Two Reasons Why Ethereum’s Rally Is on Hold This August

Ethereum's recent price stagnation is driven by diminishing leverage and whale activity, suggesting a prolonged period of consolidation or a possible price drop.

Over the past two weeks, the broader crypto market has shown lackluster performance, keeping Ethereum within a tight trading range.

Since July 21, the altcoin has repeatedly tested resistance near $3,859 while finding support at $3,524, struggling to break clear of this zone. With momentum fading, key on-chain metrics now suggest that ETH may face an extended period of sideways consolidation or a potential price breakdown.

Ethereum’s Big Players Step Back

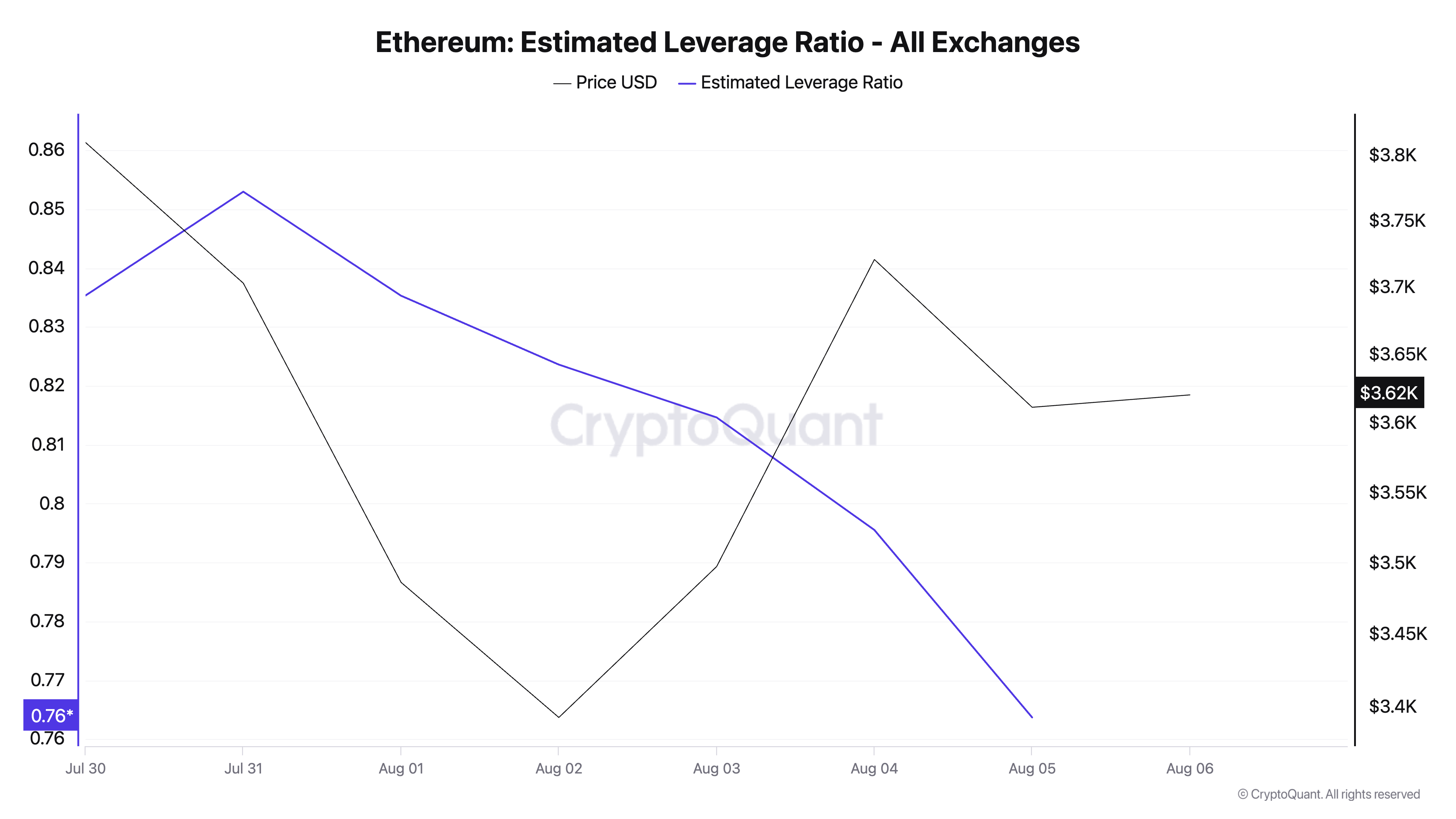

According to CryptoQuant’s data, ETH’s falling estimated leverage ratio (ELR) across all cryptocurrency exchanges reflects waning investor confidence and a declining appetite for risk among its futures traders. Per the data provider, ETH’s ELR now sits at a weekly low of 0.76.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

Ethereum ELR. Source:

CryptoQuant

Ethereum ELR. Source:

CryptoQuant

The ELR metric measures the average amount of leverage traders use to execute trades on an asset on a cryptocurrency exchange. It is calculated by dividing the asset’s open interest by the exchange’s reserve for that currency.

ETH’s declining ELR signals a market environment where traders avoid high-leverage bets. Its investors are growing cautious about the coin’s short-term prospects and are not taking high-leverage positions that could amplify potential losses.

If this pullback in speculative activity continues, it will reduce the likelihood of a near-term breakout and increase the chances of ETH remaining range-bound.

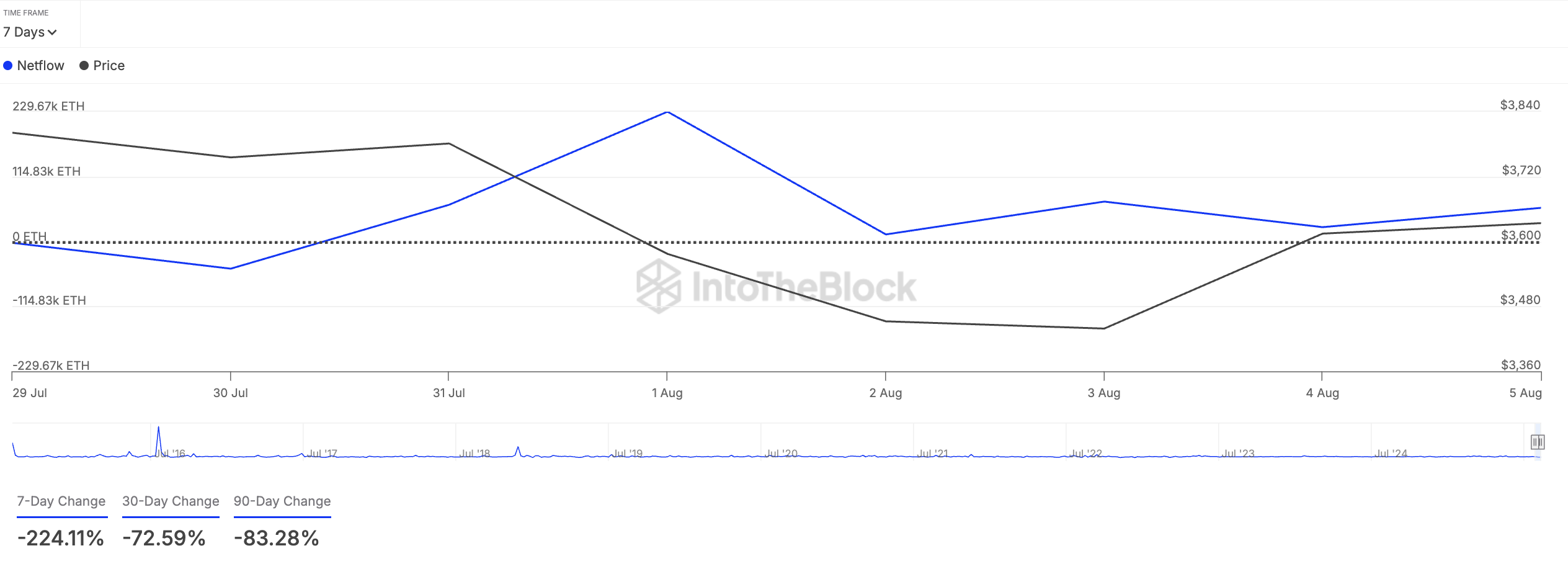

Furthermore, ETH whales have also reduced their accumulation over the past week, possibly to lock in profit. According to IntoTheBlock’s data, the coin’s large holders’ netflow is down 224% in the last seven days, showing the retreat from ETH’s key holders.

ETH Large Holders’ Netflow. Source:

IntoTheBlock

ETH Large Holders’ Netflow. Source:

IntoTheBlock

Large holders are whale addresses controlling over 0.1% of an asset’s circulating supply. Their netflow tracks the difference between the coins they buy and the amount they sell over a specific period.

When an asset’s large holders’ netflow increases, whales are buying more of its coins/tokens on exchanges, potentially in anticipation of a price rally.

On the other hand, as with ETH, when it declines, it signals reduced activity and profit-taking among these key investors.

ETH Bulls and Bears Face Off: Will $3,524 Hold or Break?

The metrics above highlight waning confidence in ETH’s near-term price gains and a reluctance among its key holders to commit significant capital to the market right now. If this persists, bearish pressure on the coin will increase, potentially triggering a breach of support at $3,524.

ETH Price Analysis. Source:

TradingView

ETH Price Analysis. Source:

TradingView

If this happens, the coin could extend its dip to $3,067.However, if the bulls regain dominance, they could drive a break above the resistance at $3,859. If successful, ETH’s price could climb above $4,000.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

This Week's Preview: Macro "Flood Release" Week—Delayed CPI and the Bank of Japan's "Rate Hike Pursuit"

Key global market data will be released this week, including the U.S. non-farm payroll report, CPI inflation data, and the Bank of Japan's interest rate decision, all of which will significantly impact market liquidity. Bitcoin prices are fluctuating due to macroeconomic factors, while institutions such as Coinbase and HashKey are striving to break through via innovation and public listings. Summary generated by Mars AI This summary was generated by the Mars AI model. Its accuracy and completeness are still being iteratively improved.

Weekly Hot Picks: The Fed Cuts Rates and Indirectly "Injects Liquidity"! Silver Replaces Gold as the New Favorite?

The Federal Reserve is cutting interest rates and starting bond purchases, while Japan and other regions may turn to rate hikes. Silver repeatedly hits record highs, SpaceX is set for a 1.5 trillion IPO, and Oracle becomes the litmus test for the AI bubble. The Russia-Ukraine peace process is stuck on territorial issues, the US seizes a Venezuelan oil tanker... What exciting market events did you miss this week?

Key Highlights to Watch at Solana Breakpoint 2025

How does Solana seize market share in an increasingly competitive landscape?