Pi Coin Faces Volatility Explosion; Price is Now 5% From New All-Time Low

Pi Coin is at risk of falling to a new all-time low, driven by bearish indicators and growing volatility. A shift in market sentiment or increased buying pressure is needed for a potential reversal.

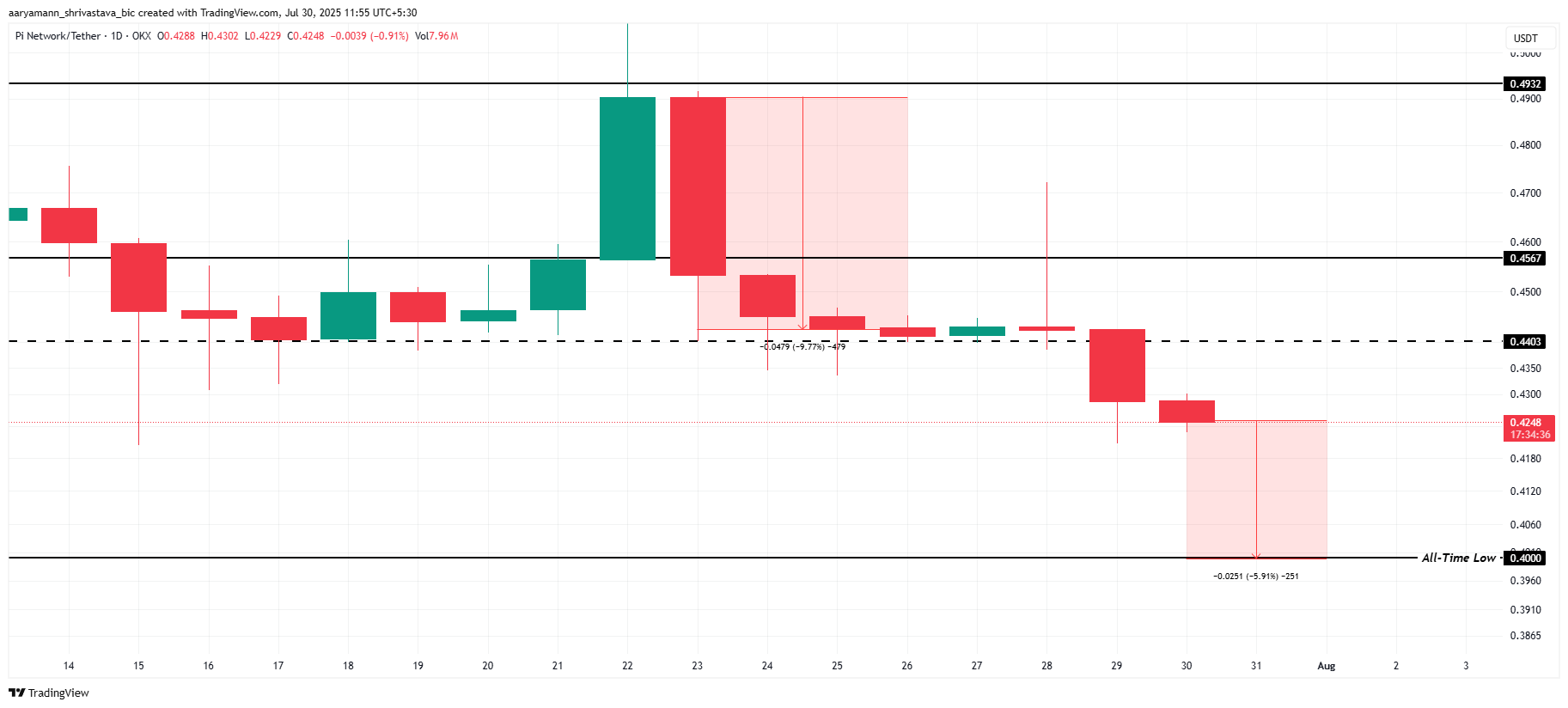

Pi Coin has been facing a steady decline over the last few days, with the altcoin now trading at $0.42. The downward trend has raised concerns among investors, as it inches closer to its all-time low (ATL) of $0.400.

Current market indicators suggest further bearish pressure, raising fears that Pi Coin could drop below this critical support level.

Pi Coin Faces Unwanted Conditions

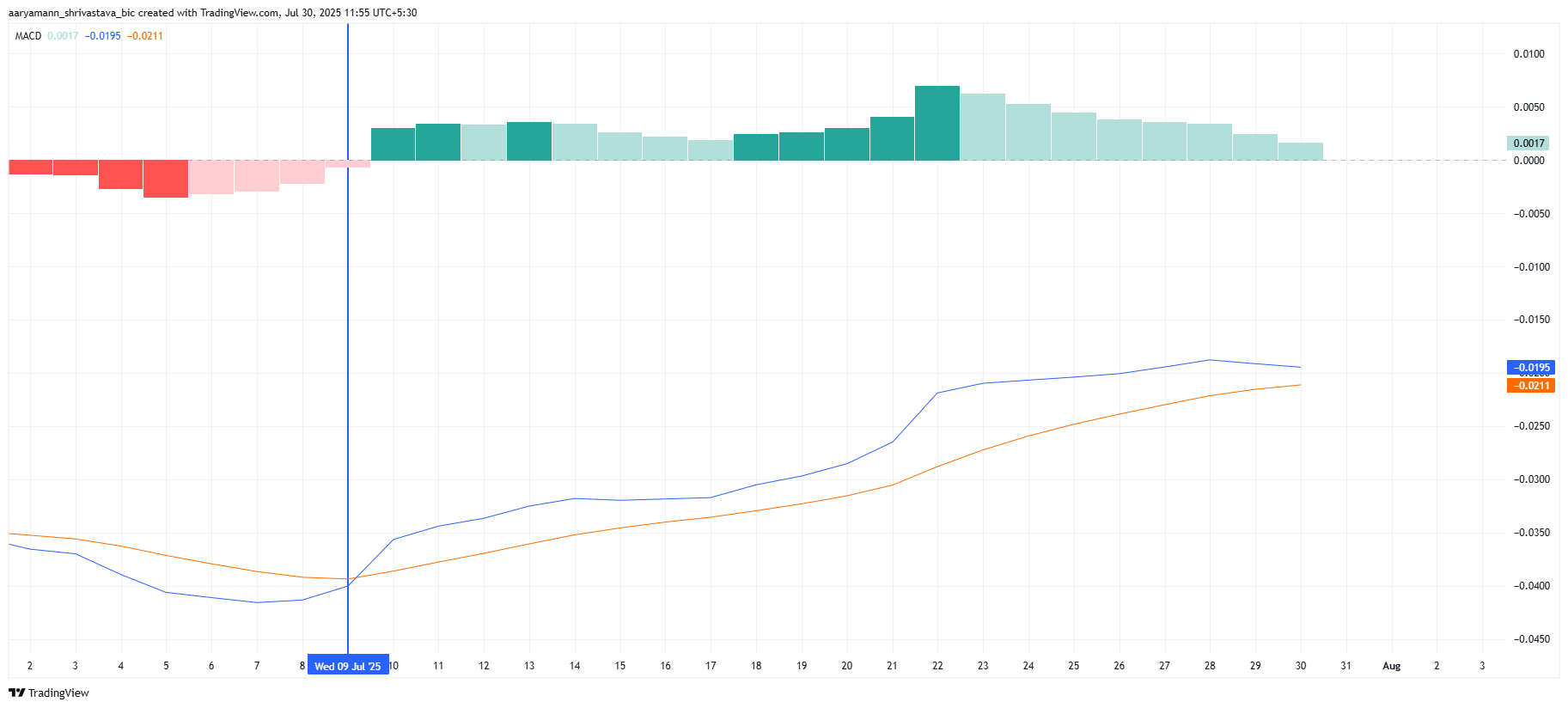

The Moving Average Convergence Divergence (MACD) indicator is signaling potential bearish momentum. The MACD line is nearing a crossover with the signal line, which would confirm the shift from a near-month-long bullish phase.

If this crossover happens, it could push Pi Coin’s price even lower, indicating the altcoin might not sustain its recent price levels. Such a shift would mark the end of the current bullish momentum, further exacerbating fears of a deeper price decline.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter.

Pi Coin MACD. Source:

Pi Coin MACD. Source:

Pi Coin MACD. Source:

Pi Coin MACD. Source:

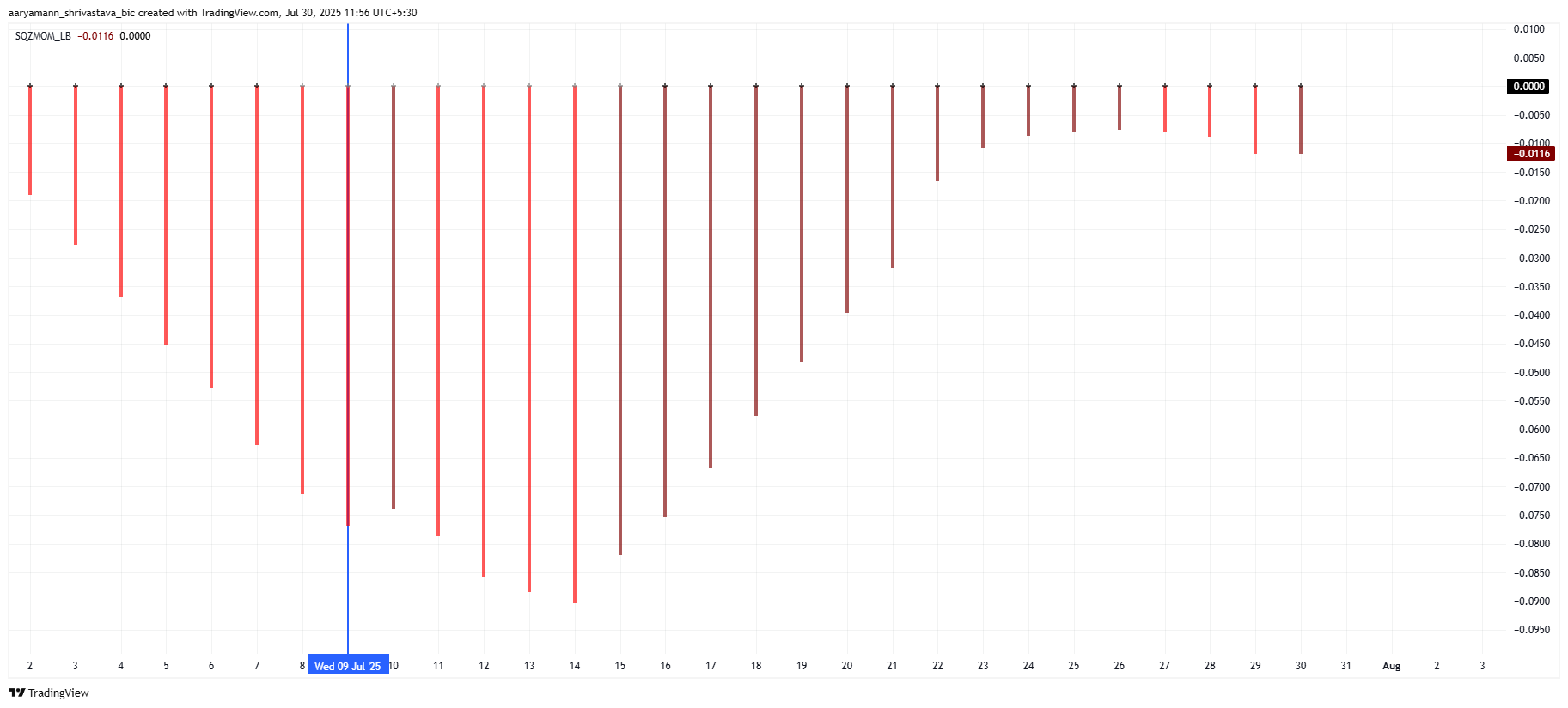

In addition to the MACD, the Squeeze Momentum Indicator also shows signs of increasing volatility. The appearance of black dots on the chart signifies the formation of a squeeze, a pattern that precedes large price movements.

If this squeeze eventually releases, it could trigger a massive shift in Pi Coin’s price. Given the current bearish market conditions, a volatility explosion during this period could result in a significant drop, possibly pushing Pi Coin’s price to new lows.

Pi Coin Squeeze Momentum Indicator. Source:

Pi Coin Squeeze Momentum Indicator. Source:

Pi Coin Squeeze Momentum Indicator. Source:

Pi Coin Squeeze Momentum Indicator. Source:

PI Price Nears ATL

Pi Coin’s price is currently at $0.424, having recently lost the key support of $0.440. The altcoin is now positioned just 6% away from its all-time low of $0.400. With the market showing limited bullish signs, the likelihood of a drop to the ATL is high.

As market conditions continue to lack strong bullish signals, the probability of further declines for Pi Coin is increasing. Without any substantial shift in sentiment or a reversal in the indicators, the altcoin investors could see more losses.

Pi Coin Price Analysis. Source:

Pi Coin Price Analysis. Source:

Pi Coin Price Analysis. Source:

Pi Coin Price Analysis. Source:

However, investors still have a chance to reverse this trend. If demand picks up and buying pressure intensifies, Pi Coin could recover, potentially pushing back above $0.440. If this happens, the bearish outlook would be invalidated, and the altcoin could resume a more stable price trajectory.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

This Week's Preview: Macro "Flood Release" Week—Delayed CPI and the Bank of Japan's "Rate Hike Pursuit"

Key global market data will be released this week, including the U.S. non-farm payroll report, CPI inflation data, and the Bank of Japan's interest rate decision, all of which will significantly impact market liquidity. Bitcoin prices are fluctuating due to macroeconomic factors, while institutions such as Coinbase and HashKey are striving to break through via innovation and public listings. Summary generated by Mars AI This summary was generated by the Mars AI model. Its accuracy and completeness are still being iteratively improved.

Weekly Hot Picks: The Fed Cuts Rates and Indirectly "Injects Liquidity"! Silver Replaces Gold as the New Favorite?

The Federal Reserve is cutting interest rates and starting bond purchases, while Japan and other regions may turn to rate hikes. Silver repeatedly hits record highs, SpaceX is set for a 1.5 trillion IPO, and Oracle becomes the litmus test for the AI bubble. The Russia-Ukraine peace process is stuck on territorial issues, the US seizes a Venezuelan oil tanker... What exciting market events did you miss this week?

Key Highlights to Watch at Solana Breakpoint 2025

How does Solana seize market share in an increasingly competitive landscape?