergence between the original aspirations and the current reality of the crypto space.

Powell: Employment is weakening, inflation remains high, and no one is talking about rate hikes now

Powell pointed out that the U.S. labor market is cooling, with hiring and layoffs slowing down and the unemployment rate rising to 4.4%. Core PCE inflation remains above the 2% target, but service inflation is slowing. The Federal Reserve has cut interest rates by 25 basis points and started purchasing short-term Treasury bonds, emphasizing that the policy path needs to balance risks between employment and inflation. Future policies will be adjusted based on data. Summary generated by Mars AI. This summary is produced by the Mars AI model, and the accuracy and completeness of its generated content are still in the process of iterative improvement.

$RAVE TGE Countdown: When Clubbing Becomes an On-Chain Economic Activity, the True Web3 Breakthrough Moment Arrives

RaveDAO is rapidly growing into an open cultural ecosystem driven by entertainment, becoming a key infrastructure for Web3 to achieve real-world adoption and mainstream breakthrough.

A "hawkish rate cut" that's not so "hawkish," and balance sheet expansion that's "not QE"

The Federal Reserve has cut interest rates by another 25 basis points as expected, still projecting one rate cut next year, and has launched an RMP to purchase $40 billion in short-term bonds.